For a considerable time now, the value of Hedera (HBAR) has been fluctuating within a limited band, moving between approximately $0.25 and $0.33.

Although this stability helps avoid significant losses, it simultaneously hinders traders from capitalizing on potential profits, resulting in increasing frustration among market players. The uncertain movement of HBAR has prompted investors to seek guidance from Bitcoin‘s price fluctuations instead.

Hedera Traders Are Unsure

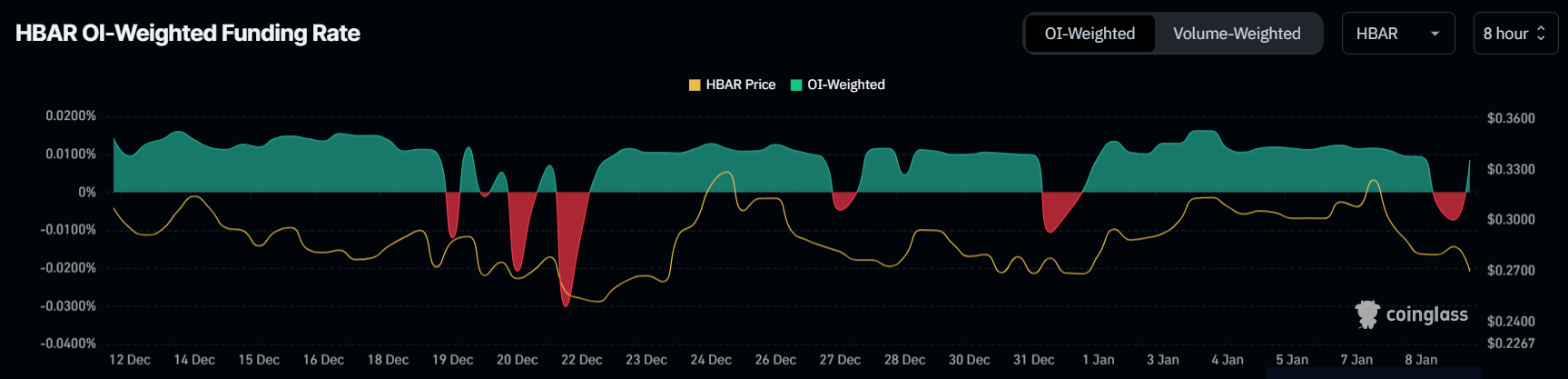

The rate at which HBAR is financed through trading has been seeing frequent changes, moving both positively and negatively. This shift mirrors the confusion among traders regarding whether HBAR’s price will rise or fall next. Traders are strategically preparing to capitalize on either a potential surge or a continued drop, resulting in this ongoing oscillation of the funding rate, which underscores the split opinions within the market.

As a researcher, I find myself pondering over the potential implications of this uncertainty on HBAR’s trading dynamics. This ambiguity might lead to sudden trading decisions, impacting the cryptocurrency’s price fluctuations. If traders decide to exit due to impatience, HBAR could encounter additional strain, amplifying its current lack of momentum. The volatile funding rate suggests that market players are uncertain about HBAR’s next step, casting a shadow over its future direction.

