As a seasoned crypto investor with several years under my belt, I can attest to the rollercoaster ride that the world of digital assets has been. However, nothing quite prepared me for the alarming surge in phishing attacks and wallet drainers in 2024. With over $500 million stolen from 330,000 addresses, it’s clear that the landscape is becoming increasingly treacherous for unsuspecting users like myself.

In my early days of investing, I was naive and careless with my digital assets, but the events of 2024 have taught me a hard-earned lesson. The steep rise in phishing attacks from 67% in 2023 to 2024 is a stark reminder that cybercriminals are becoming more sophisticated by the day.

The statistics for Ethereum losses were particularly disheartening, as it suffered the most significant losses among major cryptocurrencies. It seems that no asset is safe from these malicious schemes. I’ve learned to be extra vigilant when dealing with staking and restaking tokens, stablecoins, Aave collateral, and Pendle yield-bearing assets, as they were the most targeted assets in 2024.

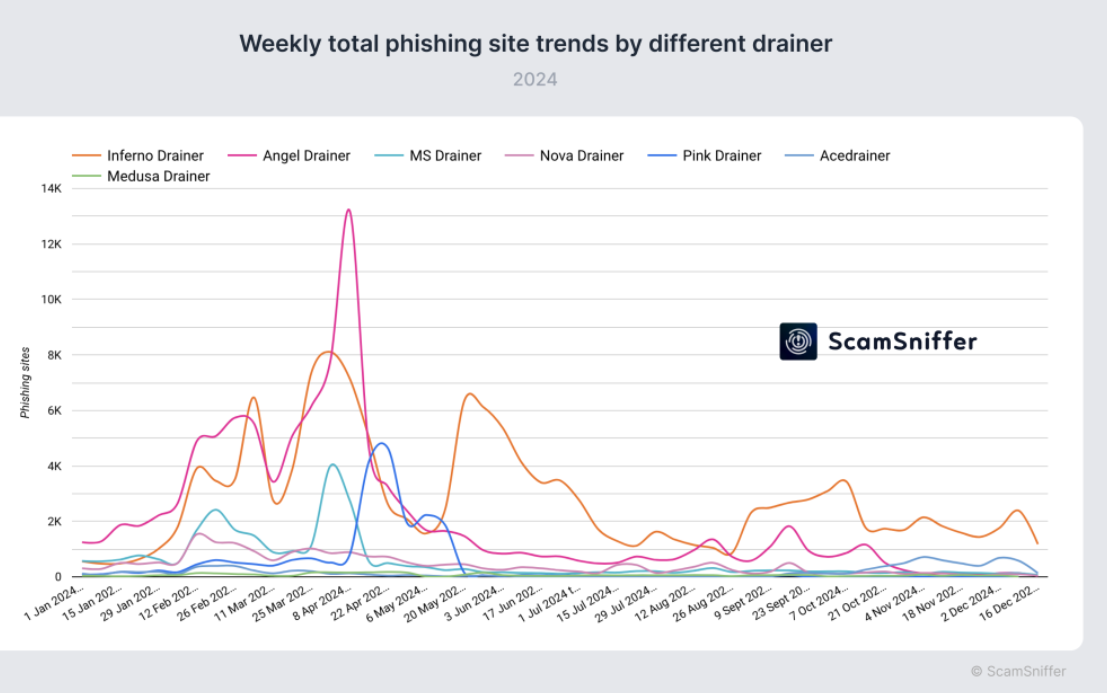

The rise of new entrants into the ecosystem only adds another layer of complexity to an already challenging landscape. I find it amusing that these malicious actors are constantly changing their names, from Angel and Pink to Inferno, but their intentions remain the same – to drain wallets.

I’ve learned my lesson and have taken steps to beef up my security measures. I now use hardware wallets, enable two-factor authentication, and never click on suspicious links or download attachments from unknown sources. I also keep a close eye on the latest trends in phishing attacks and stay informed about the evolving tactics of these cybercriminals.

In conclusion, 2024 was a wake-up call for me as a crypto investor. The sharp rise in phishing attacks and wallet drainers serves as a reminder that we must always remain vigilant in this ever-evolving ecosystem. As the old saying goes, “the best defense is a good offense,” so I’ll continue to educate myself on security practices and stay one step ahead of these cybercriminals.

On a lighter note, I’ve learned that my digital assets are safer than my sense of humor – it seems that even cybercriminals have standards!

2024 saw a significant surge in cryptocurrency wallet phishing attacks, resulting in approximately $500 million being stolen. More than 330,000 user accounts were compromised, underscoring the far-reaching consequences these attacks have on the crypto community.

This indicates a substantial 67% increase from 2023, emphasizing the growing complexity of these fraudulent strategies, as stated by Scam Sniffer.

Ethereum Leads in Crypto Phishing Losses as Attacks Evolve

In my analysis, I’ve noticed that the incidents of theft occurred in distinct surges throughout the year 2024. The first quarter (Q1) proved to be the most detrimental, with a staggering $187.2 million lost and approximately 175,000 victims reported. Among these quarters, March stood out as exceptionally damaging, with a loss of $75.2 million – the highest monthly figure recorded that year.

In Q2 and Q3 combined, a total of $257 million was lost by 90,000 different addresses. However, there was a significant drop in both the number of affected individuals and the overall losses during Q4, with only $51 million being stolen from 30,000 victims. This decrease implies that users became more aware and implemented better security measures as the year progressed.

In the first part of the year, there were numerous cases of large-scale heists, with around 30 incidents exceeding $1 million individually, cumulatively totaling approximately $171 million. More frequent in the early period were medium-sized thefts, each valued between $1 million and $8 million.

On the other hand, the latter part experienced more significant cyberattacks; August and September recorded massive losses of approximately $55 million and $32 million respectively. These two months accounted for more than half of the annual losses due to major incidents throughout the year.

In terms of cryptocurrencies, Ethereum had the largest decrease in value, with Arbitrum, Base, Blast, and BNB Chain following close behind. As for the assets impacted, it was mainly staking and restaking tokens that felt the brunt of the impact, followed by stablecoins, collateral from Aave, and yield-bearing assets on Pendle.

Throughout 2024, the variety of financial draining tools underwent significant changes. By mid-year, three primary entities – Angel, Pink, and Inferno – held considerable influence in this sphere.

Initially, Angel dominated the market with a 41% share, followed closely by Pink (28%) and Inferno (22%). However, in May, Pink decided to leave the market, resulting in a competition between Angel and Inferno for supremacy. By Q4, an interesting turn of events occurred as Angel merged with Inferno, indicating increased consolidation within the sector. Meanwhile, fresh competitors entered the scene, bringing more intricacies to the overall structure.

Last year (2024), there was a big increase in fraudulent activities such as phishing attacks and theft of digital wallets. This highlights the importance of implementing solid security practices and educating users about these issues, especially in the quickly developing world of cryptocurrencies.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

2025-01-04 12:31