As a seasoned crypto investor with over five years of experience, I have weathered numerous market cycles and learned to read between the lines when it comes to Bitcoin (BTC) price predictions. After analyzing the recent developments in the market, my gut feeling is that the first day of 2025 might not be as promising for BTC as many anticipate.

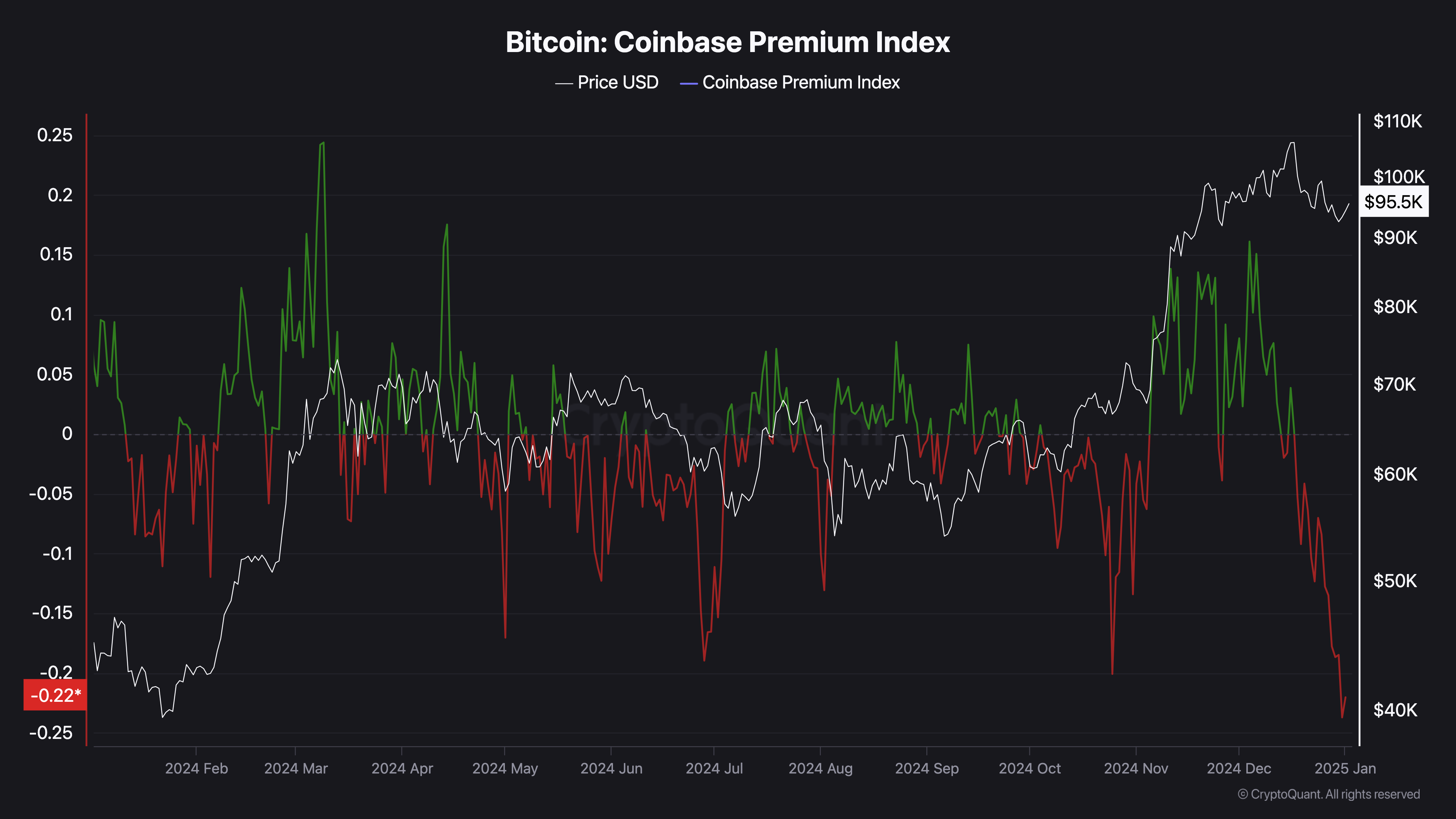

The selling pressure on day one has raised concerns about its ability to break above $95,000, and the current trend among US investors seems to support this outlook. The sharp decline in the Bitcoin Coinbase Premium Index indicates that American investors are selling their assets, which could put a sustained uptrend in doubt.

