In the last seven days, Ethereum (ETH), the front-runner among alternative cryptocurrencies, has experienced a significant surge. The price of ETH has jumped by almost ten percent, now standing at approximately $3,672.

On the other hand, the possibility of a continuous advance towards the $4,000 level could encounter resistance, given an uptick in sell orders noticed in the futures market for this coin.

Ethereum Sellers Dictate Price Trends

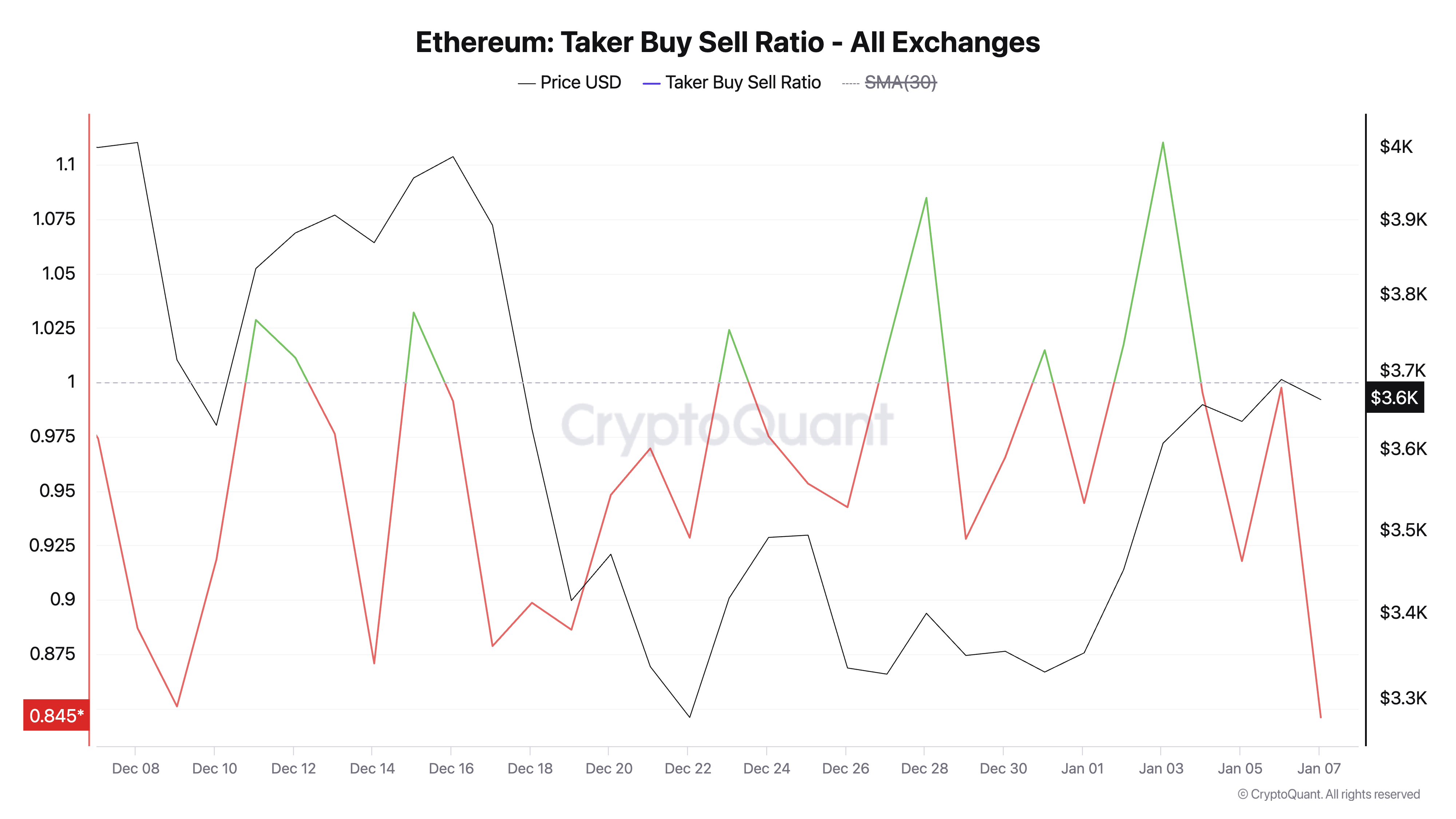

According to CryptoQuant’s analysis, there has been an increase in sell orders relative to buy orders in the Ethereum futures market. Since January 4, this taker buy-sell ratio has stayed below one, and it’s currently sitting at 0.84.

