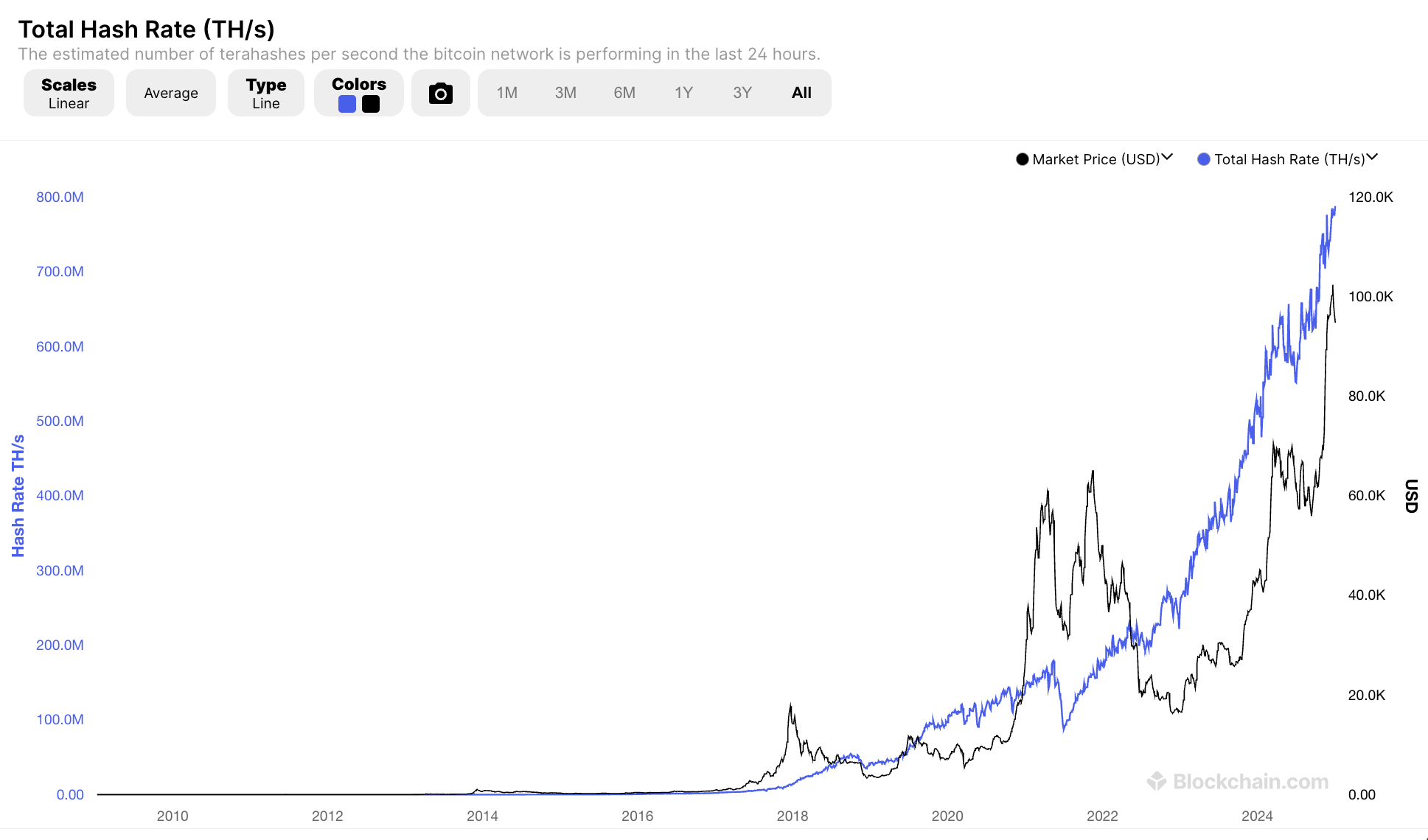

On the occasion of Genesis Block’s sixteenth birthday, which fell on January 3, 2025, Bitcoin‘s computing power (hash rate) reached a record-breaking all-time high. While the hash rate has been steadily increasing over the past few months, this latest surge marked another significant milestone in its growth trajectory.

Over the past year, Bitcoin mining activities have become more concentrated. This concentration has been particularly noticeable following the latest halving event. Despite this consolidation, surviving miners remain hopeful about the future outlook.

Bitcoin Hash Rate Steadily Rising

As a researcher, I find myself reflecting on the 16th birthday of Bitcoin, the world’s pioneering decentralized currency, as it navigates through an unprecedented market phase in its history. Today, we witnessed a temporary surge in its value following consecutive days of bearish indicators. Remarkably, fresh data points to an all-time high in its hash rate. However, there are several factors shrouded in uncertainty that could influence Bitcoin’s trajectory moving forward.

As a crypto investor in early 2024, I experienced firsthand the significant effects of the latest Bitcoin halving on its hash rate. In the months leading up to the event, increased miner activity caused a gradual inflation of the hash rate. However, this heightened activity abruptly ceased following the halving, creating a chaotic impact on Bitcoin’s price and adding to the complexity of the situation.

These occurrences, combined with other significant elements influencing the Bitcoin network, have caused a major and lasting change in the way Bitcoin’s hashing is handled.

To give an illustration, the dominance in the U.S. Bitcoin mining sector has narrowed significantly, with just two major players controlling a majority of the network’s computational power. Remarkably, one of these leading mining entities decided to reduce its workforce by 60%, despite maintaining a competitive edge in this field.

In my analysis, while there are indeed some troubling patterns within the mining sector, it’s important to highlight that there are standout performers. For example, Hive Digital just hit a significant achievement and intends to enhance its infrastructure by upgrading equipment and moving its headquarters. Furthermore, Fred Thiel, head of the leading Bitcoin mining company MARA, recently expressed optimistic projections for 2025 in a recent interview.

Simply put, despite the surge in Bitcoin liquidations and rising mining complexity, the optimistic outlook among miners remains undiminished. Over the past few months, an increasing number of miners have opted to hoard their earnings instead of selling them. This strategic move has been significantly beneficial during the recent bullish market trend.

As Bitcoin turns older by another year, plenty of miners are looking forward to the future.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- DEXE PREDICTION. DEXE cryptocurrency

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- General Hospital Spoilers: Will Willow Lose Custody of Her Children?

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Fact Check: Did Lady Gaga Mock Katy Perry’s Space Trip? X Post Saying ‘I’ve Had Farts Longer Than That’ Sparks Scrutiny

- SDCC 2024: Robert Downey Jr. Confirms MCU Return As Dr Doom In Avengers: Doomsday

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

2025-01-04 02:20