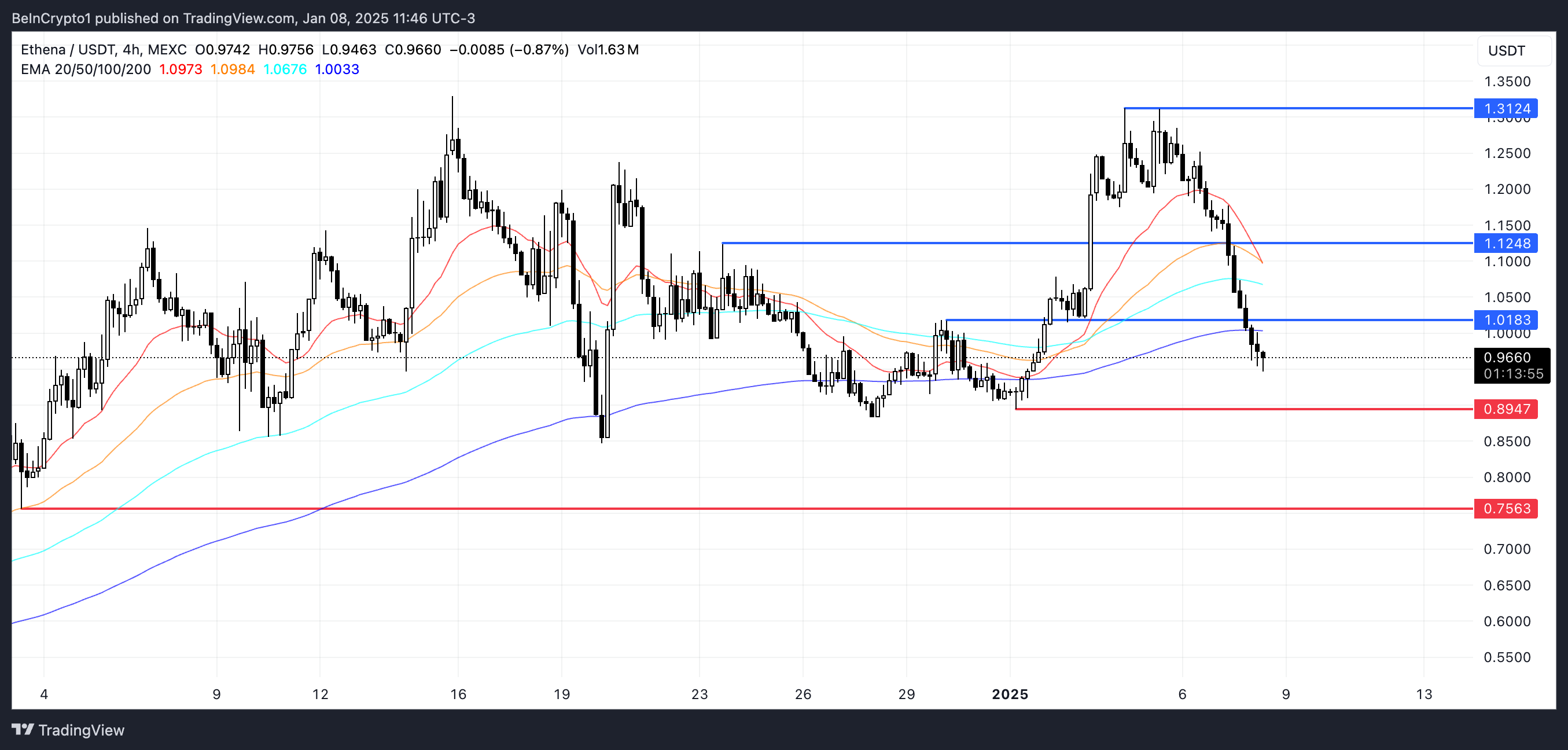

The cost of Ethena (ENA) has plummeted by 18% over the past day, causing its market value to fall beneath the $3 billion mark. However, even with this drop, ENA still holds a place among the top 50 largest cryptocurrencies in terms of market capitalization.

Signals such as RSI and CMF reveal a pessimistic outlook, yet they suggest a potential recovery if circumstances change favorably. Traders are keeping a close eye on crucial support zones around $0.89 and resistance zones at $1.01 for ENA’s upcoming action.

Ethena RSI Is At Its Lowest Level In 5 Months

The Ethena Relative Strength Index (RSI) has dropped to 26.4, which is its lowest point since August 2024. RSI is a tool used to measure the rate and intensity of price fluctuations, ranging from 0 to 100.

