As a seasoned crypto investor who has seen my fair share of market fluctuations, I find myself cautiously optimistic about Solana (SOL) at this juncture. The consolidation we’ve been witnessing, as indicated by the BBTrend and DMI readings, suggests a market in need of direction.

The BBTrend is like a timid dancer who hasn’t yet found their rhythm, while the ADX remains shyly below 20, hinting at a weak trend. This is reminiscent of a high school dance where everyone’s waiting for that one song to start moving.

The EMA lines are a bit bearish, but the lack of a strong downtrend gives me hope that SOL might find its footing soon. Key levels at $183 support and $194 resistance will likely dictate whether we break out or continue this dance of sideways movements.

In the world of crypto, you never know when the music might change, and a bull run could start at any moment. So, I’ll keep my dancing shoes on and my portfolio ready for the next big move – who knows, maybe SOL will lead us to the prom king position!

Over the last few days, Solana (SOL) has been holding steady, experiencing a minor dip of approximately 2.7% over the past week. The BBTrend and DMI readings suggest that momentum is weak, with the BBTrend just barely positive at 0.14 and the ADX sitting at 12, indicating an uncertain direction for the trend.

In simpler terms, SOL’s Exponential Moving Averages (EMA) suggest a bearish trend, but there isn’t a strong downward movement yet, which could indicate that Solana might stabilize. Important points to watch are $183 as potential support and $194 as resistance. Depending on whether SOL holds or breaks these levels, it will either continue its current consolidation or make a significant move in the short term.

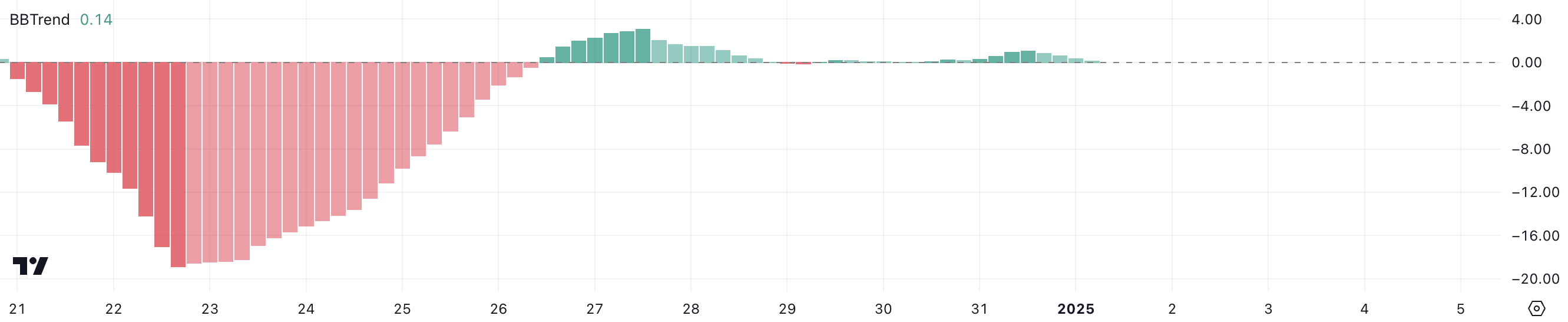

SOL BBTrend Is Not Strong Yet

At the moment, Solana’s BBTrend stands at 0.14, indicating a somewhat optimistic perspective as it aims to rise further. Over the last few days, the BBTrend has shown stability, moving between 0 and 1.08, which implies a lack of significant push in either direction.

Although the indicator’s positive value signifies a rebound from severely negative readings observed between December 21 and December 26, the minimal progress upward suggests that Solana (SOL) is finding it challenging to gather the necessary momentum for a more powerful surge.

The BBTrend, based on Bollinger Bands, gauges the intensity and direction of a trend’s movement. A positive value signifies an upward trend, while a negative value implies a downward trend. However, although Solana’s BBTrend is no longer in the negative zone, its minimal positive reading close to 0.14 indicates a market that’s showing only moderate strength.

Based on my years of trading experience and observing market trends, it appears that while selling pressure has lessened, there simply isn’t enough buying activity to trigger a substantial price surge for SOL. This cautious consolidation phase can be challenging, as it often means waiting for further movement in the BBTrend to validate any decisive price action. I’ve learned throughout my career that patience is key when navigating such periods and maintaining a well-researched trading strategy can help make informed decisions.

