A federal judge has allowed for an unusual step, known as an “interlocutory appeal,” which temporarily pauses district court hearings. The reason is that the appellate court needs to decide if the digital assets held by Coinbase meet the criteria of securities, according to legal experts, using the significant Howey test as a benchmark.

The central issue in this disagreement is whether Coinbase functions as an unregistered exchange, broker-dealer, and seller of unregistered securities via its staking program. Coinbase counters the Securities and Exchange Commission’s (SEC) claims by stating that the tokens on their platform do not fall under securities regulations. The court’s permission for an immediate appeal signifies the need to determine if cryptocurrency transactions can be considered “investment contracts,” a question that has been puzzling regulators and digital asset companies for some time.

A Rare Appeal

As an analyst, I find it uncommon when appellate courts decide to hear interlocutory appeals in crypto litigation cases, as they typically wait for a final judgment. However, the recent decision has been praised as a significant milestone by a notable legal expert within the industry on social media. This pause in district court litigation provides Coinbase with some relief, as it allows them to focus solely on their arguments before the Second Circuit without having to defend against the SEC’s claims simultaneously.

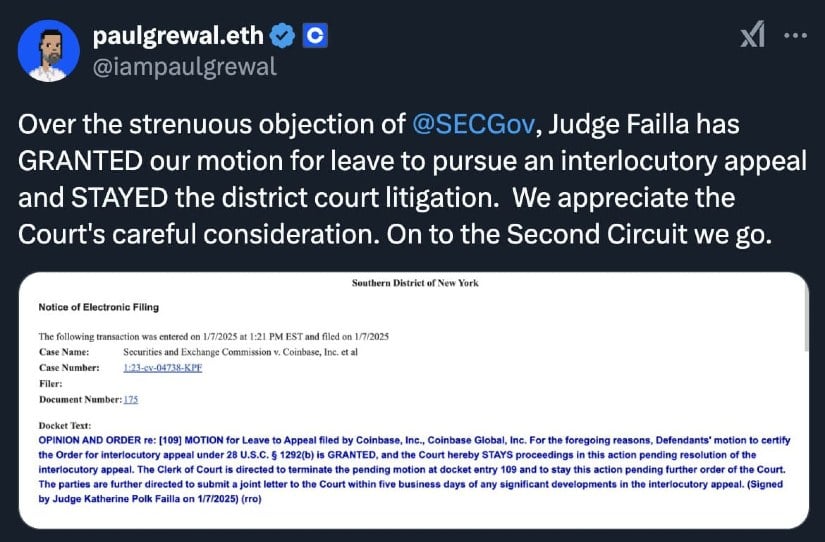

Coinbase’s top legal advisor made an online comment expressing gratitude for the court’s thoughtful review and indicating they are moving forward to the Second Circuit. Another lawyer publicly congratulated them, describing the stay as a significant victory for the entire ecosystem. If the court makes a future ruling, it could possibly dismiss or at least limit a substantial part of the SEC’s allegations.

The judgment comes at a time when there’s much debate on how federal authorities interpret traditional securities laws in relation to rapidly advancing blockchain technologies. Experts suggest that this court ruling could have a substantial impact on future regulatory actions, including high-profile cases where companies claim their cryptocurrency offerings do not qualify as regulated securities. Some contend that an adverse verdict for Coinbase might broaden the SEC’s jurisdiction over the sector, forcing exchanges and token issuers to reconsider their operations or risk similar legal actions.

In the midst of a turbulent crypto market, the company’s shares have surprisingly dipped by over 8%, even after a court victory. However, some industry experts are hopeful. One forecast suggests that Coinbase’s stock could potentially reach $700 by 2025, surpassing traditional brokerage firms if the global interest in digital assets keeps growing. At its current share price above $300, this prediction implies a significant increase in the coming years.

Simultaneously, Coinbase is challenging moves by the Federal Deposit Insurance Corporation (FDIC), which some claim are aimed at preventing Bitcoin and stablecoin usage within the U.S. Released documents through the Freedom of Information Act have sparked accusations of a wider government plan—often referred to as “Operation Chokepoint 2.0″—designed to restrict blockchain financial operations. Coinbase’s lawyers believe that certain censored documents suggest strategies meant to deter financial institutions from dealing with digital assets.

In the coming year, anticipation builds as the Second Circuit court hearings commence. Many within the crypto community view this as a pivotal juncture. If the appellate court establishes whether Coinbase’s digital assets are considered securities, the decision could set a precedent felt across federal courts throughout the nation. Market participants predict that the ensuing ruling will either strengthen or soften the regulatory landscape, impacting how cryptocurrency companies list, trade, and manage digital tokens in the U.S. For the time being, Coinbase’s advocates are rejoicing, seeing this as a significant stride towards a more transparent legal climate for the crypto market.

Read More

2025-01-09 14:04