Following the much-anticipated milestone of $100,000, the path forward seems unclear as analysts have differing opinions. While some predict Bitcoin will surge to $200,000 by year’s end, others warn about potential risks due to regulatory uncertainties. Interestingly, a CNBC survey indicates several experts backing the optimistic outlook. However, it’s important to look beyond the headlines and consider three significant events that could shape the crypto world in the coming months.

According to analysts like Tom Lee from Fundstrat Global Advisors and Bitwise Asset Management, Bitcoin’s price could see substantial growth by 2025. Specifically, Tom Lee predicts that the price of Bitcoin could reach $250,000 in 2025, based on potential factors such as the introduction of spot bitcoin ETFs and changes in U.S. political dynamics.

According to Bitwise Asset Management, Bitcoin’s value could potentially reach $200,000 by 2025 due to increased institutional investments, favorable regulatory decisions, and the scarcity resulting from bitcoin halving. Yet, they caution that potential obstacles such as government sell-offs or unfulfilled market expectations might influence these forecasts in a more moderate direction.

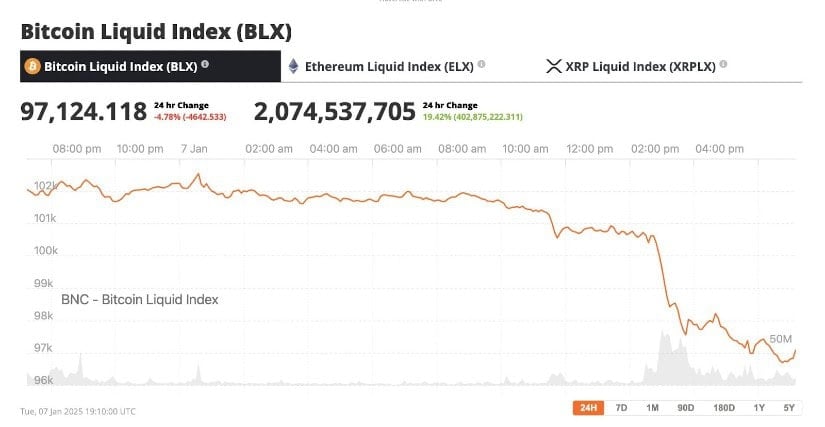

Currently, when I’m writing this, Bitcoin was being exchanged at approximately $97,124. This represents a decrease of 4.24% over the past 24 hours, as reported by Brave New Coin’s Bitcoin Liquid Index. Following a relatively quiet week where the price hovered just below the $100,000 threshold, Bitcoin demonstrated strong momentum, surpassing that mark before experiencing another dip early Wednesday morning.

Trump Aims to Make U.S. “Crypto Capital of the Planet”

The prospect of Donald Trump’s second term in the White House could bring about a transformation in how cryptocurrencies are handled within the United States. During his campaign, Trump expressed his intention to make the U.S. a global leader in cryptocurrency, and early indications suggest that his administration is moving toward fulfilling this promise. Notable appointments have been made, which could signal a major policy change.

Paul Atkins, now leading the Securities and Exchange Commission (SEC), is well-known for his support of cryptocurrencies. Previously serving as a commissioner and consultant for blockchain companies, it’s anticipated that he will adopt a more flexible stance when it comes to crypto regulations. This is quite different from the approach taken by the previous SEC leadership under Gary Gensler, who was aggressive in enforcing actions against significant players such as Coinbase.

Enhancing the positive sentiment, Trump presented David Sacks, a well-known venture capitalist, as the country’s inaugural Crypto and Artificial Intelligence Advisor. With Congress now under Republican leadership and representatives like Rep. French Hill advocating for policies beneficial to cryptocurrency and AI, it seems that the political climate is becoming advantageous for Bitcoin.

Trump’s Bitcoin Reserve Plan of $19 Billion Stockpile — Critics Warn

Trump’s most daring suggestion involves establishing a national strategic reserve of Bitcoin. This plan calls for using the approximately 200,000 Bitcoins currently owned by the government as a result of criminal seizures as a starting point. At present market values, this hoard is worth more than $19 billion.

As a researcher exploring innovative economic solutions, I’ve been pondering an audacious idea: establishing a Bitcoin Reserve, reminiscent of the Strategic Petroleum Reserve, to boost the resilience of the U.S. economy during financial turmoil. Notably, Senator Cynthia Lummis has taken this proposition a step further, proposing that the government should invest in 200,000 Bitcoins each year for five years, accumulating a total of one million tokens. Supporters argue that such a reserve could help alleviate our national debt burden and position the U.S. advantageously as Bitcoin’s growth unfolds, strategically linking our economy to this burgeoning digital asset sector.

However, critics are strongly opposing this notion. They contend that Bitcoin’s notorious price fluctuations make it a precarious investment for governments to hold due to its risky nature. Carol Alexander, a professor at the University of Sussex, likened the idea to a soccer game without a referee, expressing concern that lax regulations might advantage skilled traders over smaller investors.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

2025-01-08 12:24