Under this bold plan, we strive to fortify our financial structure and expedite our existing aggressive approach towards purchasing Bitcoins.

Details of the Offering

The announcement was made on January 3, revealing a planned sale that’s anticipated in Q1 of 2025, assuming market conditions permit. The funds raised during this capital increase will be utilized for various purposes, including improving the company’s financial health and purchasing additional Bitcoin. Notable features of MicroStrategy’s preferred stock include its potential conversion into Class A common stock, cash dividends associated with it, and the option to redeem it.

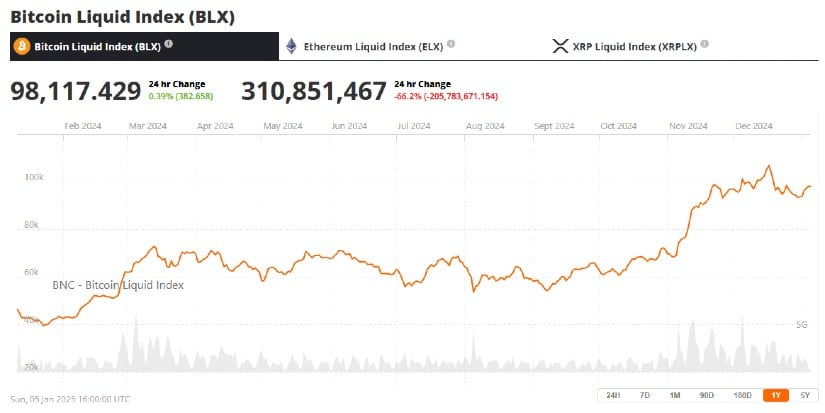

Michael Saylor, our company’s executive chairman and a prominent Bitcoin advocate, has been spearheading the development of this strategy. His organization has purchased a total of 446,400 Bitcoins, valued at approximately $43.9 billion. Each Bitcoin was bought for an average price of around $62,396. At present, the market value of one Bitcoin is roughly $97,700, which means that MicroStrategy’s Bitcoin acquisition has increased in value by 56.8% compared to what they initially paid.

On Monday’s early hours, Saylor updated his portfolio tracker. This action suggests he might soon reveal another significant Bitcoin purchase.

Part of a Larger Strategy

This stock sale is contributing to MicroStrategy’s extensive “21/21 Plan,” which aims to offload $42 billion worth of stocks and bonds over a period of three years. As such, this transaction represents approximately 45% progress in this plan, demonstrating the company’s conviction in Bitcoin as a long-term store of value and effective inflation protector.

MicroStrategy consistently adds to its Bitcoin holdings in a continuous manner. In December 2024 alone, it acquired over 60,000 Bitcoins. Out of these, approximately 21,550 Bitcoins were bought on December 9 at an average price of $98,783 per coin.

Market Impact

The announcement was made when the cryptocurrency markets were extremely volatile. In fact, Bitcoin has dropped significantly from its peak and currently faces resistance near $100,000, which is about 10% below its all-time high of $108,268 reached in December 2024. However, MicroStrategy’s news did not positively impact its stock as it increased by 13%, reaching $339.60 on January 3, marking a 438% increase compared to the same time last year.

A Pioneering Strategy with Risks

By venturing into Bitcoin investments, MicroStrategy has pioneered a new approach in business treasury management. With their significant investment in Bitcoin, they’ve reshaped the perspective many companies have towards digital currencies. However, the volatility inherent to these digital assets and the ongoing regulatory uncertainties are aspects that continue to raise concerns.

The deal additionally highlights the creative funding methods MicroStrategy uses, such as convertible notes and perpetual preferred stock, to acquire cryptocurrencies while minimizing the impact on shareholder worth. This approach offers flexibility in financing.

The Road Ahead

With Bitcoin’s usage expanding more and more, MicroStrategy’s daring actions might serve as an example for other businesses to contemplate similar strategies. The company intends to convene a shareholders meeting later this year to debate raising the authorized stock amount to accommodate proposed offerings. This action could strengthen its status as a pioneer in corporate Bitcoin investment even further.

The continuation of the $2 billion offering hinges on positive market circumstances, yet its declaration underscores MicroStrategy’s steadfast dedication to Bitcoin, serving as a crucial element in their business strategy.

Ultimately, if the picture of Michael Saylor and Eric Trump at Mar-a-Lago doesn’t spark optimism about Bitcoin, the concept of a Bitcoin Strategic Reserve, or the projected Bitcoin price in 2025, it’s hard to know what else might.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- ALEO/USD

- DEXE/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Dafne Keen? All About Logan Star As She Returns As X-23 In Deadpool & Wolverine

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- Defeat Trokka Easily in The First Berserker: Khazan!

- Gold Rate Forecast

2025-01-06 14:56