As a seasoned analyst with over two decades of experience observing and analyzing global financial markets, I find China’s latest move to intensify its scrutiny over cryptocurrency transactions intriguing, albeit not entirely surprising. Having closely followed China’s evolving relationship with digital assets, it is clear that the nation has maintained a cautious stance due to perceived risks to financial stability.

The new regulations, which require banks to report risky crypto trades, will undoubtedly make life harder for Chinese investors eager to participate in the burgeoning cryptocurrency market. However, from a regulatory perspective, this move seems prudent as it allows authorities to monitor and control activities that could potentially lead to financial instability or illicit activities.

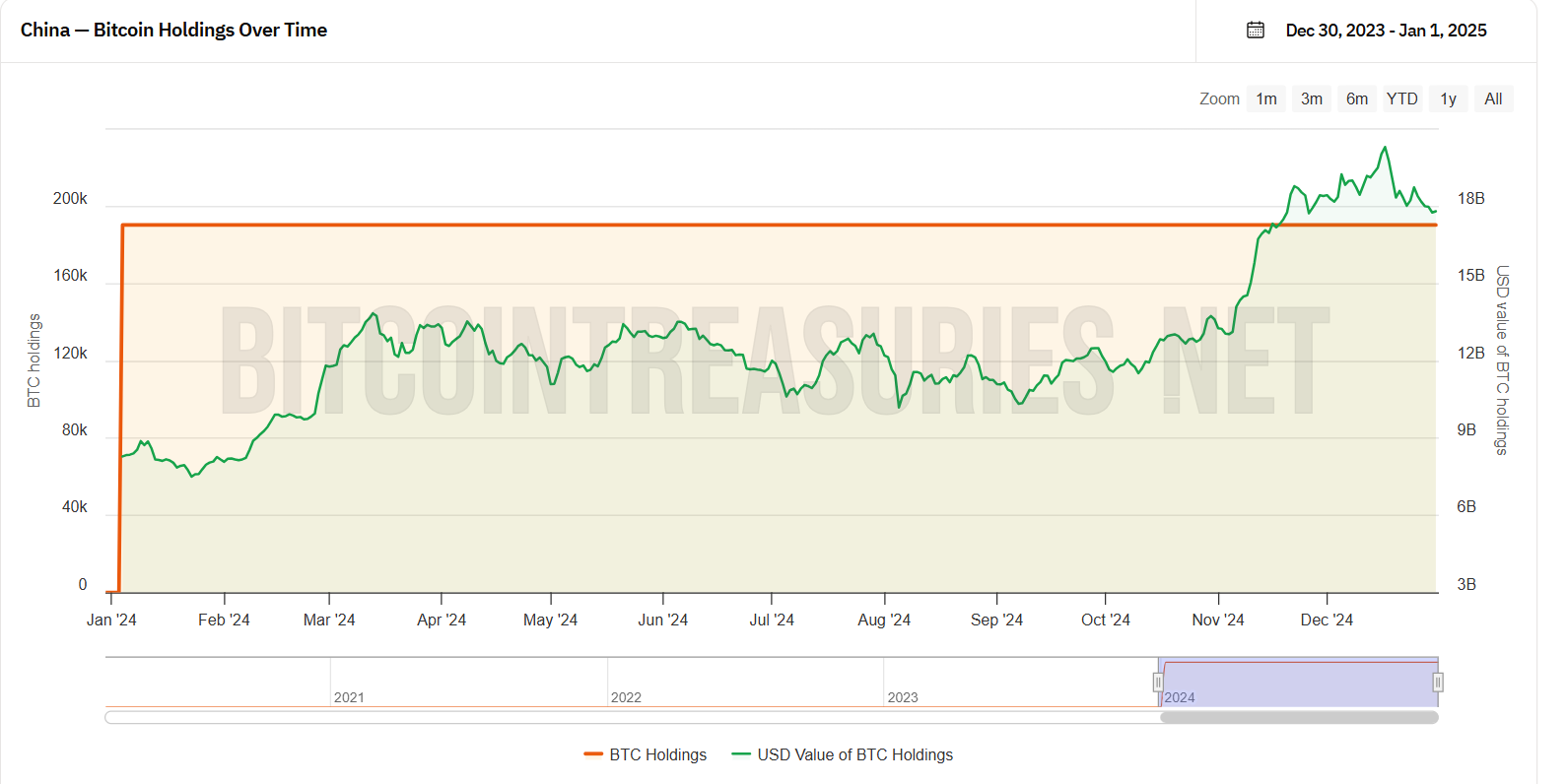

It is interesting to note that despite China’s anti-crypto position, the nation holds a significant amount of Bitcoin, acquired primarily through seizures linked to illegal trading activities. This paradox underscores the complex nature of China’s stance on cryptocurrencies and suggests that the Chinese government may be more open to the technology than its public statements imply.

In light of these developments, it will be fascinating to see how the Chinese authorities navigate this delicate balance between regulation and innovation in the years to come. As for Justin Sun’s call for China to adopt a more forward-thinking approach to cryptocurrency policy, I can only hope that wisdom prevails, and we witness a more progressive stance from China in the near future.

On a lighter note, one cannot help but wonder if China will eventually embrace cryptocurrencies so wholeheartedly that it starts minting its own digital yuan in the likeness of Bitcoin’s iconic white paper – a “White Paper Yuan” perhaps? Only time will tell!

The Chinese regulatory body overseeing foreign exchange has implemented new rules, mandating banks to identify and report potentially hazardous transactions, including ones pertaining to digital currencies like cryptocurrencies.

Last week, the State Administration of Foreign Exchange (SAFE) released an announcement requiring banks to keep track of and report any suspicious foreign exchange transactions.

China Forces Banks to Report Risky Crypto Trades

Based on a recent update, these new rules are intended to tighten restrictions on Chinese investors’ ability to trade Bitcoin and similar digital currencies. Banks are now required to document their foreign exchange operations, which encompass activities such as underground banking, cross-border gambling, and unlawful financial transactions involving cryptocurrencies.

