As a seasoned analyst with over a decade of experience in the cryptocurrency market, I’ve witnessed my fair share of price fluctuations and trends. The recent surge in Cardano (ADA) has caught my attention, as its strong performance is reminiscent of some of the bull runs I’ve seen in the past. However, it’s crucial to remain cautious and not get carried away by short-term gains.

The technical indicators, such as the golden cross and the sharp rise in ADA’s ADX, suggest a strong trend momentum that could potentially continue if buyers manage to hold above the critical support level of $1.04. The Ichimoku Cloud chart also indicates a bullish setup, with the green cloud ahead signaling further upward potential.

However, I can’t help but feel a sense of deja vu when observing the recent price pullback. History has taught me that market trends are never linear, and a slight dip could signal a period of consolidation or reduced buying pressure. The key will be for ADA to maintain its momentum and hold above the support provided by the cloud and the Kijun-sen.

My advice would be to keep a close eye on ADA’s price action and be prepared for potential volatility. If the $1.04 support level holds, we could see further gains towards $1.12, with targets at $1.18 and $1.24. However, if the trend reverses, a decline towards $0.949 might ensue, possibly even testing the $0.85 level again.

Lastly, as they say in our industry, “never underestimate the power of a bear market to teach you things you can’t learn in a bull market.” So let’s see how this plays out and stay nimble in these dynamic market conditions!

Joke: Why did ADA go to therapy? Because it had trouble holding its support levels!

In the past week, Cardano’s (ADA) price has soared by an impressive 22%. Notably, its trading volume has also hit a significant milestone of $2 billion within the last 24 hours. This remarkable growth can be attributed to optimistic technical signals, such as a golden cross and a substantial increase in ADX, demonstrating robust trend momentum.

With ADA’s recent drop in price, there are doubts about if the upward trend will persist. The importance of the $1.04 support level is growing, as ADA’s capacity to stay above it could signal that the bullish energy remains strong or if a potential shift in direction might occur instead.

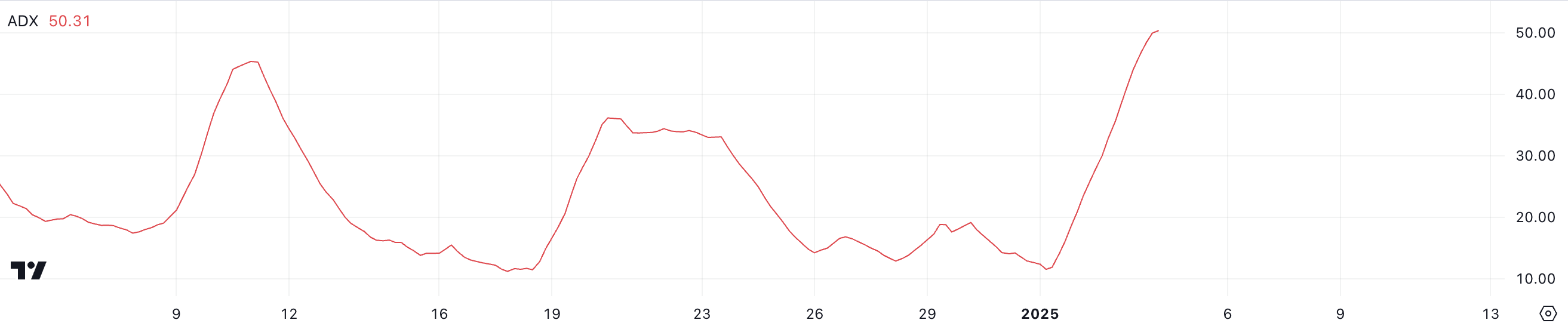

ADA ADX Confirms a Strong Uptrend

From January 1st through the 4th, the price of Cardano saw a substantial jump, rising from $0.85 to $1.06. Simultaneously, its ADX value noticeably surged from 11.8 to 50.3.

During the period between January 1 and January 4, Cardano’s price climbed significantly, going up from $0.85 to $1.06. At the same time, its ADX value sharply increased from 11.8 to 50.3.

Or:

From January 1st to January 4th, the cost of Cardano increased noticeably, moving up from $0.85 to $1.06. During this time, the ADX also showed a sharp rise, going from 11.8 to 50.3.

The Average Directional Index (ADX), which ranges from 0 to 100, quantifies the strength of a market trend. Values exceeding 25 signal a robust trend, while readings below 20 hint at weak or non-existent trend momentum. An ADX value of 50.3 underscores the presence of an extremely strong trend, bolstering the bullish sentiment observed during the price rise.

Even though the ADX reading is robust, ADA’s price has experienced a minor reversal, causing some doubts about the longevity of the uptrend. Though the EMA lines continue to point upwards, indicating that the general trend still leans towards growth, this recent price drop might signal a pause or possibly a phase of consolidation.

To keep the upward trend for Cardano’s price, purchasers should regain control to boost it further, as a decrease in buying power might lead to the ADX’s momentum becoming less robust if there is an increase in selling pressure.

