In a recent 10-minute interview on Bloomberg Television, I found myself reflecting on my role overseeing the vast $120 trillion capital market that permeates every aspect of our economy. During the discussion, I was asked to comment on the current state of cryptocurrency – a sector I previously compared to the Wild West. Intriguingly, digital assets account for less than 1% of U.S. financial markets but capture roughly 5% of the Securities and Exchange Commission’s (SEC) enforcement efforts.

In the realm of cryptocurrencies, there are many individuals who act unethically, as expressed by Gensler. He further noted that this area is unusually influenced by emotions rather than grounded in solid financial principles.

Under Gensler’s leadership, the SEC took around 100 enforcement actions against crypto companies, adding to the 80 actions started by his predecessor, Jay Clayton. He used the well-known cases against Sam Bankman-Fried (FTX founder), Changpeng Zhao (Binance founder), and Do Kwon (Terra ecosystem creator) as illustrations of the sector’s “lack of compliance” and involvement in “pump-and-dump schemes.

He cautioned that out of approximately 10 to 15,000 projects, a large portion may not make it. These projects resemble venture capital investments, meaning they likely won’t succeed. However, there are also quite a few small, speculative schemes, including pump and dump activities, prevalent in the U.S.

Gensler’s Critics

Critics within the cryptocurrency field claim that Gensler adopts a strict position by labeling many digital tokens as securities and advocating for companies to comply with existing laws. In response, Gensler argues that the Securities and Exchange Commission’s stance is based on longstanding legal principles, emphasizing that their role is to safeguard investors and maintain fair trading environments.

If you don’t want to face opposition, it’s best not to engage in public discussions about policies,” Gensler stated, using the criticism he received from pro-crypto supporters as an example. “I’m satisfied with what we’ve achieved so far, but there are still tasks ahead.

On the very same day President-elect Donald Trump begins his second term, Gensler will step down from office. It is predicted that his successor, Paul Atkins who was a former Commissioner at the SEC, will shift the agency’s policies to become more accommodating towards cryptocurrencies. Previously, Atkins served as an SEC commissioner for six years and has publicly criticized Gensler’s tough stance on enforcing crypto regulations.

In closing, Gensler firmly stood by his stance, emphasizing once more that investor security, particularly from scams, deceit, and market tampering, should remain the cornerstone of regulatory actions as we navigate the burgeoning world of digital currencies.

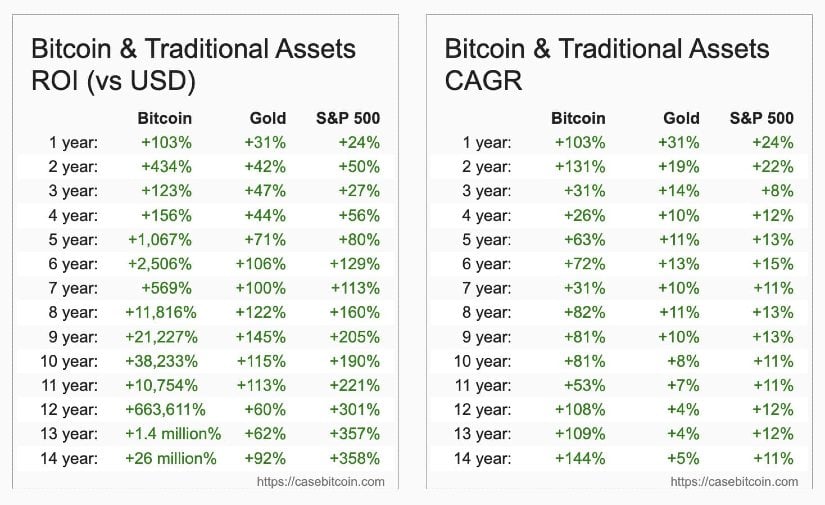

It appears that Gensler often overlooked the fact that Bitcoin and cryptocurrencies tend to yield greater returns compared to any other investment categories.

By fostering this environment, Gensler’s actions have drawn in new investors. Conversely, by prolonging restrictions on the industry for such a lengthy period, he has made it more challenging for average American investors to prosper. If they had been able to invest in a Bitcoin ETF two years ago, their chances of success might have been significantly greater.

Goodbye Gary Gensler, we’ll miss you.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DEXE/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- ‘Did Not Expect To See That Fiery Bully’: Hell’s Kitchen Alums Recall ‘sharp-tongued’ Gordon Ramsey’s Behavior On Set

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- ‘I’m So Brat Now’: Halle Berry Reveals If She Would Consider Reprising Her Catwoman Character Again

- Fact Check: Did Lady Gaga Mock Katy Perry’s Space Trip? X Post Saying ‘I’ve Had Farts Longer Than That’ Sparks Scrutiny

- ‘He Knows He’s Got May…’: Gwyneth Paltrow Reveals Husband Brad Falchuk’s Reaction To Her Viral On-Set Kiss With Timothee Chalamet

2025-01-10 13:55