The downturn occurred following robust U.S. economic figures that rekindled concerns about inflation, which might postpone Federal Reserve’s plans to loosen monetary policy. To complicate matters, the U.S. Department of Justice (DOJ) has been given permission to sell 69,370 Bitcoins, worth roughly $6.5 billion, that were seized from the Silk Road darknet marketplace. This move concludes a long-standing legal dispute. The financial markets are on edge, and if the sale takes place, it may lower Bitcoin’s price; however, some experts predict the sell order could be accommodated within a week.

Economic Data Sparks Market Reaction

1) Job openings across various sectors increased unexpectedly in November, suggesting ongoing job demand according to the Labor Department’s findings. Meanwhile, a different report shows that the U.S. service sector expanded at a quicker pace in December, driven primarily by soaring input costs reaching levels not seen since almost two years ago.

The reports sparked talk that the Federal Reserve could keep interest rates elevated for an extended period to prevent rising prices. Consequently, the benchmark 10-year Treasury yield climbed to 4.699%, a level not seen since April 2024, signifying investors’ anticipation of stricter monetary policies.

According to Ryan Lee, the head analyst at Bitget Research, a more positive outlook on the economy has led investors to view riskier investments such as cryptocurrencies less favorably.

Crypto Market Sees Broad Declines

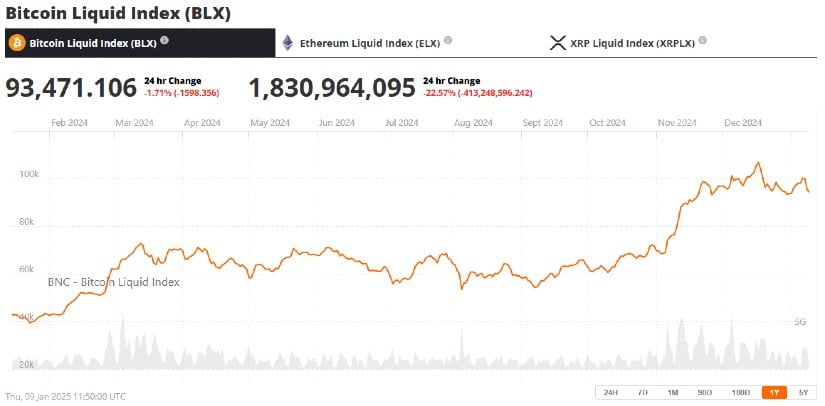

On Wednesday, a 5% drop in Bitcoin’s value to $96,602 initiated a wider sell-off within the crypto market. This caused Ethereum to plummet by 8.4%, reaching $3,373. XRP experienced a 3% decrease, settling at $2.33, while Solana fell 8%, ending the day at $199.36. By late Tuesday, the cumulative value of all cryptocurrencies had dropped by 7.2%, amounting to approximately $3.5 trillion.

Market expert Ryan Lee observed that as interest rates climb, they often negatively impact high-risk investments such as cryptocurrencies. Instead, investors are drawn towards more secure alternatives like government bonds because these offer a stable return in contrast to the unpredictable nature of cryptocurrency prices. The surge in Treasury bond yields has heightened the appeal of traditional investment choices over the turbulent crypto market.

Mass Liquidations Amplify Volatility

Large-scale sell-offs caused by quick price adjustments led to a total liquidation of around $555 million for long positions, as reported by CoinGlass. These positions, which were based on predictions of price rises, were terminated in the derivatives market, making it the first significant liquidation event this year.

Lee stated that this liquidation process is causing increased market turbulence, as rapid selling pressures are influencing price fluctuations. Given these circumstances, traders might choose to decrease their borrowing power temporarily. This could result in either a period of stabilization or additional drops in prices, depending on overall investor sentiment.

Early 2025 Outlook for the Crypto Market

The relationship between broader economic conditions and market behaviors persistently impacts the behavior of cryptocurrencies. Upcoming events like Donald Trump’s inauguration on the 20th of January and the Federal Reserve’s interest rate decision on the 29th of January are likely to significantly shape market sentiments in the near future, according to analysts’ predictions.

In simpler terms, Lee stated that the present situation clearly demonstrates how cryptocurrencies react to broad economic changes. Although the increasing involvement of institutions suggests a positive long-term perspective, it’s quite probable that the ups and downs in the short term will be significant.

With these advancements now becoming commonplace in the market, traders are readying themselves for potential fluctuations, keeping a keen eye on economic signals for any hints of policy adjustments. The ability of Bitcoin to surge past the $100,000 mark is largely contingent upon how the broader economic storyline unfolds over the coming weeks.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Summer Game Fest 2025 schedule and streams: all event start times

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

2025-01-10 15:00