Over the past day, the overall value of all cryptocurrencies has decreased by more than $60 billion due to several reasons such as lowered anticipation for Federal Reserve interest rate reductions and a possible large-scale Bitcoin sale by the U.S. government.

At the beginning of the week, stock markets began to fall possibly due to a surprising increase in U.S. job openings in November, suggesting that the employment market may be becoming tighter. Concurrently, Treasury yields saw a substantial increase, with the yield on the 10-year U.S. Treasury bond climbing approximately 5 basis points and currently standing at 4.693%.

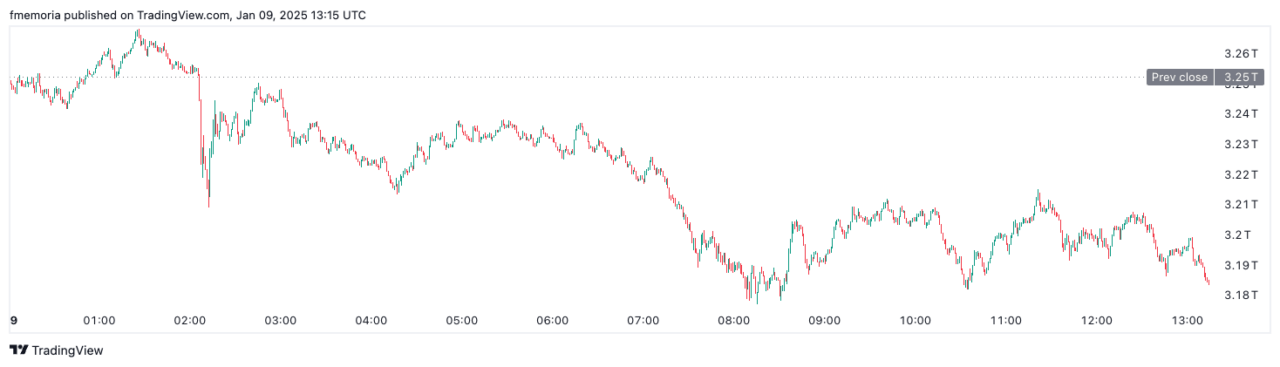

During the recent sell-off in the cryptocurrency market, the price of bitcoin dropped to approximately $93,000. Meanwhile, ether is currently being traded at around $3,280. Both of these digital currencies experienced a decline of over 2% in value within the past day. As a result, the overall cryptocurrency market has also seen a decrease in value, bringing its total market capitalization to about $3.18 trillion.

As a researcher, I found myself intrigued when the United States government authorized the sale of approximately 69,370 Bitcoins, worth around $6.5 billion, that were previously seized from the shuttered Silk Road darknet marketplace.

According to DB News and court records, Judge Richard Seebord rejected an attempt to halt the confiscation of the Bitcoin, thereby permitting the U.S. Department of Justice to move forward with auctioning off the seized Bitcoin, valued at approximately $6.5 billion.

This possible transaction might happen close to when President-elect Donald Trump assumes office, making the impending political scene captivating due to his pro-cryptocurrency views and suggestions like creating a strategic Bitcoin reserve from confiscated funds.

The CEO of CryptoQuant, Ki Young Ju, pointed out that a massive amount of around $379 billion flowed into the cryptocurrency market last year, equating to roughly $1 billion every day. He also proposed that if necessary, sales totaling $6.5 billion could potentially be handled within a single week.

The data from the blockchain shows that the wallet linked to the confiscated funds hasn’t moved any of its cryptocurrencies so far.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Summer Game Fest 2025 schedule and streams: all event start times

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

2025-01-09 16:39