As a seasoned analyst with over two decades of experience in the cryptocurrency market, I have witnessed the rise and fall of numerous digital assets. However, the recent performance of FARTCOIN has piqued my interest. With a 21% surge over the past 24 hours, it’s hard not to notice this meme coin’s meteoric rise.

The strong bullish sentiment surrounding FARTCOIN is undeniable, as evidenced by its rising long/short ratio and open interest. The increasing number of active derivative contracts suggests that new money is flowing into the market, reinforcing the strength of the uptrend. If this momentum continues, we might see FARTCOIN reaching its all-time high again.

That being said, as with any investment, there are risks involved. A sudden spike in selloffs could cause a decline, so it’s essential to keep an eye on market developments. But for now, the steady demand and increasing optimism among FARTCOIN investors make me bullish on its short-term prospects.

And as a light-hearted ending to this analysis, I can’t help but think that perhaps the name of this coin has contributed to its recent popularity – after all, who doesn’t love a good laugh while making a profit? But remember, always do your research and invest wisely!

In the last 24 hours, the meme coin Fartcoin has surged by 21%, making it the top performer among the top 100 coins. At present, a single unit of this altcoin is being traded for $1.01.

As a seasoned cryptocurrency investor with years of experience under my belt, I can confidently say that the current bullish sentiment surrounding the meme coin is quite evident from the on-chain data I’ve been closely monitoring. In my personal opinion, if this strong positive momentum continues, it could potentially propel the meme coin to further gains in the near future. This is based on my observations and analysis of market trends, which have proven accurate in the past. It’s always essential to keep a close eye on such developments, as they can significantly impact one’s investments in the dynamic world of cryptocurrencies.

Fartcoin Holders Go Long

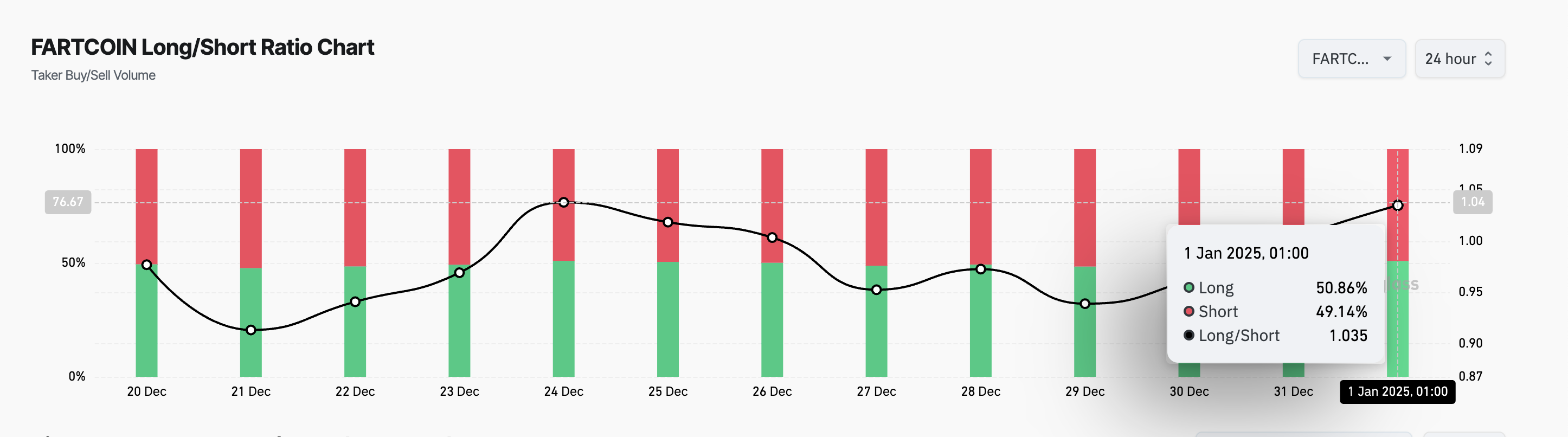

The Long/Short Ratio of FARTCOIN is currently 1.04, which suggests that more market players in its derivatives sector are favoring long positions, indicating a higher demand for such positions.

