As an analyst with over two decades of experience in the financial industry, observing the evolution of Bitcoin and blockchain technology has been nothing short of captivating. The HODL Top 70 report is a testament to the growing acceptance and strategic importance of Bitcoin among institutional players.

MicroStrategy’s dominance in this space is impressive, but it’s not surprising given Michael Saylor’s unwavering support for Bitcoin. I remember when I first heard about Bitcoin back in 2010, many dismissed it as a fad. But here we are, with corporations like MicroStrategy holding nearly 75% of the total Bitcoin among the top 70 entities.

The geographical distribution of these Bitcoin holders is also fascinating. It’s interesting to see the United States and Canada leading the pack, but I must admit, I was surprised to find companies from Asia making significant strides in this space. The growing interest in crypto from regions like Hong Kong, Japan, and Singapore is a clear indication that the future of Bitcoin is global.

One thing that stands out is the increasing number of firms from outside the mining sector joining the HODL club. It’s intriguing to see companies like Semler Scientific and MercadoLibre holding Bitcoin. It’s as if they’ve decided to bet on Bitcoin, not just because it’s the future of money, but because it’s the present of innovation!

As we look ahead, it’s clear that 2025 could see even more entities joining this elite club. But remember, in the world of crypto, the only constant is change. So, let’s wait and see who’ll be laughing all the way to the Bitcoin ATM next year!