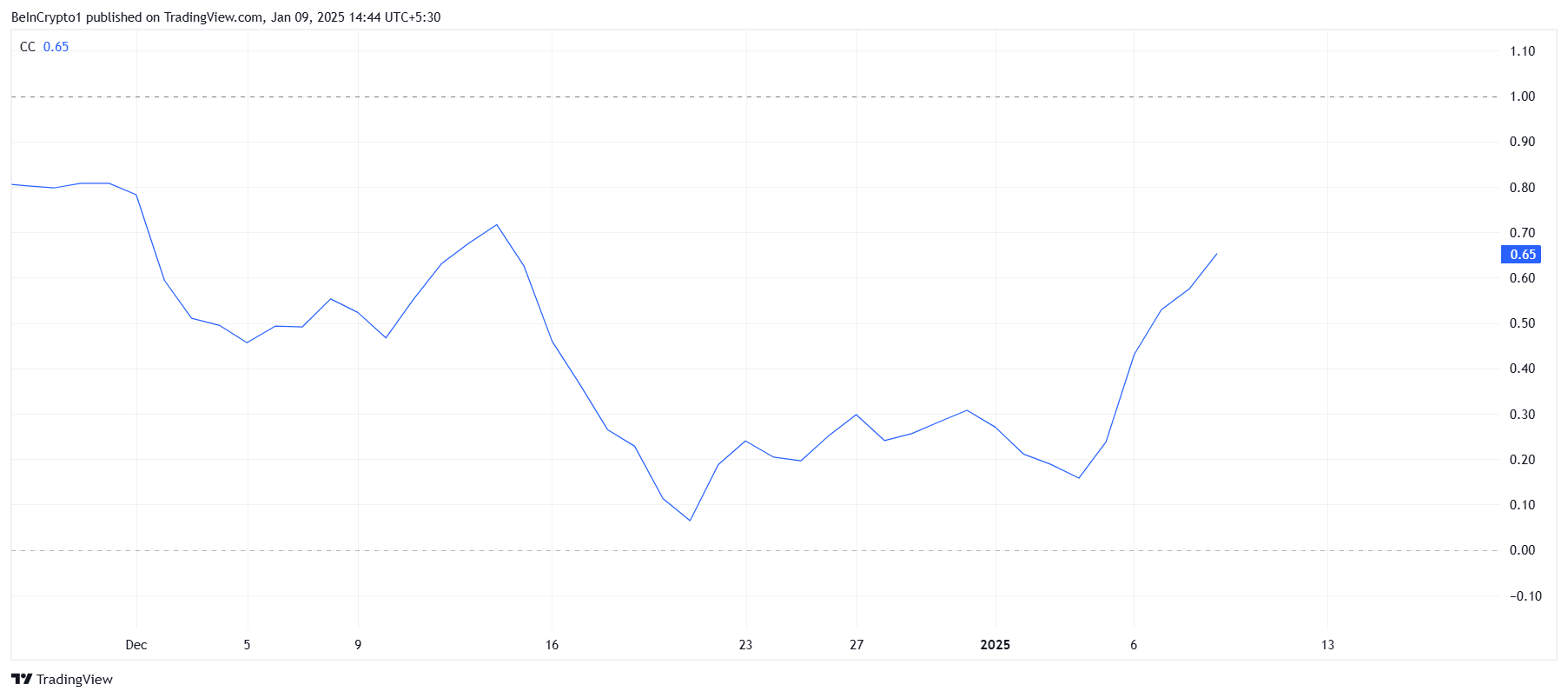

The connection between HBAR’s larger trends and Bitcoin is growing stronger, with a current correlation coefficient of 0.65. This strengthening link implies that HBAR might mirror Bitcoin’s price fluctuations more closely. If Bitcoin surges past the $100,000 mark and keeps rising, it could potentially provide the impetus for HBAR to exit its consolidation phase.

As an analyst, I’m observing that a robust performance in the Bitcoin market could potentially pave the way for HBAR. The optimistic signals from Bitcoin’s growth might serve as catalysts, propelling Hedera’s price upward and allowing it to approach higher resistance zones. However, should Bitcoin experience a downturn, the correlation between the two could work against HBAR, making its reliance on Bitcoin’s performance a potential risk factor.

HBAR Price Prediction: Finding A Way Out

Currently, HBAR is being traded at approximately $0.27. For about a month now, it’s been moving within a range – from $0.25 to $0.33. This sideways movement suggests that both traders and the overall market are uncertain, as they can’t decide on a clear direction. Until there’s a significant change in sentiment, this trend of indecision is likely to continue.

If the general market outlook becomes more negative (bearish), there’s a possibility that HBAR could drop below the crucial support of $0.25. This downturn might intensify traders’ frustration, leading to additional sell-offs and potential further declines in the value of the altcoin.

If Bitcoin recovers and reaches important milestones, it could cause HBAR to exit its current holding pattern. Should $0.33 become a support level, this might lead to a push toward $0.39, potentially reversing the negative prediction for HBAR. This close connection between Bitcoin’s progression and HBAR’s direction underscores the significance of overall market movements in shaping HBAR’s course.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Elder Scrolls Oblivion: Best Battlemage Build

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-09 20:13