Readings exceeding 70 signal overbought situations where price adjustments or corrections may occur, while levels below 30 point towards oversold conditions, potentially leading to price rebounds. The dramatic decline from 79.9 on January 3 to its current state suggests a substantial change in market opinion, with intense selling pressure prevailing over the last five days.

At 26.4, the Exponential Moving Average Relative Strength Index (ENA RSI) has clearly moved into oversold territory, suggesting that the recent downward trend might have been excessive. If investor demand picks up again, it could potentially trigger a price increase.

Yet, the downward push in the RSI (Relative Strength Index) could imply diminishing investor optimism, potentially prolonging the short-term struggle for ENA’s price to rise.

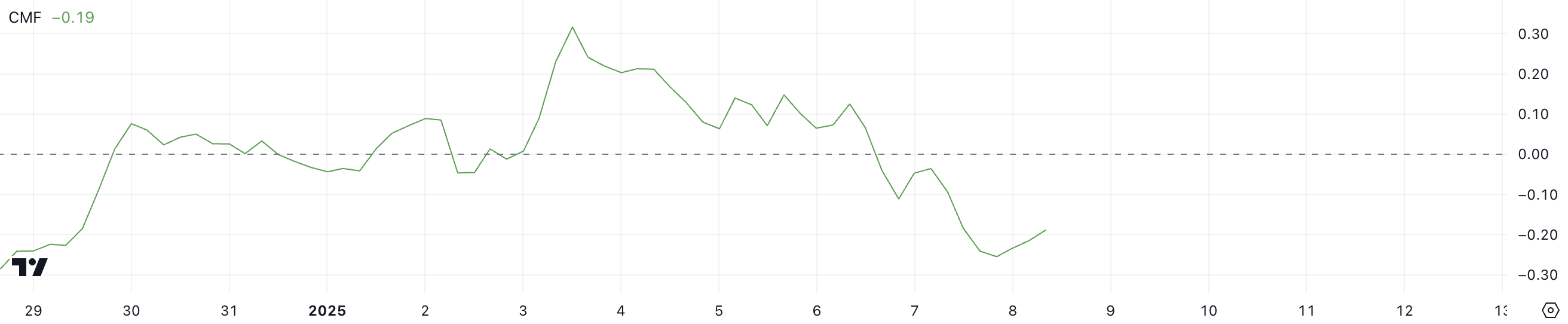

ENA CMF Is Recovering from Yesterday’s Lows

The Ethena Chaikin Money Flow (CMF) stands at -0.19, indicating a slight improvement compared to yesterday’s low of -0.25. This technical indicator gauges the movement of funds in or out of an asset by considering price and volume over a given timeframe.

In simpler terms, when the CMF (Commodity Channel Index) has positive values, it shows more buyers than sellers, which could mean an increase in price or bullish trend. Conversely, negative values imply more sellers than buyers, suggesting a decrease in price or bearish trend. The recent change from a high of 0.32 on January 3 to its current negative value indicates a significant reversal in market sentiment, coinciding with the decline of ENA’s price from above $1.2.

0.19 on the ENA’s CMF indicates that selling pressure is still significant but might be gradually lessening as the indicator recovers from its recent trough. This minor uptick could signal a slowdown in capital outflows, potentially suggesting a small ray of hope for price stabilization in Ethena.

Despite the Cumulative Moving Average (CMF) continuing below zero, pessimistic feelings persist, and a decline may continue until the CMF approaches or surpasses 0, suggesting a resurgence of purchasing enthusiasm.

ENA Price Prediction: Is $0.75 the Next Target for Ethena?

At the moment, the EMA and EMA lines show a bearish pattern, as they are currently moving in a descending trend. If this trend persists, it might result in what’s known as a ‘death cross’. This technical indicator happens when short-term EMAs drop below long-term EMAs, typically suggesting more downward pressure ahead.

This downward trend indicator might strengthen the urge to sell, possibly causing the ENA price to challenge its support at $0.89. Should this support fail, the correction could become more pronounced, with $0.75 as the next significant level to watch, indicating a potential drop of approximately 21.8% from current prices.

Despite the signals from RSI and CMF indicators indicating a potential rebound from current prices, there’s still a chance that the ENA price could recover its bullish momentum. If it does, the resistance at $1.01 may be breached, potentially leading to further advancements towards $1.12.

With strong buying pressure and a sustained uptrend, Ethena could even aim for $1.31.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Oblivion Remastered: How to get and cure Vampirism

- Does Oblivion Remastered have mod support?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DODO PREDICTION. DODO cryptocurrency

- Kingdom Come Deliverance 2: Top 5 Best Bows & Arrows

- Top Potential TGEs To Watch Out For in Q1 2025

2025-01-09 04:19