Moreover, it was outlined in the document that these new regulations will extend to every bank within China. As a result, these banks will begin monitoring transactions according to the identities of the parties involved, the origin of the funds, as well as the regularity of the trades.

This action signifies China’s persistent tough stance on controlling cryptocurrency transactions within businesses, as they perceive these digital assets as potentially destabilizing the country’s economic system.

As reported by the South China Morning Post, Liu Zhengyao, an attorney at the ZhiHeng law firm based in Shanghai, shared his insights on the latest regulations regarding WeChat.

According to Liu, the upcoming regulations will offer an additional legal ground for penalizing cryptocurrency transactions. It’s expected that China’s control over cryptocurrencies will become stricter in the days ahead.

As a researcher, I too have observed that purchasing cryptocurrencies using yuan and subsequently exchanging them for foreign fiat currencies can now be classified as a “transnational financial action involving cryptocurrencies.” This is particularly true when the transaction value surpasses the established legal threshold.

China’s Anti-Crypto Stance

Starting from 2017, China has imposed restrictions on cryptocurrency trades and forbidden banks and digital payment platforms from dealing with virtual currencies. In May 2021, the People’s Bank of China outlawed all transactions related to Bitcoin and other digital assets, making them illegal.

Contrary to its negative stance on cryptocurrencies, China is in possession of over 190,000 Bitcoins, placing it as the world’s second-largest Bitcoin holder after the United States. This substantial amount was amassed from confiscations related to unlawful crypto trading activities.

As a researcher, I found myself intrigued by my own call to action in July 2024, where I, Justin Sun, advocate for a progressive stance on cryptocurrency regulation from China’s policymakers, being the founder of the Tron blockchain.

According to Sun, it’s important for China to advance more in this specific field. He believes that the rivalry between China and the U.S. regarding Bitcoin regulations would ultimately be advantageous for the entire Bitcoin industry.

In a recent verdict, a Chinese court has classified cryptocurrencies as having ‘asset-like characteristics.’ It’s important to note that Chinese legislation doesn’t explicitly ban them. Nevertheless, the legal safeguards apply primarily when cryptocurrency is treated as a commodity, not as money or financial instruments.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2025-01-01 19:06