As a seasoned analyst with over two decades of market observation under my belt, I have seen countless trends come and go, but few have been as fascinating as the rise and fall of meme coins in the crypto space. Today, I find myself reflecting on the intriguing journey of Pudgy Penguins (PENGU), a project that briefly claimed the top spot among Solana’s meme coins before facing a 9% drop within 24 hours.

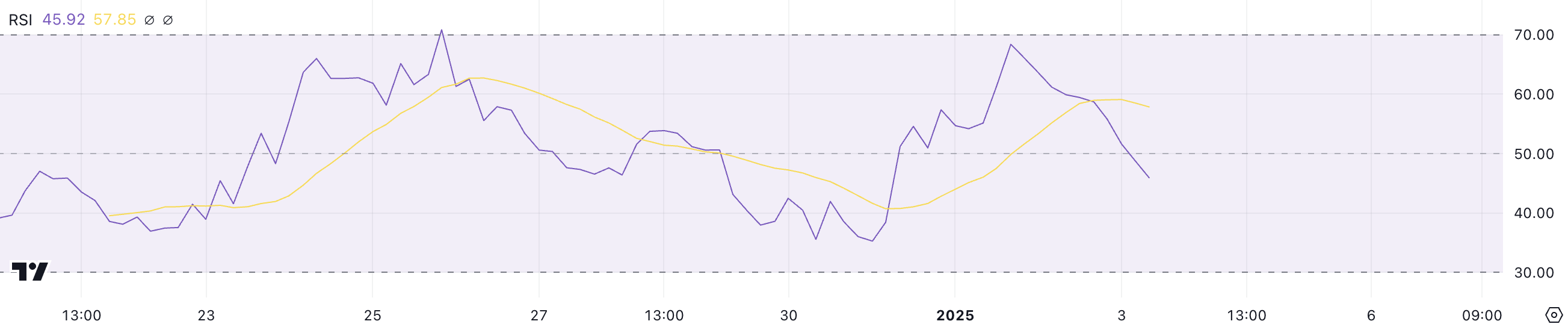

Having studied key technical indicators like the RSI and DMI, I can confidently say that the recent decline in PENGU’s price is no fluke. The cooling momentum, reflected in its RSI dropping from 68.3 to 45.9, indicates a shift in market sentiment. With the current RSI level placing PENGU in the neutral zone, we may be entering a consolidation phase in the short term. However, this doesn’t mean that prices will remain stagnant; significant shifts in buying or selling activity could drive prices up or down.

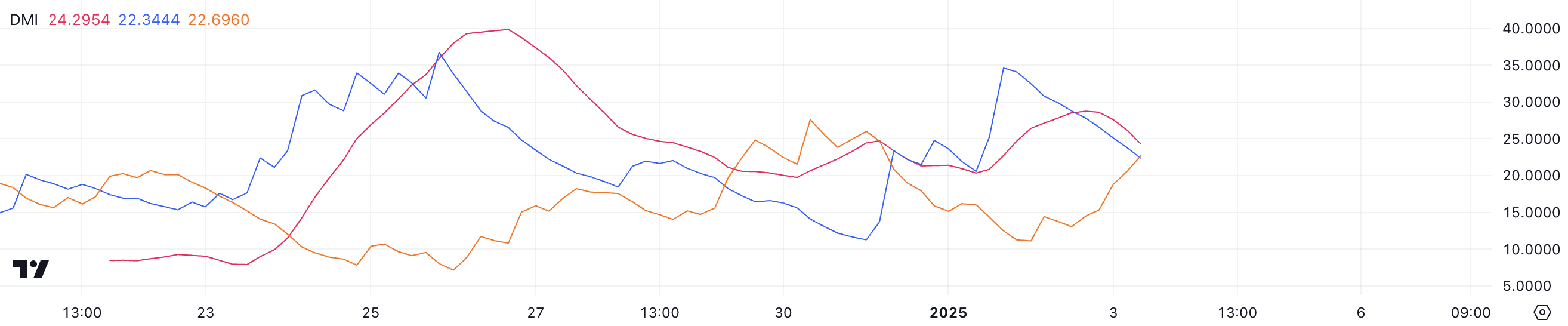

The DMI chart also shows a moderately strong downtrend, with the -DI overtaking the +DI slightly. This suggests bearish momentum is starting to gain traction, but it’s essential to note that the close values of the indicators indicate a market in transition. In other words, we could see continued consolidation or a potential tilt toward further bearishness unless bullish momentum regains strength.

