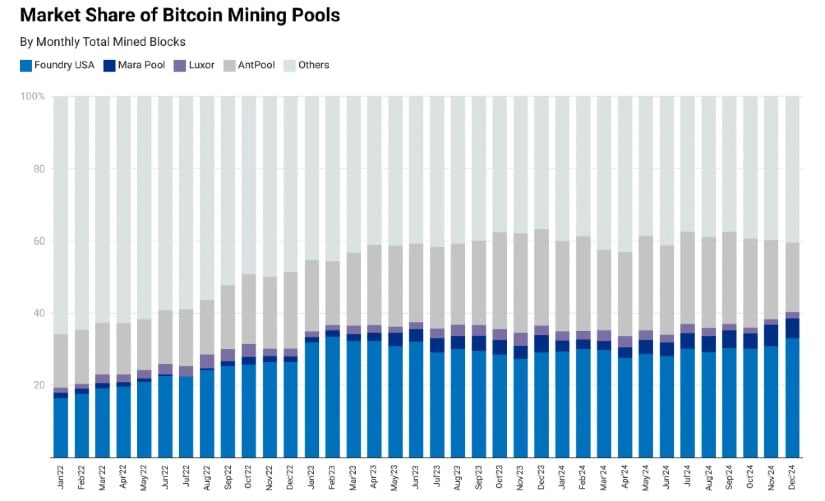

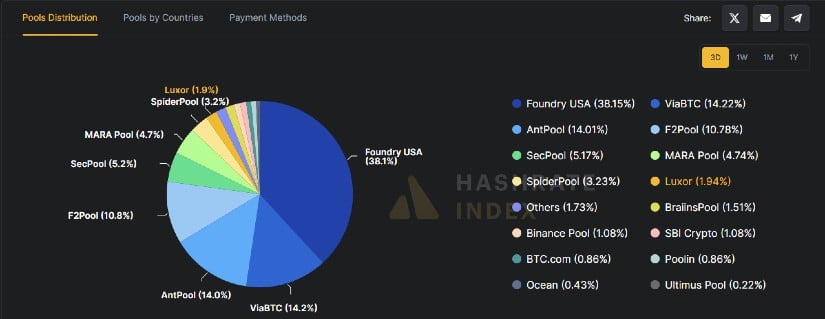

During the past year, a notable achievement is attributed largely to two American mining pools – Foundry USA and MARA Pool. Together, they accounted for an impressive 38.5% of all mined Bitcoin blocks.

Foundry USA: A Leader in Hashrate Expansion

Initially, Foundry USA, currently the world’s leading Bitcoin mining pool in terms of computational power (hashrate), significantly boosted its processing capabilities. Starting the year with a hash rate of 157 Exahash per second (EH/s) in January, it ended 2024 at an impressive 280 EH/s. This represents a growth of approximately 68% within a single year, making Foundry responsible for managing 36.5% of the total hash rate on the Bitcoin network.

The MARA Pool significantly expanded, boosting its hashing power to 32 Exahash per second (EH/s), representing 4.35% of global hash rate. Collectively, these pools have been instrumental in boosting the United States’ share of Bitcoin mining capability.

Challenges in Hashrate Distribution and Centralization

Chinese mining pools continue to hold significant power, making up approximately 55% of the global hashrate, as stated by CryptoQuant CEO Ki Young Ju. This is surprising given China’s ban on cryptocurrency mining in 2021. However, Chinese miners are finding ways around these restrictions using Virtual Private Networks (VPNs) and Peer-to-Peer (P2P) applications to contribute anonymously to the mining pools.

Despite China banning cryptocurrency mining in 2021, Chinese mining pools still control around 55% of the world’s mining activities. This is because miners are using VPNs and P2P apps to hide their identities and continue participating in these mining pools.

As a crypto investor, I’ve found it challenging to pinpoint the precise geographical distribution of mining power due to its complex nature. Although some mining pools may be based in particular countries, their hashrate contributions frequently originate from global participants. For instance, Bitmain, a prominent mining hardware manufacturer, allegedly sold 32 Exahash per second (EH/s) of U.S.-produced hashrate to a Chinese company towards the end of 2024, making regional differences even more obscure.

Industry Concerns Over Centralization

As an analyst, I’ve observed a trend where mining power in the Bitcoin network is increasingly being consolidated among a small number of large pools. This concentration raises questions about the preservation of Bitcoin’s decentralized essence, sparking debates on potential risks it might pose. Rajiv Khemani, CEO of Auradine, a leading mining chip manufacturer, underscores the importance of maintaining diversity: “It’s crucial that no single nation or entity gains control over the majority of Bitcoin’s hashrate.

Additionally, he emphasized the importance of manufacturing essential components such as ASICs from numerous sources to mitigate potential risks in the supply chain and preserve the trustworthiness of the Bitcoin network.

U.S. Initiatives to Enhance Mining Infrastructure

Significantly, with worries about centralization in mind, efforts have been made by the U.S. to bolster its mining facilities. Most notably, mining hardware titan Bitmain has broadened its production activities within the U.S., aiming to streamline supply chains and respond proactively to geopolitical issues.

Concurrently, Bitcoin mining receives backing from legal initiatives in states such as Texas. At the end of 2024, the North American Blockchain Summit featured talks about creating a Strategic Bitcoin Reserve, aimed at solidifying the United States’ dominance within this industry.

The Path Ahead

Even though achieving a significant role in Bitcoin mining is noteworthy for the U.S., industry heads warn that further actions are essential if decentralization and security are to be fully realized. As the hashrate discussion unfolds among regulators, miners, and sector leaders alike, it’s only by assuming responsibility that we can address challenges and seize opportunities, shaping the future of Bitcoin mining more effectively.

This significant change underscores how vital the United States is becoming for the safety of the Bitcoin network, as it balances the need for decentralization with global political complexities.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

2025-01-05 14:00