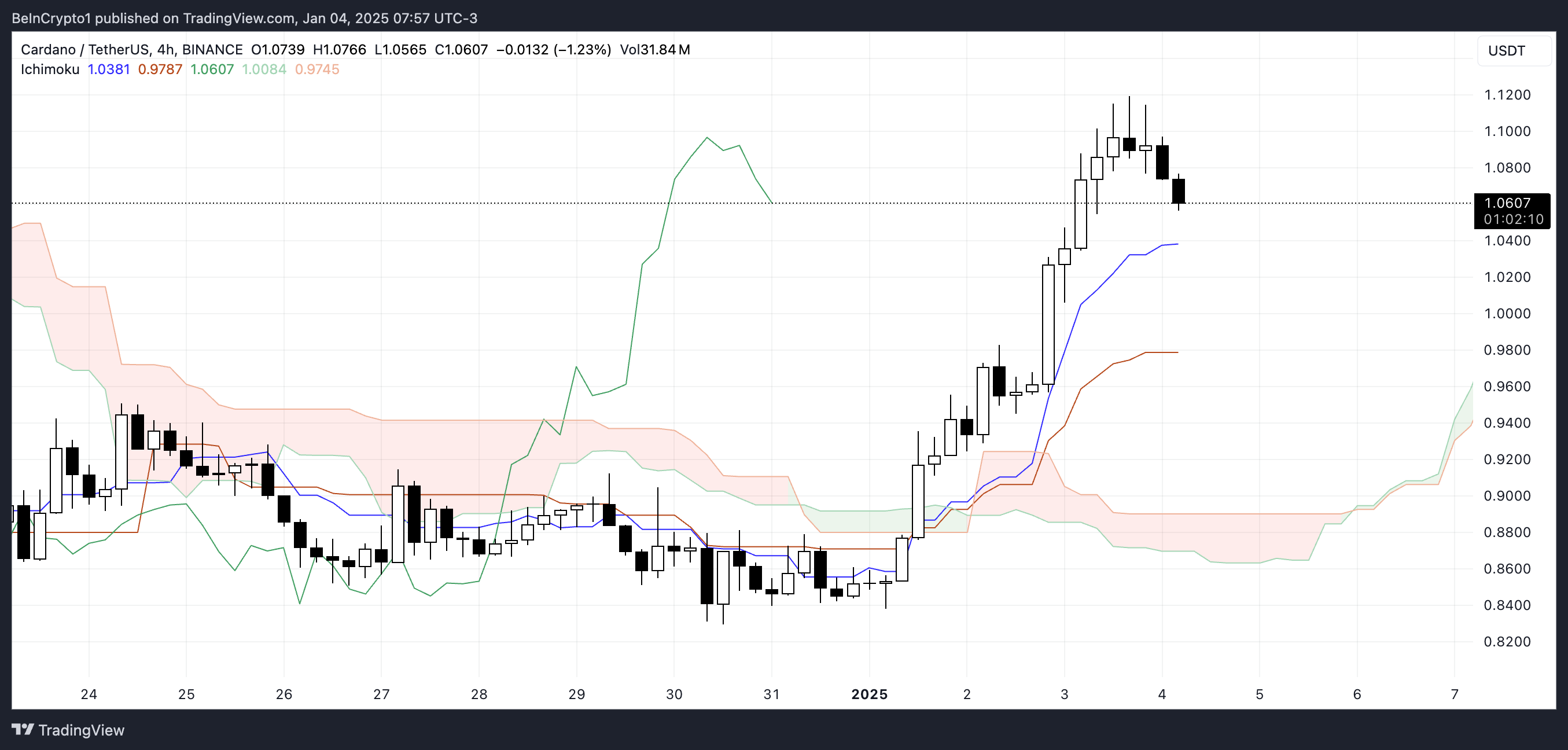

Ichimoku Cloud Indicates Bullish Setup

For Cardano, the Ichimoku Cloud chart currently shows a bullish pattern emerging after a recent price surge surpassing the red cloud. The approaching green cloud, created by the ascending Senkou Span A and Senkou Span B, signifies persistent optimism. This suggests that if the current trend persists, there could be more upward movement in the price.

Furthermore, the blue conversion line stays higher than the orange baseline, implying that the current short-term momentum is stronger than the long-term trend.

Although the price has dropped from its peaks, this could be a phase of consolidation or decreased demand for ADA. For it to continue its bullish trend, it needs to stay above the support given by the cloud and the Kijun-sen. Dropping below these points might suggest a possible reversal or further price decline.

ADA Price Prediction: The Support at $1.04 Is Fundamental

On January 3, the trajectory of Cardano’s price displayed a golden cross, meaning its short-term moving average line crossed above the longer-term lines. This technical pattern is typically considered a bullish sign that may lead to an increase in momentum. If this upward trend continues, it’s possible that the cost of ADA could climb, aiming to challenge the resistance level at approximately $1.12.

Surpassing this point might open up opportunities for additional increases, aiming at $1.18 and $1.24 respectively. These levels signify a possible 16.9% rise in value.

Even though the EMA lines are still positive, the latest market movements hint at a potential drop for ADA’s price. If the $1.04 support doesn’t withstand the pressure, there might be a shift in trend towards $0.949. Further declines could occur if ADA approaches the $0.85 mark.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-04 18:09