The value of Bitcoin decreased by almost 10% from its peak of $102,735 set on Tuesday, causing a substantial impact on miners. Consequently, the daily income generated by the Bitcoin network has dropped to its lowest point in the past 30 days.

If the demand to purchase Bitcoin lessens, there’s a risk that its price could drop below $90,000. This potential decline might exacerbate the financial difficulties faced by miners who are already struggling.

Bitcoin Miner Revenue Declines Amid Price Drop

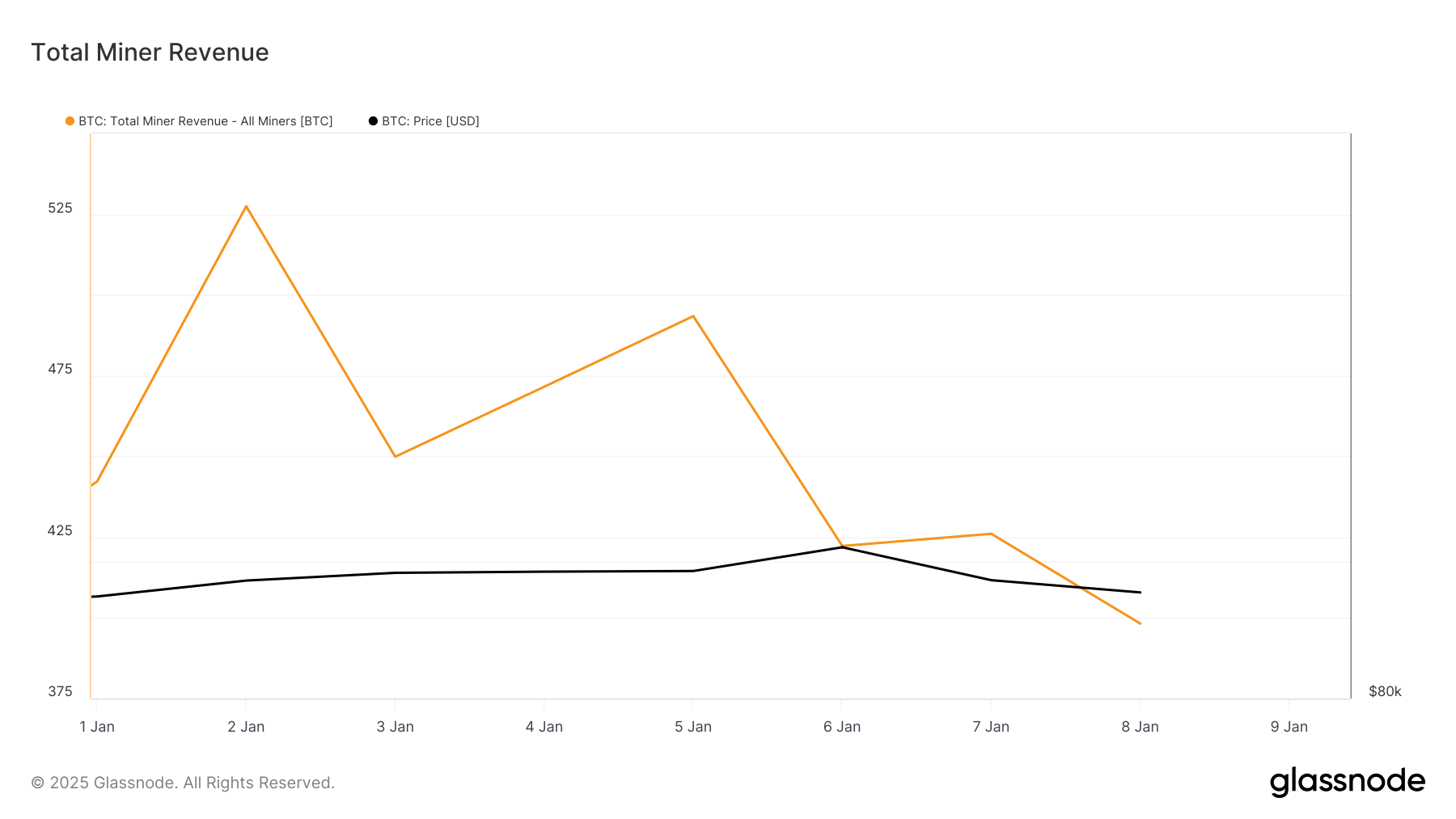

As an analyst, I’ve observed a consistent decline in my BTC mining revenue, derived primarily from transaction fees and block rewards, since January 2. Presently, according to Glassnode, this revenue stands at approximately 398.20 BTC, marking a decrease of around 24% over the past week.

When the income of Bitcoin miners decreases, it signifies they’re making fewer profits from confirming transactions and maintaining the network’s security. Usually, this decrease is due to a drop in Bitcoin’s price, causing a reduction in the worth of rewards given to miners.

