The price of Hyperliquid (HYPE) has dropped approximately 15% in the last week, causing its market capitalization to reach $6.8 billion and moving it down to the 25th position among cryptocurrencies. This drop occurs as criticism mounts, focusing on concerns about the project’s transparency and centralization issues.

Although the overall trend appears negative, some technical indicators present mixed signals. The DMI shows that bearish sentiment continues, yet the BBTrend seems to suggest potential stability. Whether HYPE manages to change direction may hinge on restored investor trust and successfully tackling its current market hurdles.

Hyperliquid Downtrend is Getting Stronger

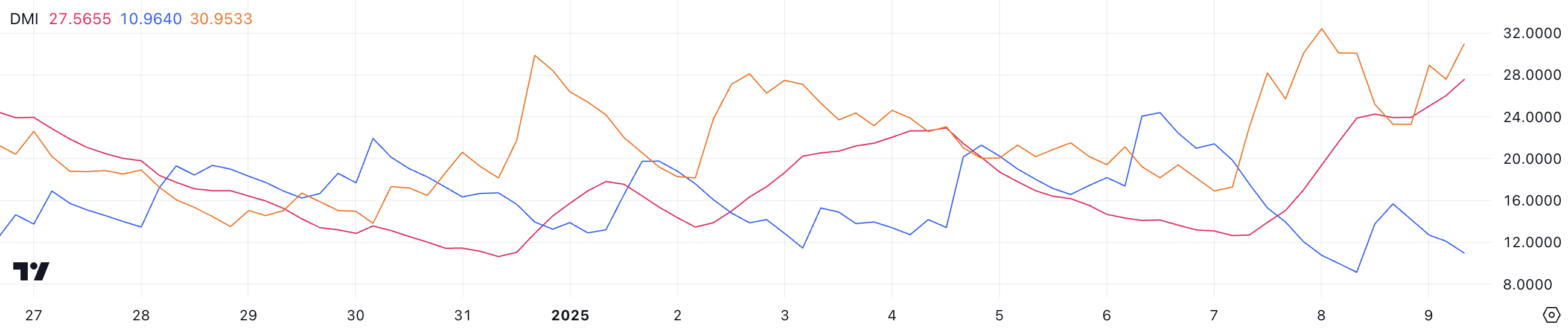

The Technical Indicator called Average Directional Index (ADX) for HYPE has risen to 27.5, an increase from 12.6 on January 7, indicating a more robust trend is developing. The ADX assesses the strength of any trend, irrespective of its direction, and ranges between 0 and 100. A value above 25 signifies a strong trend, while values below 20 indicate weak or non-existent momentum.

An elevated ADX value indicates that HYPE’s ongoing downtrend may be strengthening, signaling higher market activity and reinforcing bearish dominance.

Over the last three days, the buying pressure (as indicated by the +DI) has noticeably decreased from 24.3 to 10.9, suggesting a weakening bullish attitude. On the flip side, the selling pressure (represented by the -DI) has increased dramatically, going from 18.1 to 30.9, demonstrating an uptick in bearish activity.

This change in direction signals that sellers are dominating the market, which could push Hyperliquid prices lower unless a strong surge in buyers takes over. The increasing Average Directional Index (ADX) along with the dropping Positive Directional Indicator (DI+) and rising Negative Directional Indicator (DI-) suggests that the short-term downtrend will persist.

Positive BBTrend Offers Hope for HYPE

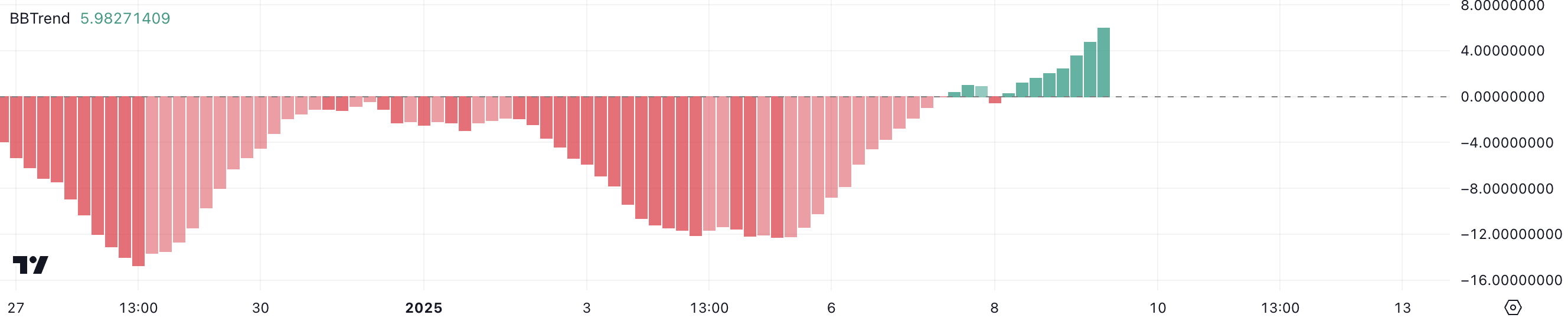

Hyperliquid recently conducted one of the largest token distributions in 2024, and its trend as measured by BBTrend stands at 5.9, demonstrating continuous growth from 0.27 within the last day. The BBTrend metric, based on Bollinger Bands, helps us understand the power and direction of market trends. A positive BBTrend value indicates increasing investor optimism (bullish trend), while a negative value signals potential decreasing investor sentiment (bearish conditions).

During the timeframe from December 26 to January 7, HYPE’s BBTrend showed a consistent downtrend, hitting a lowest point of -14.7 on December 28, indicating substantial bearish influence over that period.

The latest shift toward a favorable position indicates that the intensity of selling might be decreasing, despite the ongoing decline of HYPE, which has dropped nearly 15% in the last week. Criticism has been mounting recently regarding its openness and questions about its decentralized structure.

A strengthening trend in BBTrend may hint at a possible change or stabilization in market feelings. If this trend persists, it could suggest a chance for a price rebound. Nevertheless, persistent bullish sentiment is crucial to combat the current bearish trend and verify a reversal.

HYPE Price Prediction: Will the Downtrend Continue?

It seems that the decline in HYPE may persist, given that its Total Value Locked (TVL) has reached a bottom for this year, and its short-term Exponential Moving Average (EMA) lines are now positioned beneath their long-term counterparts.

As I analyze the market trends, it appears that the bearish setup indicates an escalating downtrend momentum. The crucial support level for HYPE price is identified at $14.99. If this level proves insufficient to halt the decline, there’s a possibility of HYPE experiencing a further drop, potentially reaching $12, representing a substantial 40% correction from its current position.

If HYPE succeeds in changing its downward trajectory, it may revisit the resistance at $22 once more. A surge beyond this threshold, accompanied by robust positive momentum, could propel the price towards $29 and possibly even surpass $30, which would likely reinstate HYPE as one of the top 20 cryptocurrencies in the market.

Recovering like this would help HYPE approach the highs it sustained from late December 2024.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-01-10 07:50