Solana Is Stuck in Consolidation

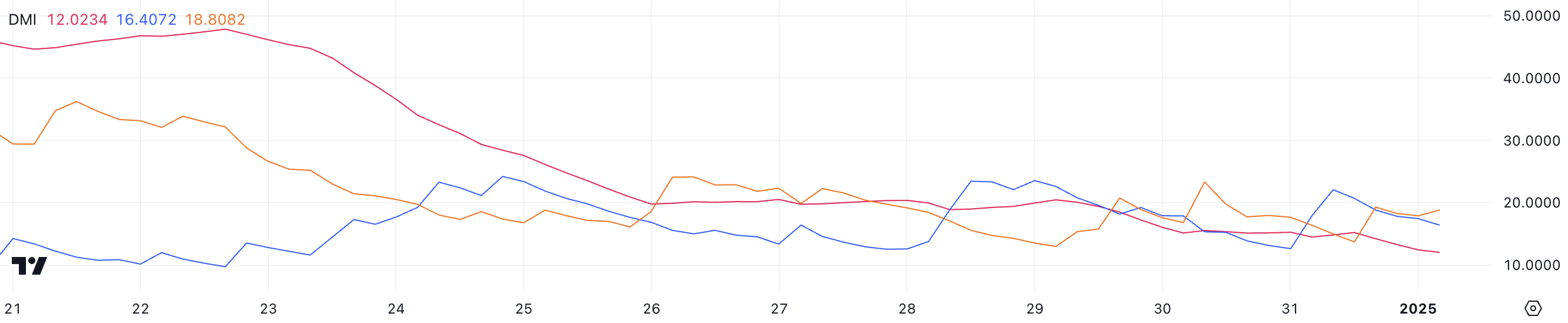

The Solana DMI chart shows that its ADX has been under 20 since December 30, which typically signals a weak trend. This means the ongoing downtrend may not have much force behind it, creating a market scenario where prices are stabilizing rather than moving strongly in one direction.

When D+ (positive directional indicator) and D- (negative directional indicator) are fairly near each other on the graph, it suggests that neither is strongly dominant. However, D- with a value of 18.8 slightly surpasses D+ at 16. This discrepancy gives the chart a bearish tilt.

The Average Directional Index (ADX) quantifies the intensity of a price trend, disregarding its direction, ranging from 0 to 100. A reading above 25 suggests a robust trend, whereas values below 20, such as the current SOL value of 12, hint at a weak or non-existent trend.

For now, with a lower ADX and a slightly stronger D- line, it appears that Solana is experiencing a period of stabilization or consolidation. The downward trend seems to be weakening, but it hasn’t yet been replaced by an upward trend.

SOL Price Prediction: More Side Movements Ahead

As a seasoned researcher who has spent years studying market trends and analyzing various assets, I find myself observing a potentially bearish setup for Solana (SOL) based on the EMA lines. The long-term EMA lines sit above the short-term ones, suggesting that there is lingering downward momentum in the market. However, upon examining the DMI chart and BBTrend, it appears that there is currently no strong trend driving SOL price action, which aligns with its consolidative behavior. This could indicate a period of stability or even sideways movement for SOL, which I have seen in my experience can sometimes precede significant market shifts. It’s crucial to remain vigilant and keep a close eye on the market for any potential changes that may signal a shift in the overall trend.

Should the current decline intensify, the Solana (SOL) price may encounter resistance at approximately $183, which if broken, could lead to a drop towards $175. This potential movement suggests an increase in bearish sentiment.

If the price of SOL picks up speed again and a rising trend is established, it might attempt to break through the resistance level at $194.

As a seasoned trader with over a decade of experience under my belt, I have witnessed many market fluctuations and trends that have shaped my trading strategy. Given the current market conditions, a breakout above the current level could potentially lead me to test the next resistance at $201. If this resistance is successfully breached, I am confident in the possibility of the price rising further towards $215. However, it’s important to remember that past performance is not always indicative of future results, and I always approach trading with caution, taking into account the various factors that could impact the market.

Read More

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- Everything We Know About DOCTOR WHO Season 2

2025-01-01 23:12