However, it’s essential to remember that markets can be unpredictable, and short-term trends don’t always dictate long-term performance. I once made the mistake of selling BTC at the bottom of a bear market, only to regret it when prices skyrocketed shortly after.

That being said, it’s crucial to keep an eye on other indicators such as the price – Daily Active Addresses (DAA) divergence and the Exponential Moving Average (EMA). A negative DAA reading suggests decreasing user engagement, which could make it challenging for BTC to trade above $95,000. The EMA also indicates that Bitcoin’s recent upswing might not last, as the price is currently below the 20 EMA, suggesting a bearish trend.

In my experience, I have learned that markets can turn on a dime, so it’s essential to stay informed and adaptable. If US investors start contributing to Bitcoin’s buying pressure, this trend could change, and we might see BTC jumping to $108,398. On the other hand, if selling pressure continues, the price might slide lower.

As always in crypto, it’s a rollercoaster ride, and I wouldn’t be surprised if we see some unexpected twists and turns along the way. But as they say, “Buy the rumor, sell the news.” So, let’s wait and see what 2025 has in store for us!

Oh, and remember: Always DYOR (Do Your Own Research) and never invest more than you can afford to lose!

2025 appears to be a very optimistic year for the overall crypto market, as far as many investors are concerned. However, on its debut day, Bitcoin (BTC) is experiencing significant selling pressure, causing worry about its potential to surpass the $95,000 mark.

In this analysis, BeInCrypto examines Bitcoin’s short-term price outlook using key indicators.

Bitcoin Investors Put Sustained Uptrend in Doubt

Following the US elections in November 2024, the Coinbase Bitcoin Index increased to 0.14. This index indicates if American investors are demonstrating significant buying interest or if they’re offloading Bitcoin in substantial quantities.

In simpler terms, when the values are high, as they were in November, it suggests a lot of people are selling Bitcoins. Currently, however, the index has fallen to -0.22, which is its lowest point over the past year. This substantial drop suggests that many American Bitcoin investors are offloading their assets.

Even though Bitcoin’s current price stands at $95,318, showing a minimal rise of 2.06% over the past day, if these investors choose to sell off their Bitcoins further, there could be a shift in this trend and the cryptocurrency’s value might potentially drop even lower.

After this progression, crypto analyst Burak Kesmeci pointed out that it might be challenging for the price of Bitcoin to rise.

Based on my extensive experience in the cryptocurrency market and my observations of Bitcoin’s behavior over the years, I believe that current trends may pose a significant challenge to Bitcoin’s short-term price recovery. This is because macroeconomic conditions can have a profound impact on the crypto market, and if they remain unfavorable, it could be difficult for Bitcoin to rebound.

However, there are two potential scenarios that could lead to a shift in the current trend: a change in macroeconomic conditions or renewed interest from institutional or retail buyers. I have seen instances in the past where such events have led to significant price increases in the crypto market, so it’s not inconceivable that they could happen again.

That being said, it’s important for investors to remain cautious and to carefully consider their investment strategies. The crypto market can be highly volatile, and it’s essential to make informed decisions based on a thorough understanding of the current market conditions and trends. In my experience, those who approach the market with a clear strategy and a well-thought-out plan are more likely to succeed in the long run.

