I have been closely observing the evolution of Bitcoin since its inception, and I must admit that the journey has been nothing short of fascinating. As someone who spent my formative years working in finance, I can attest to the skepticism and apprehension that initially surrounded this decentralized digital currency. However, watching it grow into a global phenomenon with a market cap rivaling traditional financial institutions is truly remarkable.

The resilience of Bitcoin’s network, surpassing 16 years without downtime, is particularly impressive. It’s like having a 24/7 bank that never closes, not even during holidays or power outages. And the fact that it operates independently from any central authority, making it less susceptible to manipulation and control, is truly revolutionary in today’s financial landscape.

The increasing adoption by institutions and the potential integration into national reserves are testament to its growing legitimacy as an asset class. I can only imagine what Bitcoin would have been like in the hands of the old-school bankers who used to scoff at it during my days in finance. They’d probably be surprised to see their traditional financial world being disrupted by something they once dismissed as a passing fad.

As for the environmental concerns, it’s heartening to see that more than 60% of Bitcoin mining is now powered by renewable energy sources. It’s like watching a phoenix rise from its own ashes, adapting and growing in response to criticism. I can’t help but chuckle at the thought of Bitcoin being powered by stranded natural gas or excess grid energy—who would have thought that the future of finance could be so…gassy?

In all seriousness, the transformation of Bitcoin over the years is a testament to human ingenuity and resilience. It’s an example of how technology can disrupt and improve our financial systems, providing alternatives for individuals and institutions alike. And as someone who has seen both traditional finance and the nascent world of cryptocurrencies, I can confidently say that the future is bright—and it’s powered by Bitcoin.

This year, Bitcoin celebrates its 16th birthday, transitioning from a little-known trial to a significant global financial resource. Since its debut in 2009, Bitcoin has reshaped our understanding of money and decentralization, leaving an indelible impact on technology, finance, and culture.

Delving into its enigmatic origin with the enigma of Satoshi Nakamoto at its helm, Bitcoin’s journey has been nothing short of extraordinary. To celebrate this remarkable milestone, here are 16 significant facts that underscore its influence and expansion over the past 16 years.