This measurement monitors the number of buy orders compared to sell orders in the futures market. A ratio less than one indicates more sell orders are being processed, which suggests a change in market sentiment from optimistic (bullish) to pessimistic (bearish). The increasing selling pressure may impact ETH’s price, possibly reversing some of its recent growth.

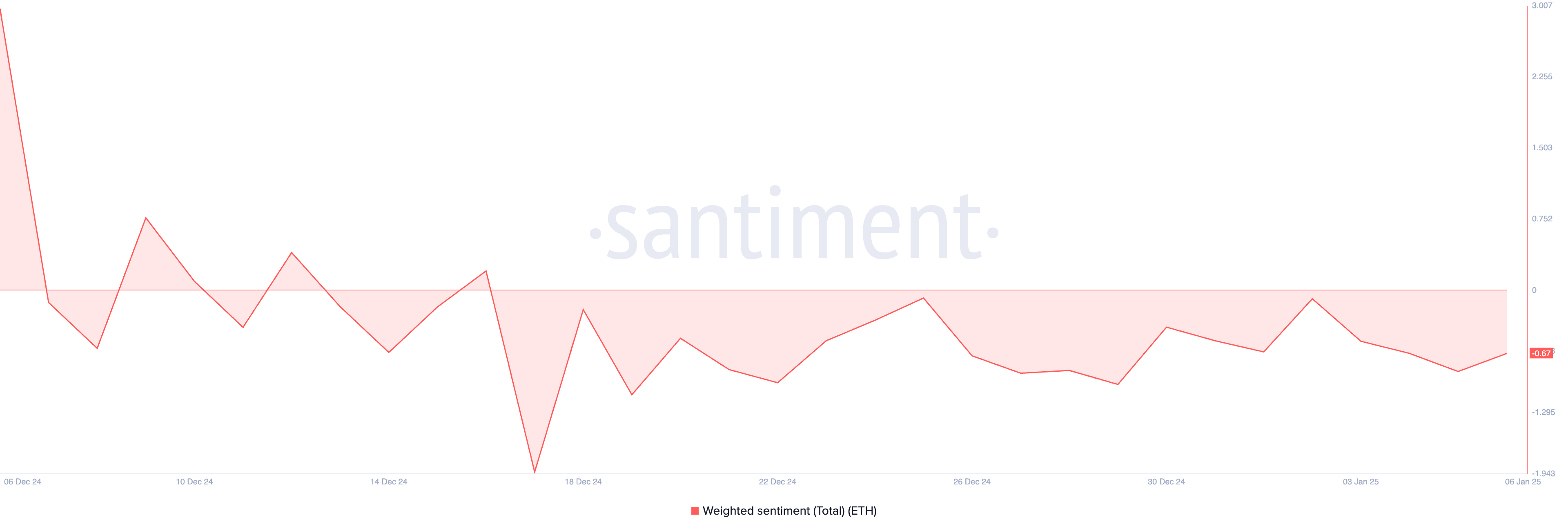

Additionally, the heavy negative opinion towards the coin suggests that a price adjustment is likely imminent. Notably, Ethereum’s overall sentiment has been predominantly negative since December 17, with its weighted sentiment currently standing at -0.67.

This measurement assesses the general feeling toward a specific asset by taking into account both the strength of the sentiment (positive or negative) and the frequency of discussions about it on social media platforms. For example, when referring to Ethereum, a strongly negative weighted sentiment means that the majority of conversations about the asset are negative, possibly signaling a bearish market trend.

ETH Price Prediction: $4,000 Target Feels Distant

Currently, Ethereum (ETH) is trading at approximately $3,654, slightly above the support established at $3,332. Should the selling pressure in the futures market increase significantly, this support level may be challenged. If this support zone were to break, it could potentially lead to a decrease in Ethereum’s price to around $2,509, moving further away from the much sought-after $4,000 threshold.

As a researcher examining Ethereum’s market trends, I can say that if the selling activity slows down and buying pressure intensifies once more, it could potentially propel ETH’s price beyond the $4,000 threshold and move towards the four-year high of $4,783.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-01-07 18:43