The long/short ratio of an asset represents the comparison between the number of investors who have taken long positions (anticipating a price increase) and those with short positions (predicting a price decrease). A ratio higher than 1 signifies that there are more traders betting on price increases, which often indicates a bullish outlook since many believe the price will go up.

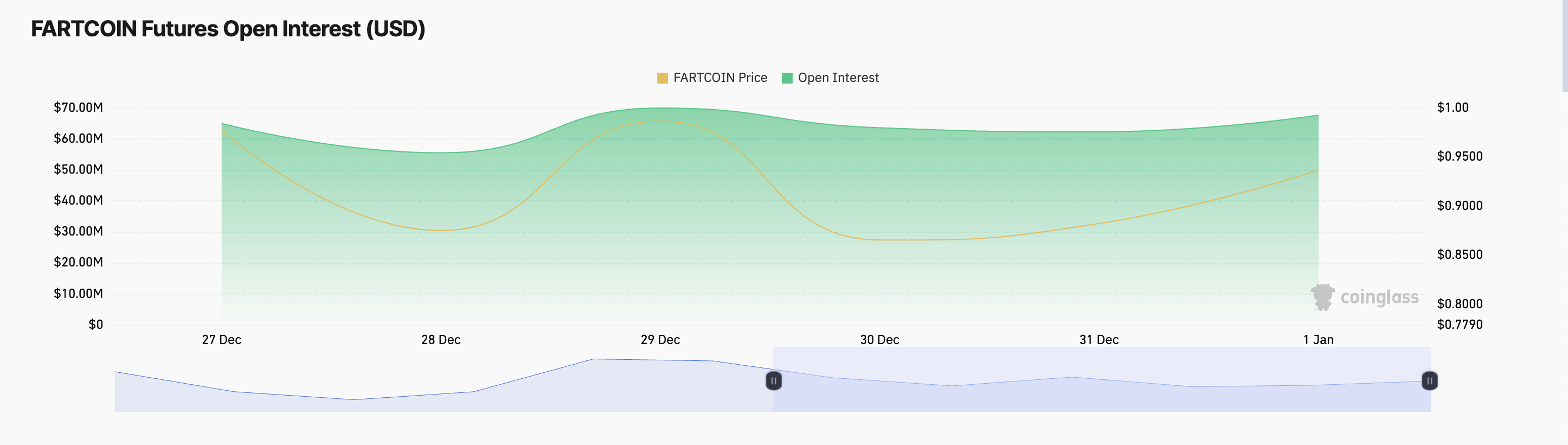

Furthermore, the anticipation of an increase in FARTCOIN’s value has led its traders to be more active. This heightened activity is evident from the meme coin’s growing open interest, as reported by Coinglass, which has surged by approximately 28% within the last 24 hours.

Open interest refers to the quantity of active derivative agreements, including futures or options, that have yet to be settled. For instance, in relation to FARTCOIN, when open interest escalates during a price surge, it indicates growing involvement and fresh funds flowing into the market. This trend strengthens the conviction behind the upward trend.

FARTCOIN Price Prediction: Bullish Trend May Push Token to Its All-Time High

Currently, FARTCOIN is being traded at $1.01. On a daily chart analysis, its Relative Strength Index (RSI), which gauges market conditions like overbought and oversold states, shows an upward trajectory at 59.11. This trend suggests a consistent demand for the meme coin, indicating potential growth.

The RSI reading indicates that the demand for the Fartcoin token is escalating, with investors growing more hopeful. It implies that the price trend could persist upward, potentially reaching new highs, as there seems to be potential for further growth without an imminent downturn. If this trend continues, Fartcoin might regain its previous all-time high of $1.29, a level last seen on Christmas Day.

Based on my own personal experience and observations of the cryptocurrency market, if a meme coin experiences a surge in sell-offs as holders cash out their profits, it could potentially lead to a significant drop in price, possibly down to $0.48. This is a scenario I’ve seen play out numerous times before, and it highlights the volatile nature of this market. It’s always important to remember that past performance is not indicative of future results, but this serves as a reminder to stay vigilant and make informed decisions when investing in meme coins or any other cryptocurrencies.

Read More

2025-01-01 14:06