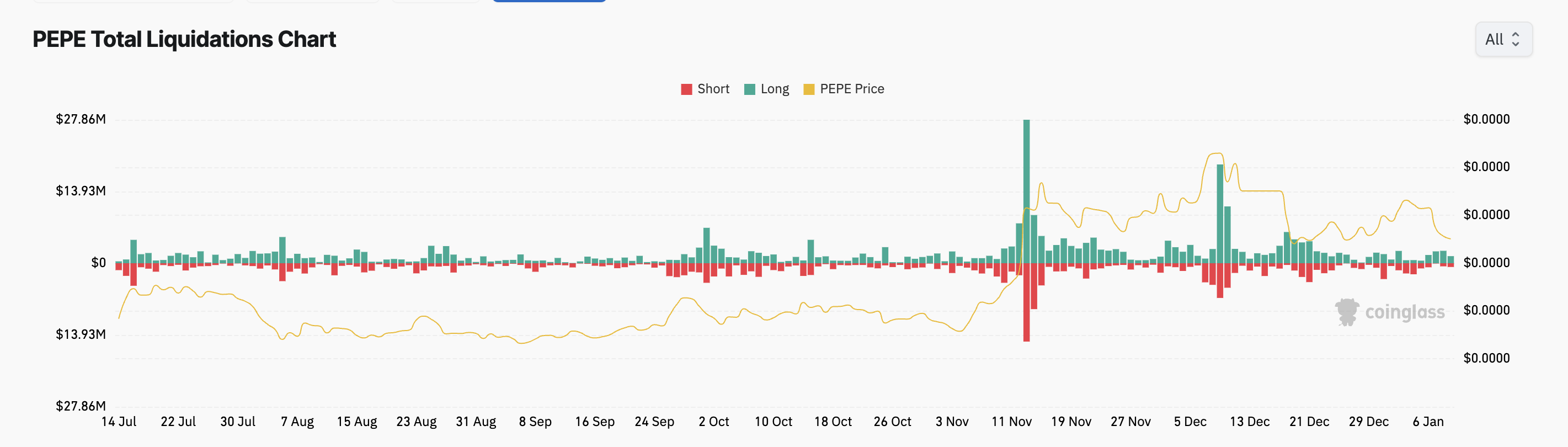

due to a drop in PEPE‘s price, there has been a surge of forced sales among traders who held long positions in its futures market. In just the past three days, over $7 million dollars’ worth of these long positions have been liquidated, resulting in significant financial losses for optimistic traders.

Should the current downward trend persist over the short term, those holding PEPE for the long haul might experience additional losses. This is due to…

PEPE’s Struggling Price Leads to $7.7M in Liquidations

Over the last several days, PEPE’s price has been steadily decreasing. As we speak, it is trading at approximately 0.000017 dollars. This represents a 14% drop in value over the past week.

Over $7.73 million worth of positions for the cryptocurrency PEPE have been closed due to the drop in price in the futures market, as reported by Coinglass data, starting from January 6. This represents a surge in liquidations.

In the market for assets’ derivatives, liquidation occurs when the price of the asset shifts adversely to a trader’s investment, leading them to close the position because they don’t have enough resources to maintain it further.

As an analyst, I often observe instances where prolonged selling takes place due to a predicament faced by bullish traders. These are individuals who have wagered on an asset’s price rise, but are forced to sell it at a lower cost in order to mitigate their losses when the asset’s value plummets below a significant threshold. This downward pressure on the asset’s value usually triggers these traders to leave the market.

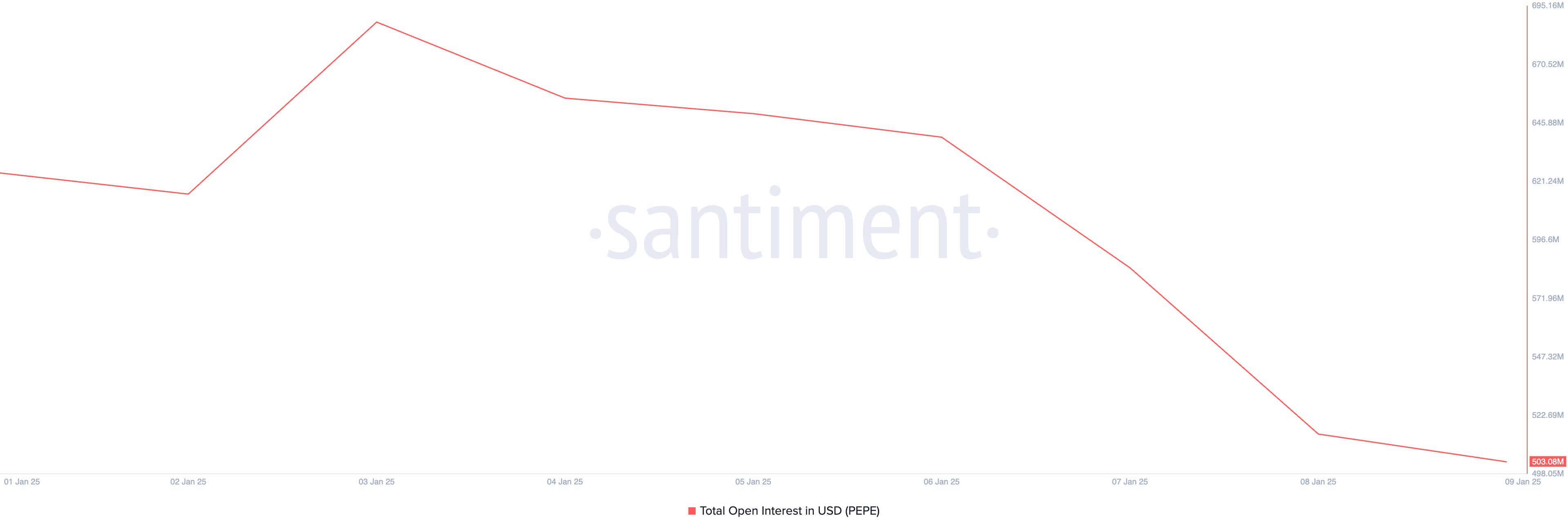

Moreover, the open interest for PEPE has gone down over the last few days, indicating reduced trading action surrounding the meme token. This reduction in activity seems to be a factor contributing to its ongoing price drop. Currently, its market cap stands at approximately $503 million, marking a 19% decrease in the past week.

The term “open interest” represents the overall count of unsettled derivative contracts or positions for a specific financial asset’s market. A decrease in open interest suggests that traders are liquidating their positions, which could be an indicator of decreased market activity.

PEPE Price Prediction: Bearish Momentum Persists

On the daily chart, PEPE’s trading remains under a falling trendline. This pattern arises when the asset’s price successively creates lower peaks, suggesting a bearish trend.

When a financial asset falls beneath a certain level, it suggests persistent bearish energy and predicts possible continued pressure on its price decrease. Should this pattern persist, the price of PEPE might plummet to 0.000015 dollars.

If the demand for purchasing this meme coin increases significantly, it may overcome the falling trendline, a level that currently acts as resistance at approximately $0.000020, causing its price to rise above it.

Read More

2025-01-10 02:11