As for my prediction, I believe that a potential death cross is on the horizon, which could reinforce the current downtrend and push PENGU price towards its nearest support at $0.0296. Failure to hold this level could result in a significant correction of up to 27.6%. On the flip side, if bullish momentum takes over, we might see prices retesting the $0.0409 resistance level and potentially rising further.

In a lighter note, it seems that the crypto market has a knack for serving up unexpected twists and turns – much like a rollercoaster ride I once took in Cedar Point. So buckle up, fellow traders, as we navigate this ever-evolving landscape of meme coins on Solana!

In the past 24 hours, the value of Pudgy Penguins (PENGU) has decreased by over 9%, a shift that occurred after it temporarily held the title of the largest meme coin on Solana. However, this position has since been taken by BONK and ai16z.

The current drop in performance occurs when things are slowing down, as suggested by significant changes in vital technical measures such as Relative Strength Index (RSI) and Daily Moving Average (DMI).

PENGU RSI Is Cooling Off

The Penguin’s Relative Strength Index (RSI) stands at 45.9, showing a significant decrease from the 68.3 reading on January 1st. This decrease suggests that the buying force is lessening, and the momentum that was pushing the price up has started to slow down.

As a researcher studying the financial markets, I find myself observing that theRelative Strength Index (RSI) for PENGU is currently situated within the neutral zone. This indicates an equilibrium between buying and selling forces, with neither significantly outweighing the other, suggesting a lack of clear dominance from either party at this time.

As an analyst, I utilize the Relative Strength Index (RSI) as a common tool to gauge market momentum. This indicator rates the speed and intensity of price fluctuations on a scale ranging from 0 to 100. A reading exceeding 70 signals overbought conditions, which may predict a potential price correction or pullback. Conversely, readings below 30 indicate oversold conditions, potentially hinting at an upcoming rebound or recovery in the market.

Based on the PENGU RSI reading of 45.9, the indicator indicates that the asset is in a stabilization period, neither overbought nor oversold. In the near future, this level could suggest minimal price fluctuations unless market sentiments change significantly, which might be triggered by increased buying or selling activity.

PENGU Downtrend Is Getting Stronger

Based on my extensive experience in financial analysis and trading, I can confidently say that PENGU’s DMI chart currently shows its ADX at 24.2, indicating a moderately strong trend. As someone who has closely monitored market trends for several years, I can tell you that this level of ADX suggests that while there is some momentum in the market, it hasn’t yet reached a decisively strong point. This means that while it may be worth keeping an eye on PENGU, it’s important to approach any investment decisions with caution and a discerning eye, as trends can change rapidly in the financial markets.

Over the past two days, the Directional Indicator (DI) has dropped from 34.6 to 22.3, indicating a decrease in buying activity and less demand for Penguin (PENGU). Simultaneously, we’ve seen an uptick in selling pressure as the -DI rose from 11.2 to 22.6. This trend could potentially result in WIF overtaking PENGU’s position as the third-largest meme coin on Solana.

As I analyze the directional indicators, it appears that the negative directional indicator (-DI) has slightly surpassed the positive directional indicator (+DI), indicating that short-term bearish momentum might be growing stronger. The close proximity of both the +DI and -DI suggests that we’re dealing with a market in flux, where neither buyers nor sellers currently hold a clear upper hand, implying a transition period.

In simpler terms, if the PENGU price doesn’t see an increase in its +DI (a technical indicator) or if the ADX (another technical indicator) fails to rise significantly above 25, it could indicate ongoing stability or even a shift toward decreasing prices, also known as bearishness. However, a stronger trend might be confirmed only when the +DI regains strength and the ADX climbs beyond 25.

PENGU Price Prediction: A Potential 27.6% Correction

Based on the EMA (Exponential Moving Average) lines from PENGU, it seems that a “death cross” might appear shortly. This is a pessimistic sign as the shorter-duration EMA could drop below the longer-duration EMA, suggesting a potential downward trend in the market.

If this event happens, it might strengthen the ongoing fall in PENGU’s price, moving it closer to its nearest support at $0.0296. Should it fail to maintain this level, there may be additional drops, with the next support at $0.025 indicating a potential 27.6% correction if breached.

Instead, if the trend shifts and bullish power prevails, the PENGU price might challenge the resistance at $0.0409 again. Overcoming this barrier could lead to additional growth, potentially pushing the price up to $0.0439, signifying a 26.5% increase. If successful, the PENGU price could regain its position as one of the top Solana meme coins, similar to its standing last week.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-04 00:50