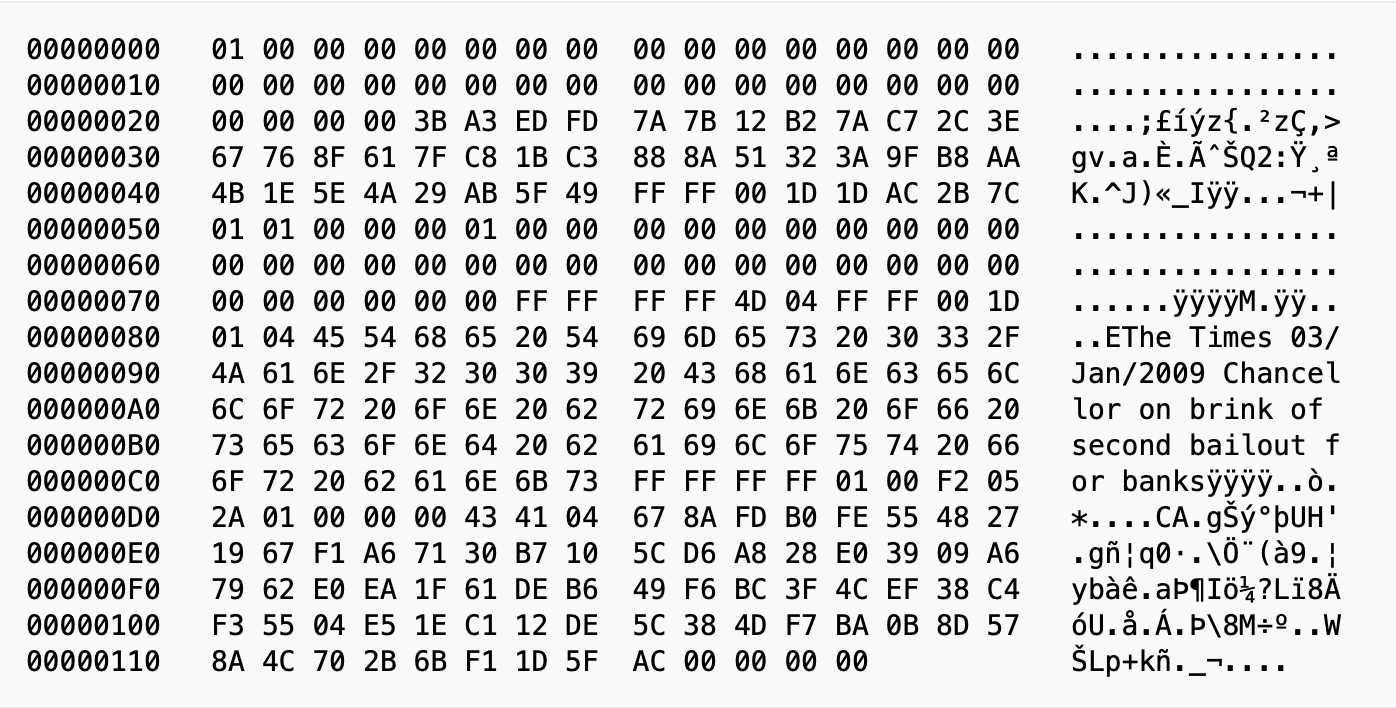

1. Bitcoin Genesis Block Contained a Secret Message

The first instance of Bitcoin was mined on January 3rd, 2009, marking its birth. Unlike subsequent blocks, the Genesis Block – also known as Block 0 – was embedded within the Bitcoin code and did not yield any spendable Bitcoins. This intentional design choice was made by the enigmatic creator of Bitcoin, Satoshi Nakamoto.

Inside this section, there was an extract from “The Times” dated January 3rd, 2009: “Chancellor on brink of second bailout for banks.” This insert served as a timestamp and a subtle criticism of the conventional financial system, emphasizing Bitcoin’s objective to de-centralize currency.

As I delve into the intricate world of Bitcoin, I can’t help but be captivated by the significance of the Genesis Block. In countless conversations about its roots and objectives, this block stands as a symbolic cornerstone. Its creation laid the groundwork for Bitcoin’s uninterrupted 16-year journey, transforming it from a mere concept into a global phenomenon that continues to grow and evolve.

2. Satoshi Nakamoto Sent 10 BTC to Hal Finney in Bitcoin’s First Transaction

On the 12th of January, 2009, Satoshi Nakamoto is known to have executed the initial Bitcoin transaction, transferring 10 Bitcoins to well-known computer scientist and cryptographer, Hal Finney.

On the day it was launched, Finney, who was among the first to adopt and contribute to Bitcoin, posted a tweet that read, “Operating Bitcoin,” on January 11, 2009.

3. Bitcoin’s Creator Remains Unknown to This Day

The creator of Bitcoin, who goes by the pseudonym and keeps their real identity hidden, continues to be one of the most intriguing enigmas in the realm of cryptocurrencies. In October 2008, under the title “Bitcoin: A Peer-to-Peer Electronic Cash System“, a document outlining the blueprint for a decentralized digital currency was published by this mysterious figure. To this day, despite numerous theories and investigations, no one has been able to definitively reveal Satoshi’s true identity.

Satoshi Nakamoto, who is believed to be either an individual or a group of developers using that pseudonym, frequently interacted with early Bitcoin pioneers through online forums and emails, contributing significantly to the development and fine-tuning of the Bitcoin network until around April 2011. However, the true identity behind Satoshi Nakamoto remains a mystery, with various theories circulating about who might be hiding behind that alias.

After Satoshi vanished, the control of the project shifted to its community, thereby nurturing the decentralized spirit that defines it now. Regardless of who Satoshi might be, or once was, their idea gave birth to a technology that fundamentally transformed the global financial landscape.

4. The Bitcoin Whitepaper Is Embedded in the Blockchain

As a seasoned cryptocurrency enthusiast with over a decade of experience in the field, I deeply appreciate the significance of the anonymous individual who took a unique and historic step to preserve Bitcoin’s origins by embedding the entire Bitcoin whitepaper directly into the Bitcoin blockchain in 2013. This innovative action not only showcases the decentralized nature of the technology but also underscores the commitment of early adopters to maintaining its foundational principles.

In my view, this act serves as a testament to the power and resilience of the Bitcoin community, who have consistently demonstrated their ability to adapt and innovate in response to the ever-evolving landscape of finance and technology. The fact that such an important document could be seamlessly integrated into the blockchain, ensuring its accessibility for all users, speaks volumes about the potential of this revolutionary technology.

In my personal journey through the world of cryptocurrencies, I have come to understand the importance of preserving the origins and principles upon which these digital assets were built. This action by the anonymous individual serves as a powerful reminder that, at its core, Bitcoin represents more than just a financial tool; it embodies the spirit of innovation, decentralization, and transparency that lies at the heart of the blockchain revolution.

