The front-runner among alternative cryptocurrencies, Ethereum (ETH), is experiencing heightened selling activity following a significant transfer of approximately $200 million in ETH from Fidelity to Coinbase over a two-day period.

This large amount of coins being added to the exchange is causing worry because it might worsen the ongoing drop in the value of Ethereum.

Ethereum Risks Decline As Fidelity Transfers ETH to Coinbase

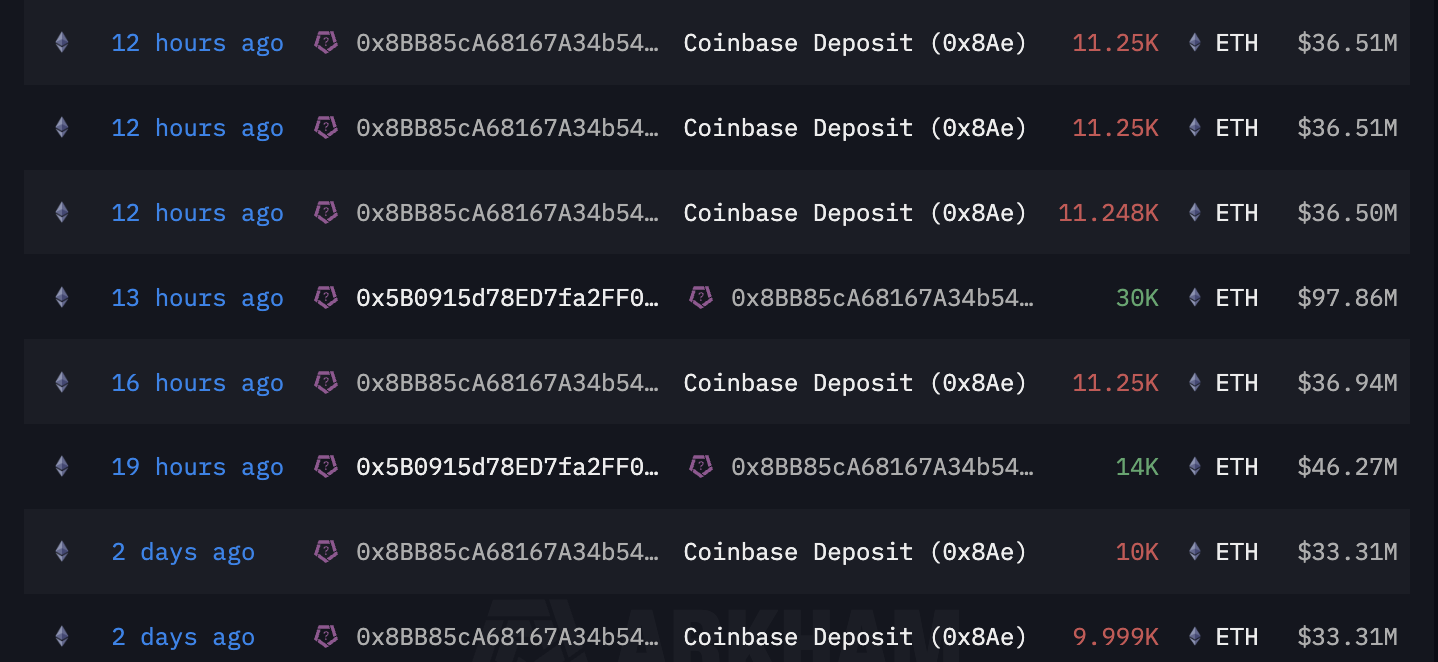

Over the last two days, Fidelity’s cryptocurrency division has transferred approximately $213 million in Ethereum to the prominent exchange, Coinbase, using Cumberland as an intermediary.

On January 8, the initial pair of transactions where 20,000 ETH was sent to Coinbase were successfully carried out, as stated by Arkham. The most recent transaction on Thursday involved a deposit of 11,250 ETH, equivalent to approximately $36.51 million, into Coinbase.