For the last two days, Bitcoin has experienced a substantial drop. To put it into perspective, on Tuesday during intraday trading, the primary cryptocurrency reached a peak of around $102,735. But as selling increased, the coin’s price started to dip. As we speak, Bitcoin is being traded at approximately $93,419.

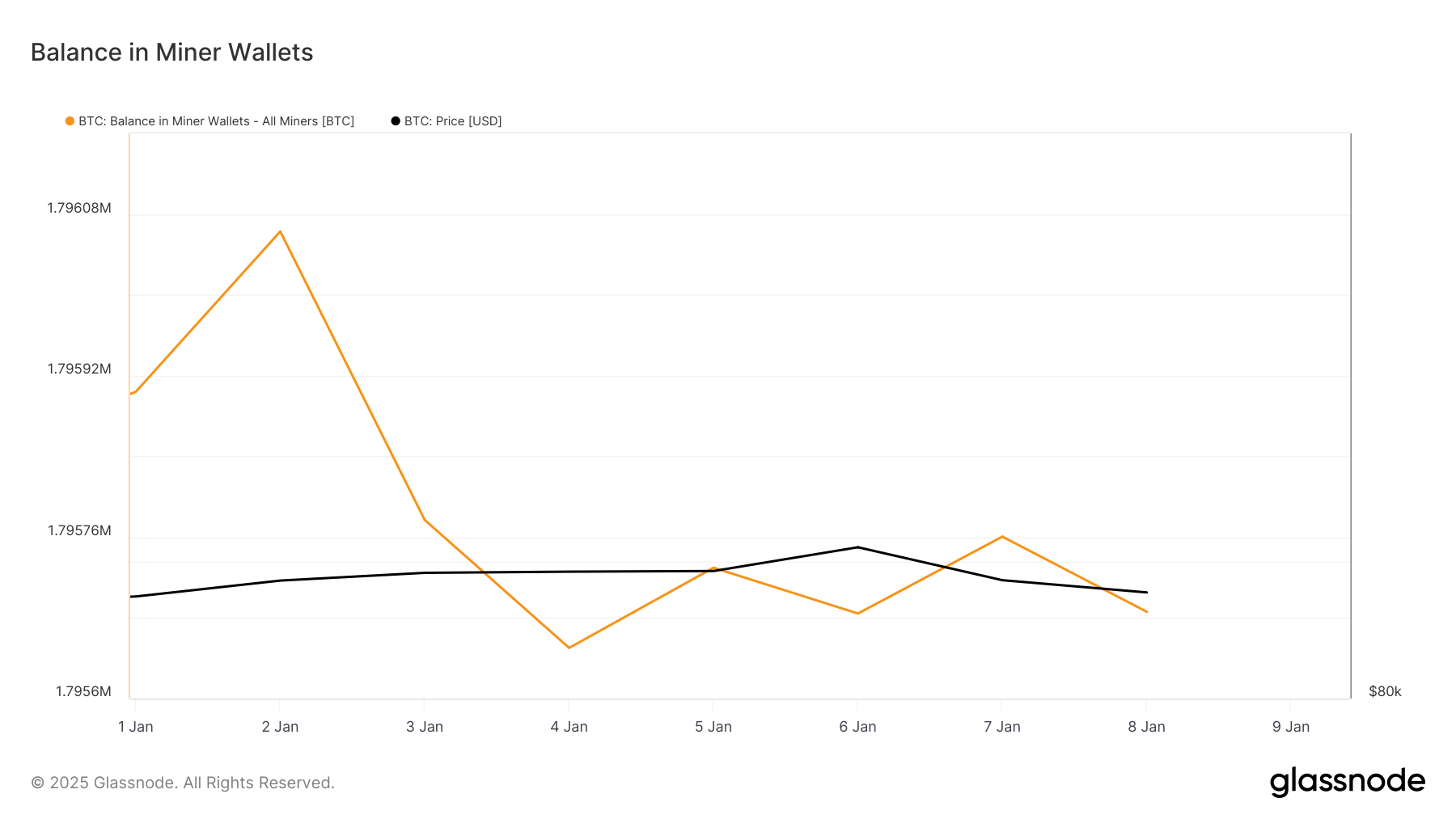

Due to an increasing number of Bitcoin miners looking to sell their coins to minimize future losses, the quantity of Bitcoin stored in miner wallets has gradually decreased. Currently, it’s approximately 1.79 million BTC, a reduction by about 0.005% compared to January 2nd.

BTC Price Prediction: Will it Hold or Break Below $90K?

On the daily BTC/USD graph, Bitcoin is currently hovering just above the support established around $91,437. If downward pressure continues, it’s possible for the coin’s value to drop below this point and head towards the $85,224 range. In such a situation, Bitcoin miners could see a significant decrease in their income, potentially leading more miners to sell their coins to meet expenses.

If positive feelings about the market grow and the demand escalates, it could potentially push the coin’s value up to $102,538, thereby boosting Bitcoin miner income.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2025-01-09 21:12