As a researcher delving into the realm of digital currencies, I’ve come to appreciate the inherent permanence of the blockchain’s design. This immutable nature ensures that the Bitcoin whitepaper remains accessible to all users within the network, fostering a sense of shared knowledge and understanding about the cryptocurrency’s origins. By embedding the whitepaper onto the blockchain, I believe we’ve forged an indelible link between Bitcoin’s initial concepts and the technology itself, vividly illustrating the profound bond between the inception of this digital currency and its decentralized infrastructure.

5. The First Transaction in a New BTC Block Is Called a Coinbase Transaction

Every new Bitcoin block initiates a special transaction called a coinbase transaction, which is distinct from regular transactions. Unlike standard transactions, it doesn’t require inputs because it creates new Bitcoins as a reward for miners. This unique transaction encompasses both the block reward (currently 6.25 BTC following the halving in 2024) and any fees associated with the block itself.

It’s worth noting that the name of well-known cryptocurrency platform Coinbase originates from a term tied to Bitcoin’s method of generating new coins. This term may be technically related to Bitcoin, but Coinbase’s name underscores its link to the fundamental process within the blockchain upon which it operates.

6. About 4 Million BTC Are Lost Forever

By the year 2025, it’s projected that around 20% of all Bitcoins, which amounts to approximately 4 million units, are currently unreachable because of forgotten passwords, misplaced hardware wallets, or lost account access. The majority of these instances happened during Bitcoin’s formative years when the importance and safekeeping of digital assets were not as widely recognized as they are today.

Some individuals have lost access to their Bitcoin wallets due to forgotten passwords or discarded devices holding private keys, oblivious to Bitcoin’s future growth potential. The tale of James Howells, who inadvertently dumped a hard drive containing 8,000 BTC in 2013, remains notorious as he finances extensive searches through landfills in hopes of unearthing his lost fortune.

7. 10,000 Bitcoin Spent on Two Pizzas in First Real Transaction

2010 marked the first occasion when Bitcoin was utilized to purchase real-world items, specifically two pizzas that cost around $40. These pizzas were bought by a coder known as Laszlo Hanyecz using 10,000 Bitcoins. Today, this event is commemorated annually as Bitcoin Pizza Day, emphasizing a significant milestone in the digital currency’s history.

In the past, a single Bitcoin had minimal value, yet those 10,000 Bitcoins are now worth hundreds of millions of dollars today. This trade took place on a Bitcoin forum, where Laszlo offered the coins in exchange for two Papa John’s pizzas. Another user agreed to this deal and arranged for the delivery of the pizzas to Laszlo.

8. Satoshi Nakamoto’s Fortune Remains Untouched

By 2025, approximately 1.1 million Bitcoins, believed to have been mined by the anonymous creator of Bitcoin, remain undisturbed. These valuable assets are kept in various digital wallets, with an estimated value of roughly $100 billion.

The enigma surrounding who Nakamoto is and the unused Bitcoins still stirs debate over Bitcoin’s beginnings. Some analysts see these coins as a demonstration of Bitcoin’s core value of decentralization, while others argue that Nakamoto’s absence underscores Bitcoin’s autonomy from traditional central control. This untouched stash of Bitcoins symbolizes its exceptional position as an unyielding, trustless financial system.

9. World’s First Satoshi Nakamoto Statue Stands in Budapest

As an analyst, I’d rephrase it as follows: In Graphisoft Park, Budapest, Hungary, stands the world’s inaugural statue honoring the enigmatic creator of Bitcoin, Satoshi Nakamoto. This monument, unveiled on September 16, 2021, is a bronze sculpture that portrays a figure cloaked in mystery, with a mirror-like, faceless visage. The anonymity of Nakamoto is encapsulated in this statue, inviting viewers to perceive themselves as part of the image, echoing the sentiment that “we all embody Satoshi.

In October 2024, a statue of Satoshi Nakamoto that seems to vanish was put up in Lugano, Switzerland. This distinctive piece of art, situated outside Villa Ciani, depicts a figure without a face busily working on a computer. The artwork’s design gives the illusion of transparency when viewed from the front or back, mirroring Nakamoto’s mysterious persona.

10. Bitcoin Appeared in Popular Movies

The topic of Bitcoin has gained significant attention in various media outlets, with appearances in films such as “Dope” (2015), where characters utilize Bitcoin for online transactions, and television series like “Billions” and “Mr. Robot”, delving into its financial and transformative dimensions.

These documentaries, such as “Banking on Bitcoin” (2016) and “The Rise and Rise of Bitcoin” (2014), trace its beginnings and increasing influence, while “Cryptopia” (2020) delves into its role within the blockchain community.