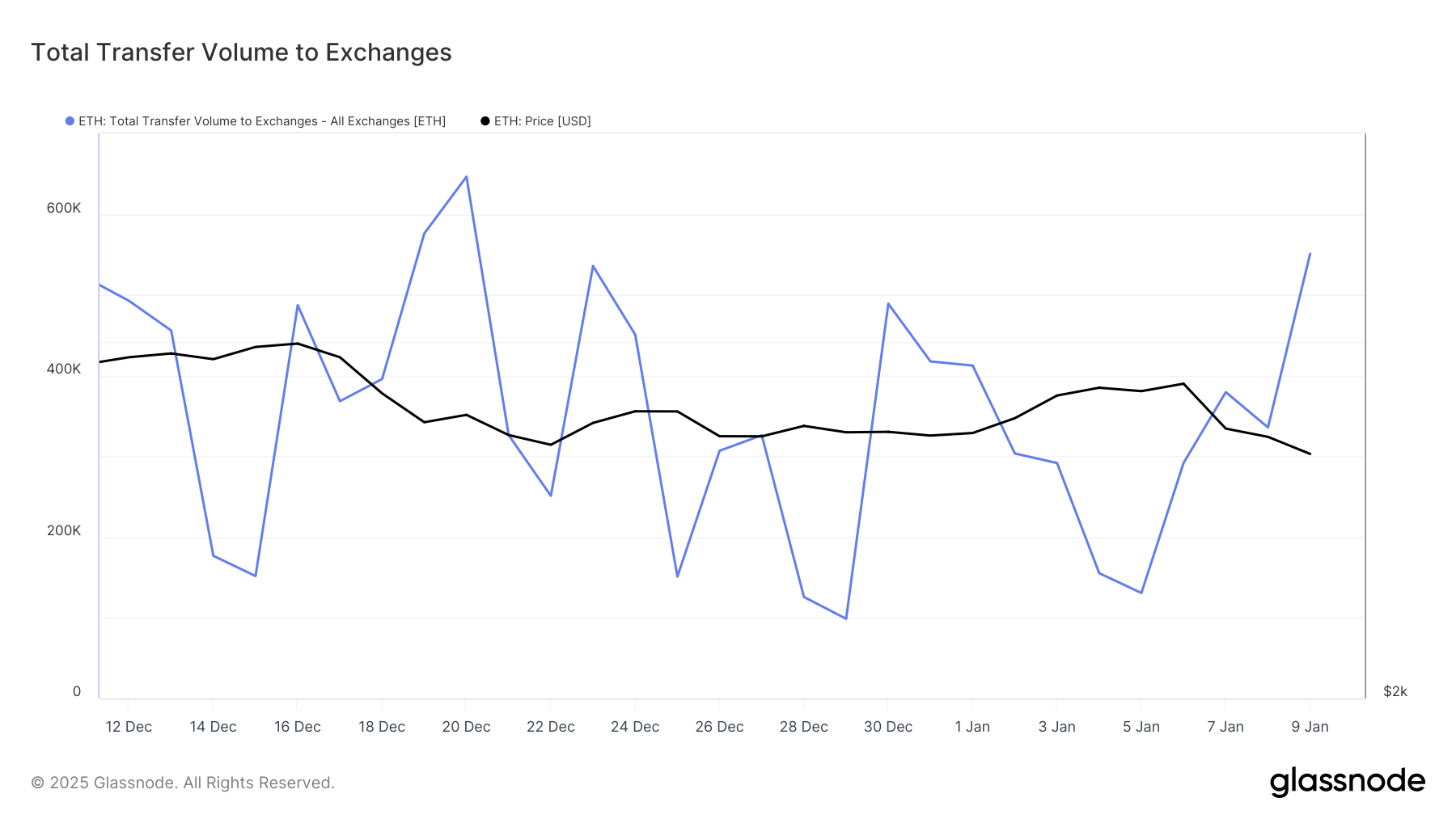

On January 9th, a significant amount of Ethereum (ETH) transfers resulted in a surge of coins entering exchange platforms, as reported by Glassnode. Remarkably, approximately 550,930 ETH, equivalent to over $1 billion, was moved to exchange wallets on that day – this being the highest daily inflow since December 20th.

The continuous buildup of Ethereum (ETH) in exchange wallets might cause a stronger drop in its value if the market demand isn’t sufficient to counterbalance the rising supply.

When the influx of an asset onto an exchange increases significantly, it often indicates that owners are offloading their assets, possibly to cash them out. If there are more sell orders than demand, this trend could result in a decrease in the asset’s price.

ETH Price Prediction: Low Demand Worsens Concerns

Analysis of ETH/USD daily chart reveals that there’s currently no substantial demand in the altcoin market to counteract the increasing supply. This is indicated by the falling Relative Strength Index (RSI), suggesting decreasing buying pressure. Currently, the RSI is trending downwards at 42.73.

The readings of Ethereum’s Relative Strength Index (RSI) suggest a decrease in its momentum, approaching the point where it’s overbought but not yet significantly undervalued. If buying interest continues to dwindle, Ethereum’s price might fall below $3,249 and potentially slide down to around $3,027.

Conversely, if the flow into exchanges comes to a halt and the demand increases, there’s a possibility that the value of Ethereum could rise to approximately $3,758.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2025-01-10 15:50