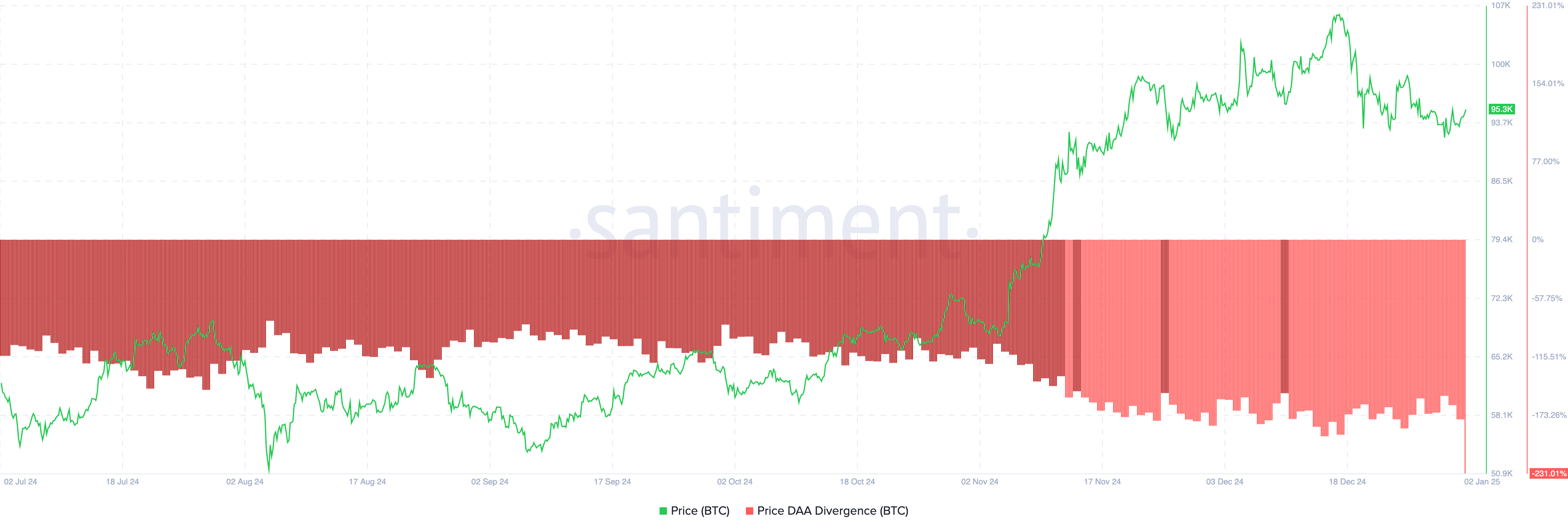

A supportive factor for this viewpoint is the discrepancy observed between the daily active addresses (DAA) and the price, often referred to as the DAA-price divergence. This measurement assesses the correlation between the level of activity among users on a blockchain network and its price fluctuations.

If it’s favorable, this suggests an enhancement in user involvement, which is optimistic for the cryptocurrency. Conversely, an unfavorable result means declining user activity, which translates to a pessimistic outlook.

Based on my years of observing and analyzing the cryptocurrency market, I’ve noticed that divergences in Bitcoin’s price DAA can often signal significant shifts in its value. The current 231% divergence we see above is quite substantial and could be a warning sign for the near future. If this trend continues, it’s possible that Bitcoin could trade below the $95,000 mark, which would represent a notable drop from its recent highs. I’ve seen similar patterns in the past, and they often signal bearish sentiment in the market. So, while I can’t predict the future with certainty, I believe it’s important for investors to be mindful of this development and consider taking appropriate measures to protect their investments.

BTC Price Prediction: Sub-$90,000 Levels Still Possible

Despite Bitcoin’s recent surge, the Exponential Moving Average indicates that this upward trend may be temporary. The Exponential Moving Average serves as a technical tool for evaluating the direction of the price trend.

From my perspective as a crypto investor, when the Exponential Moving Average (EMA) lines up above the current price, it indicates a bearish trend. However, if the price stays above the EMA, it’s a bullish sign. At this moment, Bitcoin’s price is below its 20 EMA (the blue line), hinting that the cryptocurrency’s value might keep dropping.

Based on my extensive experience in the cryptocurrency market and my deep understanding of technical analysis, I believe that if the crypto fails to surpass the 20 Exponential Moving Average (EMA) and the selling pressure from Bitcoin increases, it could potentially lead to a drop in its price down to $85,851. However, should US investors decide to contribute significantly to Bitcoin’s buying pressure, this trend might reverse, causing the coin’s value to possibly climb up to $108,398. It is essential to closely monitor market trends and make informed decisions based on data and analysis.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2025-01-02 14:09