As an analyst, I’ve noticed that Bitcoin has made its mark in popular culture, with shows like The Simpsons humorously foreshadowing its future and South Park depicting it as a dominant currency. These representations underscore Bitcoin’s evolution from a technology intrigue to a cultural movement.

11. Bitcoin Transaction Successfully Sent from the Stratosphere

Back in August 2016, Genesis Mining, a cryptocurrency mining company, carried out an intriguing test. They initiated the first Bitcoin transaction ever sent from space! To do this, they utilized a weather balloon fitted with a Bitcoin wallet and a miniature Bitcoin model. This payload ascended to approximately 34 kilometers or about 21 miles high in the stratosphere.

In the course of the flight, the team managed to send a Bitcoin transaction to a wallet on the weather balloon. This groundbreaking feat underscored Bitcoin’s robustness and its unique capacity to function independently from conventional infrastructures, even under harsh conditions. The experiment represented the boundless possibilities of decentralized technology, illustrating how Bitcoin could overcome geographical limitations and link users globally – and possibly beyond.

12. 60% of Bitcoin Mining Now Powered by Renewable Energy

2024 saw a significant change in the practice of Bitcoin mining, as it moved towards more sustainable methods amidst growing concerns over its environmental footprint. Reports from the industry suggest that around 60% of worldwide Bitcoin mining activities are now powered by renewable energy sources.

More and more mining operations are choosing to situate themselves close to hydroelectric plants, solar energy farms, and wind turbine sites in order to minimize their environmental impact and take advantage of cheaper energy prices. Similarly, Bitcoin miners are looking into creative ways to manage energy consumption, including tapping into unused natural gas reserves or extra electricity from the grid that might otherwise be squandered.

13. Over 95% of Bitcoin’s Supply Is Already Mined

The Bitcoin system sets a maximum of 21 million units, mirroring the rarity of valuable metals such as gold. This set number aims to prevent excessive printing or creation, making Bitcoin resemble a deflationary resource instead of an inflating one.

By the year 2025, approximately 19.9 million Bitcoins have already been mined, leaving just under a million coins yet to be produced. This scarcity has earned Bitcoin the title of “digital gold,” as it’s become an attractive investment option for those seeking protection against inflation. Regrettably, an estimated 20% of all mined Bitcoins are believed to be irretrievable due to lost keys or inaccessible accounts, further increasing its scarcity.

14. Institutional Bitcoin Holdings Surpass Satoshi Nakamoto’s Stash

By the close of 2024, the amount of Bitcoin held by institutions, mostly through spot ETFs, had reached over 1.1 million coins, surpassing the presumed holdings of Bitcoin’s anonymous creator. This development underscores the increasing acceptance of cryptocurrencies as a bona fide investment class among institutions.

Notable financial corporations such as BlackRock and Fidelity have introduced Bitcoin Exchange-Traded Funds (ETFs), which have drawn significant investments and helped to solidify Bitcoin’s position within conventional finance, paving the way for wider acceptance.

15. Bitcoin Reserve Proposal Gains Traction Worldwide

2024 saw a surge in talks about incorporating Bitcoin into national reserves, with countries from both the developed and emerging economies showing interest in its possibilities. In the United States, politicians and financial analysts put forth ideas to earmark a section of the federal reserves for Bitcoin, highlighting its limited supply and decentralized nature as significant benefits. Supporters contend that adding Bitcoin could protect against the waning influence of the dollar and broaden reserve assets, complementing traditional investments like gold.

In some countries, there has been tangible progress in adopting Bitcoin as a part of their reserve currencies. For instance, political suggestions have been made to the Swiss National Bank to diversify its reserves by incorporating Bitcoin. Proponents believe that Bitcoin’s limited supply and decentralized nature make it an exceptional shield against currency devaluation and global economic turmoil.

Just like Germany, there have been talks about the European Central Bank exploring the use of Bitcoin in their digital reserve plans, driven by growing curiosity towards decentralized options.

16. Bitcoin’s Network Resilience Surpasses 16 Years Without Downtime

2025 saw Bitcoin reaching an extraordinary feat – it operated non-stop for 16 years without experiencing a single instance of network failure. This remarkable achievement highlights the unmatched dependability of Bitcoin’s distributed system, powered by countless nodes and miners situated worldwide.

Unlike traditional financial systems that often face downtimes due to outages or cyberattacks, this network has shown an impressive ability to withstand threats, from large-scale hacking attempts to regulatory interventions and technical difficulties. Remarkably, even during peak periods, such as the time when Bitcoin reached over $100,000 in late 2024, the network managed to handle transactions securely and smoothly without any significant delays.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-01-03 15:18