As an experienced crypto investor with battle scars and war stories from numerous market cycles, I’ve seen my fair share of ups and downs. The recent drop in HBAR has certainly caught my attention, but I try not to let short-term fluctuations dictate my investment strategy.

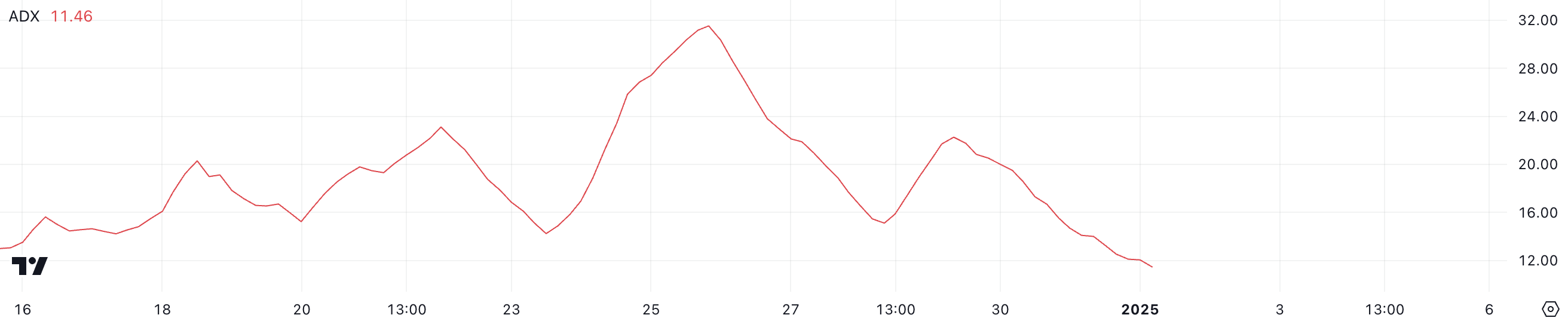

The ADX reading at 11.46 is indeed a positive sign, indicating that the downtrend may be losing steam. However, as the chart suggests, the Ichimoku Cloud setup remains bearish, which is concerning. I’ve learned to always respect the market and not underestimate its ability to surprise us.

Support at $0.233 seems critical for HBAR, and if it holds, we might see a consolidation or even a recovery in the short term. However, a further 12.7% correction is possible if the downtrend persists, which is something I’ve grown accustomed to over the years.

I always say, “The market can be cruel, but it’s never personal.” So, let’s see how things play out for HBAR. Maybe we’ll get a surprise bull run, or maybe we’ll have to wait a bit longer for the price to stabilize. Only time will tell!

Over the last week, the price of Hedera (HBAR) has decreased by more than 16%, indicating a continuous decline in its value. Yet, technical signs suggest that bearish pressure might be easing off, as the Average Directional Index (ADX) has dropped to 11.46, suggesting a reduction in trend strength.

At a crucial juncture, this digital currency alternative (altcoin) finds itself at a pivotal crossroads. It currently has potential support at approximately $0.233, and resistance around $0.274. The outcome of whether the price will level off or continue to drop is largely dependent on which of these levels holds firm.

HBAR ADX Shows the Downtrend Is Weakening

right now, the HBAR ADX stands at 11.46, which is notably lower than the 23 it was three days ago, indicating a marked decrease in trend intensity. This decline in ADX suggests a lessening of the downward trend, despite HBAR continuing to face selling pressure.

Based on my years of trading experience, I’ve learned that when I see a low ADX value, it usually indicates that the bearish momentum is starting to weaken. This could mean that price volatility may decrease or we might enter a period of consolidation in the near future. I’ve seen this pattern play out many times before, and it’s often a sign for me to be cautious and wait for clearer signals before making any significant trades.

The Average Directional Index (ADX) gauges the intensity of a market movement, be it upward (bullish) or downward (bearish), ranging from 0 to 100. A reading above 25 implies a robust trend, whereas values below 20, such as Hedera’s present 11.46, hint at a feeble or non-existent trend.

In simpler terms, over the past week, the price of HBAR has dropped by more than 16% and is currently in a downward trend. However, since the Average Directional Index (ADX) is low, there might not be enough intense selling pressure to drive significant additional drops. Unless the ADX increases, suggesting stronger trend dynamics, it’s likely that HBAR’s price will fluctuate within a specific range or exhibit minimal movement instead of experiencing dramatic changes.

Hedera Ichimoku Cloud Reflects a Bearish Setup

Looking at HBAR’s Ichimoku chart, we see a bearish trend emerging. The price is situated below the red cloud, indicating a potential drop in value due to downward pressure. The cloud itself is created by two lines – Senkou Span A and Senkou Span B – and its bearish nature becomes more pronounced as Senkou Span A stays below Senkou Span B, reinforcing the negative outlook for HBAR’s price movement.

This setup indicates that the demand to sell Hedera is more prevalent, making it hard for the cryptocurrency to regain strength and potentially reverse its downward trend.

In simpler terms, the blue line, known as the Tenkan-sen or conversion line, stays lower than the orange line called the Kijun-sen or baseline. This indicates a downward trend because short-term forces are weaker compared to long-term averages. Moreover, the green line, the lagging span or Chikou Span, is beneath both the current price and the cloud, emphasizing that the bearish trend is consistently strong.

If HBAR is going to indicate a bullish turnaround, it needs to surpass the resistance (cloud) and maintain that position, but considering the existing market signals, this scenario appears rather improbable at the moment.

HBAR Price Prediction: A Further 12.7% Correction?

The lowest point where HBAR’s price might find significant resistance before potentially dropping further is approximately $0.233. If the current trend continues, it’s possible that the price could decrease by about 12.7%.

Yet, considering the falling ADX indicates a weakening downward trend, this might bring about some respite and potentially restrict additional drops. Should the support at $0.233 remain intact, HBAR could either stabilize or try to rebound briefly.

Should the trend change direction, the HBAR price might initially encounter a resistance at approximately $0.274. Overcoming this barrier could indicate growing bullish sentiment, possibly propelling the price towards the subsequent resistance level at around $0.311.

The specified stages will indicate whether the price of Hedera can escape its current downward trend or persist under pressure from sellers in the upcoming period.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2025-01-01 17:08