The latest update follows the EU’s rule that cryptocurrency companies must be registered as Crypto Asset Service Providers (CASPs) to cater to customers across the union. Despite a December 30 deadline for member states to adopt MiCA, not every jurisdiction has progressed at the same speed. Experts suggest that the Netherlands’ quick adoption highlights its leadership role in European cryptocurrency regulation.

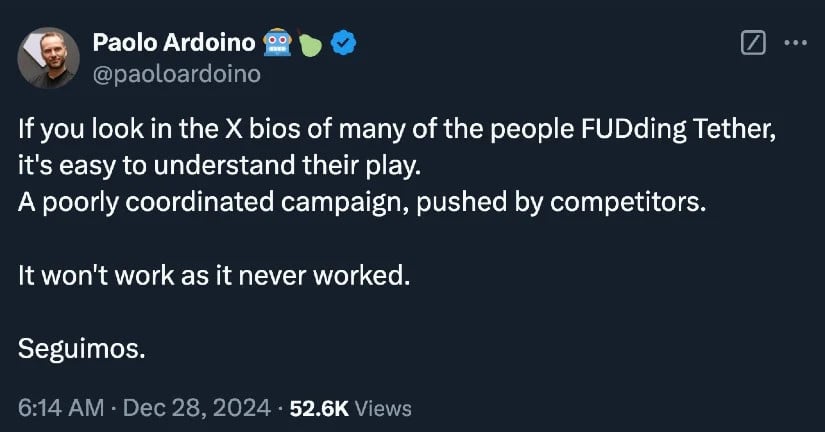

Tether Under Scrutiny

As a researcher, I’m closely observing the situation with Tether’s USDT stablecoin in the European Union. The Markets in Crypto-Assets (MiCA) regulation, set to be fully enforced on December 30, 2024, is bringing increased scrutiny to stablecoin issuers like Tether. Under MiCA, we can expect stricter rules, such as obtaining e-money licenses, maintaining reserves in reputable banks, and abiding by comprehensive disclosure standards.

In advance of these regulations, Coinbase has preemptively removed USDT for its European customers due to compliance issues. Exchanges such as Binance and Crypto.com are still providing USDT, choosing to monitor the situation until they receive clear instructions from European authorities.

The prospect of USDT being removed from European trading platforms stirs worries about market fluidity and solidity. As the most valuable stablecoin by market cap, USDT significantly contributes to cross-border transactions and maintaining liquidity in digital asset markets. If USDT is phased out, traders might shift towards alternatives like Circle’s USDC, which conforms to MiCA regulations, although this switch could bring hurdles such as increased trading costs and reduced market fluidity.

Tether has voiced worries about MiCA’s reserve management regulations, as they might jeopardize its business strategy and potentially pose risks for both local banking networks and stablecoins. Notably, Tether hasn’t secured the necessary MiCA license that competitors like Circle have already obtained since mid-2024.

A Pivotal Moment

MiCA marks a significant shift for the European digital asset sector, and we’re honored to have collaboratively contributed towards this new regulatory landscape,” said the CEO and co-founder of MoonPay, one of the newly licensed firms. With backing from prominent investors, MoonPay, now valued over $3 billion, mirrors the wider market’s optimism for regulated cryptocurrency services in Europe.

As the European Union’s cryptocurrency environment undergoes major transformations, licenses are being issued. The Markets in Crypto-Assets (MiCA) regulation, introduced in 2020 and passed in 2023, is establishing a unified rulebook for digital assets. This regulation mandates that Central Arrangement Service Providers (CASPs) must hold one license valid across the entire EU bloc, with the goal of replacing the disparate national regulations that previously governed the sector. Many crypto companies operating within the EU have had to maneuver various regulations and apply for multiple licenses in different countries.

As the EU changes how it handles cryptocurrencies, new licenses are being given out. A law called MiCA, passed in 2023 after being introduced in 2020, makes one set of rules for digital assets that applies across all EU countries. This means companies offering these services will need only one license to operate in the entire EU instead of having different licenses for each country they work in. Since these changes, many crypto firms have had to adapt to various regulations and apply for multiple operating permits in different EU nations.

Apart from the Netherlands, other regions are following the EU’s evolving regulations. For instance, Socios.com, a fan engagement platform based in Malta, has secured a Class 3 Virtual Financial Assets Act (VFAA) license from the Malta Financial Services Authority. This permit enables the company to legally operate as a regulated provider of Virtual Financial Assets within Maltese jurisdiction, which is said to align with the rules proposed by MiCA (Markets in Crypto-Assets).

In the wake of maintaining EU regulatory standards even after leaving the bloc, the United Kingdom has just added trading firm GSR Markets to its cryptocurrency register. This action demonstrates the U.K.’s commitment to stay aligned with Europe’s increased emphasis on anti-money laundering measures and investor protection in the digital asset market.

As a researcher delving into the world of cryptocurrencies, my primary focus lies in fostering legal transparency, safeguarding investors, and combating market manipulation. The MiCA framework I’m exploring sets forth a strategic rollout, initially targeting regulations on two types of tokens: asset-referenced tokens (ARTs) and e-money tokens (EMTs), often referred to as stablecoins. In the subsequent phase, it plans for the licensing of Crypto Asset Service Providers (CASPs). A grace period is included in this stage, allowing established service providers to carry on their operations while they apply for full authorization during a transition phase.

According to MiCA, companies providing digital asset management, storage, or cryptocurrency exchange services will face tighter regulations concerning transparency and security. These businesses are expected to meet certain capital requirements, publish detailed whitepapers, and enforce stringent anti-money laundering protocols. While non-fungible tokens (NFTs) and decentralized applications (dApps) typically fall outside MiCA’s jurisdiction, any token that resembles a financial instrument may still attract legal attention.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2025-01-07 22:07