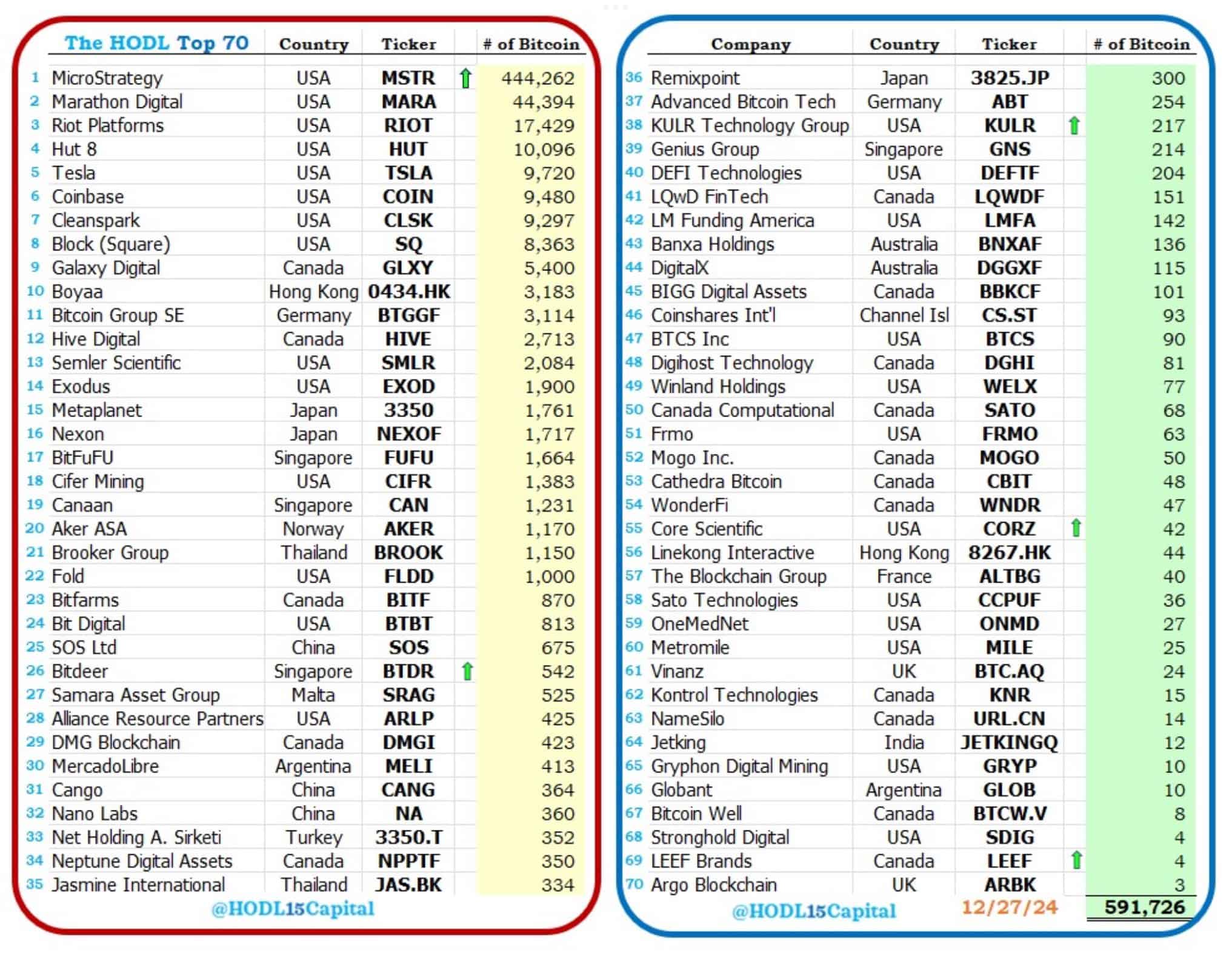

As someone who has been closely following the crypto market for several years now, I find the latest data from the “HODL Top 70” to be quite intriguing. It offers a unique glimpse into the world’s leading organizations that are sitting on massive Bitcoin reserves. With a collective holding of 591,726 Bitcoin, it is clear that these companies see Bitcoin as a valuable strategic asset, and their continued investment underscores the enduring allure of this digital currency in today’s rapidly changing financial landscape. Personally, I find it fascinating to witness the growing acceptance and recognition of Bitcoin as a significant player in the global economy.

The Titans of Bitcoin: MicroStrategy Leads the Pack

It’s hardly shocking that MicroStrategy maintains its commanding position, boasting an astounding 444,262 Bitcoins in its reserves. Driven by Bitcoin advocate Michael Saylor, the firm has integrated Bitcoin as a primary component of its financial structure. This substantial investment places MicroStrategy among the top 70 entities with an impressive 75% share of all held Bitcoins, outstripping its closest contenders significantly.

After MicroStrategy, significant players in the Bitcoin market include Marathon Digital (holding approximately 44,394 Bitcoins), Riot Platforms (with around 17,429 Bitcoins), and Hut 8 Mining (owning about 12,106 Bitcoins). Notably, Tesla, under the leadership of Elon Musk, also ranks among the top five with a Bitcoin reserve of 9,720 coins. However, Tesla’s focus on Bitcoin has diminished compared to previous years.

The Regional Dynamics of Bitcoin Holdings

The leaderboard reveals an intriguing geographical distribution of Bitcoin ownership. Companies based in the U.S., like Coinbase (holding 9,000 BTC) and Block (previously Square, with 8,463 BTC), are among the top-tier Bitcoin holders. Canada isn’t far behind, with mining companies such as Galaxy Digital (5,400 BTC) and Hive Digital (2,713 BTC) making a significant presence on the list.

Furthermore, Asia is also making a substantial impact in the crypto sphere. For instance, companies such as Boyaa from Hong Kong (with 4,155 BTC), Metaplanet based in Japan (1,761 BTC), and BitFuFu hailing from Singapore (1,664 BTC) are indicative of the region’s increasing fascination with cryptocurrencies.

Beyond Mining: Diverse Industries Join the HODL Club

As cryptocurrency mining giants continue to lead the way, an increasing number of businesses from diverse sectors are jumping on the bandwagon by HODLing. Companies such as Block (previously Square) and Coinbase demonstrate this trend, showing how they’re weaving Bitcoin into their broader financial plans.

Additionally, unexpected inclusions like Semler Scientific (2,084 BTC) and MercadoLibre (413 BTC) suggest a change in direction. These companies are employing Bitcoin for diversification, risk management, or pioneering applications, demonstrating the asset’s growing importance beyond just the tech industry.

The Evolving Landscape: Winners and Risers

2024 has witnessed significant shifts within the Bitcoin community as well. For instance, KULR Technology Group and Core Scientific have substantially boosted their Bitcoin reserves, with the former now holding 217 BTC and the latter owning 42 BTC. This move indicates a positive outlook towards Bitcoin amidst the ongoing cryptocurrency market fluctuations.

However, it’s important to note that not everything is going smoothly. Some companies, especially those struggling financially, are selling parts of their Bitcoin holdings. This process allows other investors to potentially increase their positions.

While things may seem promising for some, there are challenges faced by certain firms, including the necessity of selling a portion of their Bitcoin assets due to financial difficulties. This situation creates possibilities for other investors to gain more holdings.

The Long View: A Strategic Bet on Bitcoin

The persistent use of the ‘HODL’ strategy by these companies reflects a common conviction in Bitcoin’s lasting worth. Amidst increasing turmoil in conventional financial markets, Bitcoin stands out as an effective safeguard against inflation and a reliable means for storing value.

As a long-time cryptocurrency investor and tech enthusiast, I have witnessed the meteoric rise of Bitcoin from a fringe asset to a mainstream financial instrument. The increasing holdings of the Top 70 HODLers, now approaching 600,000 BTC, is a testament to its strategic importance in corporate treasuries. This trend towards institutional adoption, coupled with the next Bitcoin halving on the horizon, suggests that more entities will join this exclusive club in the years to come. As someone who has seen the ups and downs of the crypto market, I am confident that 2025 could see a significant increase in the number of entities investing in Bitcoin.

Regardless of whether you support Bitcoin’s decentralized philosophy or have doubts about its instability, it’s undeniable that Bitcoin is making a lasting impact on the international financial world. Moreover, the top 70 HODLers are spearheading this transformation.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Elder Scrolls Oblivion: Best Battlemage Build

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

2024-12-30 13:32