The price of Stellar (XLM) has spiked by more than 16% within the past day, reclaiming its $13 billion market capitalization and indicating a robust bullish trend. Various technical indicators such as the Relative Strength Index (RSI), Ichimoku Cloud, and Exponential Moving Averages (EMA) lines suggest that XLM could see additional growth; however, potential resistance may be encountered along the way.

The Relative Strength Index (RSI) is still in the overcrowded buying area, signaling increased purchasing activity. Additionally, a recent Golden Cross and Ichimoku configuration suggest prolonged bullish trends. Crucial levels like the resistance at $0.47 and support at $0.41 will significantly influence whether XLM continues its upward trend or experiences a steep decline.

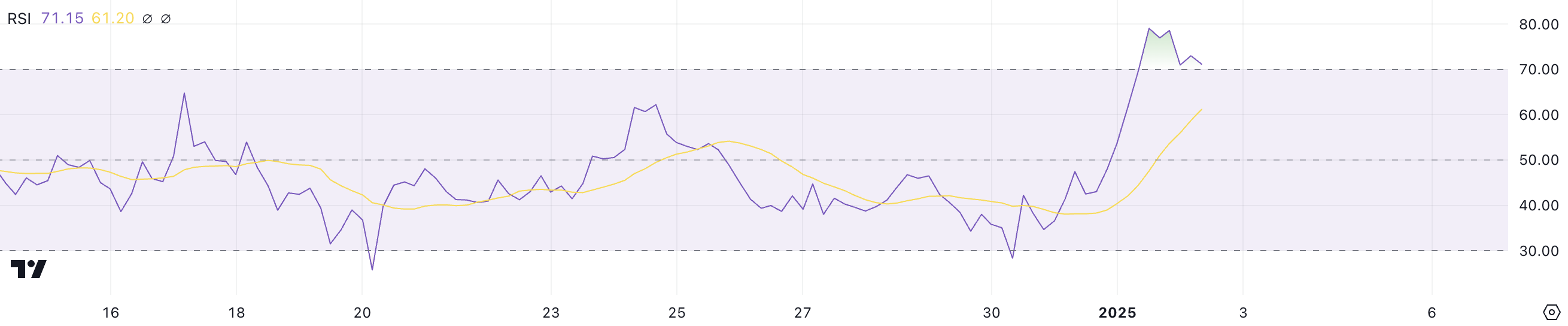

Stellar RSI Is Still In the Overbought Zone

The Relative Strength Index (RSI) of XLM is standing at 71.1, having stayed above the overbought level of 70 since January 1st. This represents a substantial rise from December 31, where the RSI was in a more balanced state. The high RSI suggests robust buying activity, which has likely driven the nearly 16% price jump that XLM experienced within the last 24 hours.

Conversely, when the Relative Strength Index (RSI) exceeds 70, it could indicate that the asset might be nearing an overbought state, increasing the likelihood of a temporary correction or pause in its growth.

The Relative Strength Index (RSI) is a tool used to gauge the rate and intensity of price changes, ranging from 0 to 100. Readings above 70 signal overbought situations, which might be followed by a price adjustment or stabilization. On the other hand, readings below 30 point towards oversold conditions, possibly indicating an upcoming recovery.

Using XLM’s Relative Strength Index (RSI) at 71.1, the indicator indicates that the bullish energy persists, however, the asset may be approaching an area where further advancement could prove challenging to maintain.

Ichimoku Cloud Shows a Bullish Momentum

For the Stellar’s Ichimoku Cloud graph, there is a robust bullish configuration, as the price sits comfortably above the red cloud layer. This ascending breach from the cloud indicates a significant change in direction, suggesting that the market is now dominated by strong buyers.

The green-tinted mass on the horizon, created by Senkou Span A and Senkou Span B, strengthens optimistic beliefs, implying a probable prolongation of the rising market pattern for a short while.

Furthermore, the blue Tenkan line has risen above the orange Kijun line, suggesting a strengthening bullish trend since the short-term price movement is surpassing the long-term trend. The green Chikou Span, which follows the price action, is positioned above both the current price and the cloud, signifying that the recent uptrend aligns with the latest price history.

From my perspective as a researcher, the Ichimoku Cloud configuration indicates that I’m observing a robust upward trend for XLM. The technical indicators lend credence to this observation, hinting at more significant increases ahead.

XLM Price Prediction: Potential 27% Correction If the $0.41 Support Fails

More recently, the Exponential Moving Average (EMA) lines from Stellar have intersected in what’s known as a ‘golden cross’. This is considered a positive signal because it happens when the shorter-term EMA moves above the longer-term EMA, suggesting a potential increase in price.

Based on my years of trading experience and close observation of the Stellar market, I believe that the current technical signal points to a strong possibility of continued upward momentum. Having witnessed similar patterns play out in the past, I can confidently say that if this uptrend persists, we might see Stellar testing the $0.47 resistance level. A successful breakout above this barrier could open doors for even more gains, with the next target at $0.50. This bullish movement would indicate a growing optimism among investors, which I’ve seen in my career lead to further price increases. Keeping a close eye on Stellar and its market trends is essential for anyone looking to make informed investment decisions.

As a seasoned investor with years of experience under my belt, I can’t help but notice the current trend of XLM prices. Having seen many market fluctuations over the years, I must admit that I have a keen eye for spotting potential dips and surges. Based on my analysis, if the uptrend in XLM seems to be losing momentum, it could potentially signal a downturn. If this were to happen, the price of XLM might plunge below its nearest support at $0.41.

I’ve learned from past experience that when a support level fails to hold, it can lead to a sudden and sharp decline. In this case, a 27% correction could take XLM down to the next strong support at $0.31. So, while I always encourage investing with caution, I would urge potential investors to exercise extra vigilance when considering XLM at this juncture.

Read More

2025-01-03 02:17