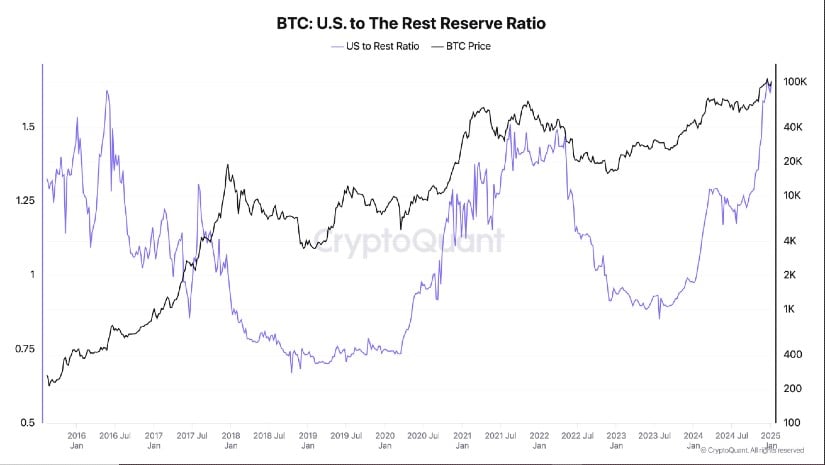

According to Ki Young Ju, the CEO of CryptoQuant, this unprecedented dominance is indicative of the rapid increase in both institutional and individual investment in Bitcoin within the United States.

The executive’s data reveals that the proportion of U.S. to non-U.S. Bitcoin reserves grew significantly, rising from 1.24 in September 2024 to 1.66 by December 16 and holding at 1.65 as of January 6, 2025. This surge followed a phase in 2023 where offshore holdings dominated, with Bitcoin’s value trading below $30,000.

The rise in Bitcoin holdings within the United States correlates significantly with key occurrences such as Donald Trump’s reelection in November 2024 and his subsequent announcement to create a National Strategic Bitcoin Reserve. This policy shift happened concurrently with Bitcoin reaching its peak price of $108,135, a surge driven by increased institutional interest and strategic investments.

MicroStrategy Doubles Down on Bitcoin

In the world of Bitcoin, MicroStrategy, a prominent figure, stepped up its buying spree by acquiring 1,070 Bitcoins between December 30 and 31, 2024. This purchase was made at an average price of approximately $94,000 per Bitcoin, totaling a significant investment of $101 million. Now holding a staggering 447,470 Bitcoins, MicroStrategy’s assets are valued at over $28 billion. This hefty reserve amounts to 2.1% of the total Bitcoin that will ever be mined.

Other companies are jumping on the bandwagon. For instance, Thumzup Media Corporation, a major player in social media marketing, has purchased 9.783 BTC for $1 million, thus entering the Bitcoin market following Trump’s election victory. Meanwhile, Solidion Technology, an influential battery materials company, intends to invest a portion of its cash reserves into Bitcoin. Lastly, Genius Group has pledged $120 million towards a project focused on Bitcoin.

As a researcher, I’ve been closely observing the investment landscape, and it’s fascinating to note the surge in interest towards Bitcoin Exchange-Traded Funds (ETFs). Since their debut in U.S. markets in January 2024, these funds have attracted an astounding $106.82 billion. This influx caters to both institutional and individual investors, providing a regulated pathway for market participants to invest in Bitcoin. The increasing popularity of these ETFs underscores the escalating demand for Bitcoin exposure across various financial sectors.

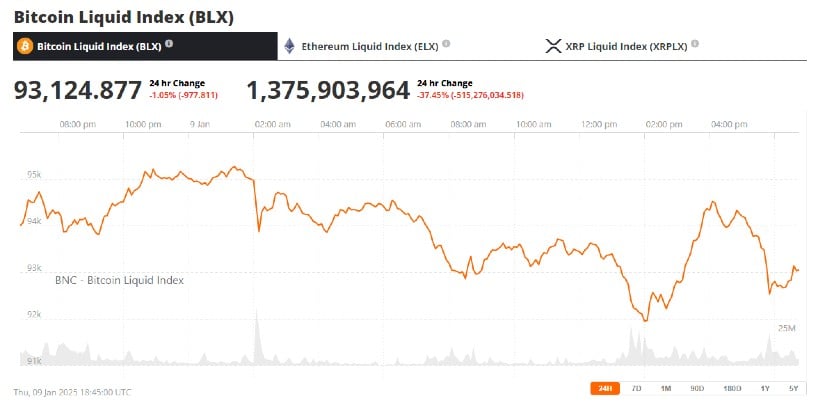

Price Volatility Shakes Market Sentiment

As of now, Bitcoin is being transacted at approximately $93,124. Its value has been experiencing ups and downs similar to a rollercoaster ride. It hit an all-time high of $108,268 on December 17, 2024, but then dropped back to around $93,000 in January 2025, as per Brave New Coin’s Bitcoin Liquid Index data.

Bitcoin’s Long-Term Prospects Strong

Julio Moreno, the head of research at CryptoQuant, noted that the profits for traders holding Bitcoin on the blockchain have dropped substantially due to the current price adjustment. This decrease is considered beneficial after our rapid rise surpassed $100k.

Regardless of the recent drop, Bitcoin’s underlying strength remains robust according to QCP analysts. They attribute the dip to unexpectedly strong U.S. job data, which led to a wave of caution among investors. The job openings figure rose significantly to 8.1 million, exceeding expectations of 7.74 million, causing a sell-off in riskier assets and pushing long-term bond yields upwards.

In the last day, significant sell-offs have occurred across the cryptocurrency market due to market volatility, resulting in a loss of approximately $348 million, as reported by CoinGlass. About $200 million of this amount was from long positions on Bitcoin, which momentarily dropped to $92,000, causing concern over potential Federal Reserve tightening policies in 2025.

As Trump’s inauguration is imminent, we anticipate a prosperous year for Bitcoin in 2025. Don’t let short-term market fluctuations scare you; those with a long-term investment perspective are primed to reap substantial rewards from Bitcoin investments in 2025.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

2025-01-10 15:44