As a seasoned crypto investor with over two decades of experience navigating the digital asset landscape, I’ve seen my fair share of twists and turns. However, the ongoing legal battle between Rossi and Akridge is one that caught my attention, given its unique intersection of personal disputes and advanced blockchain technology.

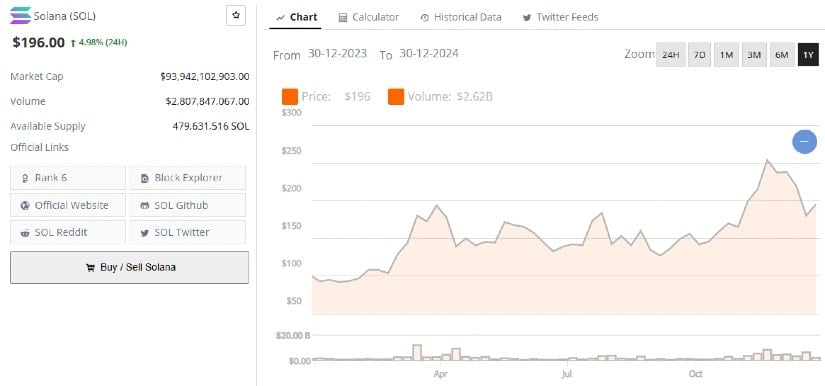

Having invested in Solana since its early days, I’ve witnessed its meteoric rise and occasional setbacks. The recent surge in SOL‘s price has been particularly noteworthy, but the allegations against Akridge have cast a long shadow over the once-promising project.

The complexity of the case lies in the ambiguity surrounding staking rewards, an essential component of Solana’s operations. As someone who has staked cryptocurrencies myself, I can attest to their potential value and the need for clear regulatory guidelines on ownership and control during divorce proceedings.

If proven, Akridge’s alleged misconduct could have far-reaching implications not only for his personal reputation but also for Solana’s standing within the crypto community. As an investor, I am closely watching how this case unfolds, as it has the potential to set a significant precedent in the realm of digital asset ownership and divorce settlements.

On a lighter note, one can’t help but chuckle at the irony – here we are, using cutting-edge technology to resolve age-old disputes like property division, only to find ourselves tangled in even more complex issues! But that’s the nature of investing in crypto, isn’t it? Always a rollercoaster ride with unexpected twists and turns.

The case sheds light on the growing complexities of cryptocurrency ownership in personal disputes.

Allegations of Misconduct

In simple terms, Rossi alleged in the San Francisco Superior Court that Akridge exploited his expertise in blockchain technology to gain control over her Solana (SOL) digital wallet and divert the staking rewards, which are accumulated by committing cryptocurrency assets to verify transactions on the blockchain, toward himself. These rewards could be valued at millions of dollars.

It’s been reported that an instance of misappropriation supposedly took place from March to May in the year 2023. This incident occurred not long after the couple decided to part ways by filing for divorce in February, concluding a ten-year marriage. In his complaint, Rossi outlines allegations against the other party which include violating contractual obligations, fraudulent activities, unjustly benefiting from the situation, and neglecting fiduciary responsibilities.

The court records disclose that Rossi asked certain aspects of the case to remain private because they involve delicate financial matters, which he referred to as substantial or sizeable.

Akridge’s Response and Court Developments

Additionally, Rossi asserts that Akridge is said to have disregarded her queries concerning the finances, supposedly ridiculing her efforts to retrieve the staking rewards. She maintains that he openly declared she would not be reclaiming control over the funds.

As of now, the head of blockchain company Cyber Grant Inc., Akridge, hasn’t spoken out about the accusations made against him. Industry experts believe that this situation could potentially harm his reputation and that of his projects, considering the growing focus on ethical behavior in the cryptocurrency market.

As an analyst, I’m closely following the ongoing court case titled Rossi v. Akridge (CGC-24-620900). The outcome of this trial could significantly influence Akridge’s position within the cryptocurrency industry. If the allegations against him are upheld, it could lead to legal consequences that transcend this particular dispute, potentially impacting his professional ventures in the sector.

What Are Staking Rewards?

As a researcher delving into the intricacies of blockchain technology, I cannot overlook the pivotal role of staking rewards. These rewards are essentially profits accrued from locking up cryptocurrency holdings to take part in the functioning of the blockchain. In proof-of-stake (PoS) systems such as Solana, these rewards play a crucial part in encouraging network security and maintaining decentralization.

Given the attractive yields associated with SOL staking, disagreements over these assets have escalated significantly, particularly in high-value divorce settlements where substantial digital portfolios are at stake.

Staking cryptocurrencies has expanded into a massive financial sector, attracting both large institutions and individual investors due to its lucrative potential. However, as demonstrated here, the absence of definitive regulations regarding ownership of staking rewards may result in intricate legal issues.

Implications for Solana

At a point when Solana is experiencing fresh enthusiasm, a legal dispute arises. Renowned for its swift transaction rates and groundbreaking proof-of-history consensus mechanism, this blockchain network has recovered from the turmoil related to the downfall of FTX in the past.

2024 saw Solana’s native token, SOL, skyrocket by more than 70%, reaching a high of $263 in November. Despite the uproar over one of its co-founders, the blockchain has managed to hold its ground as a prominent figure in decentralized finance (DeFi) and non-fungible tokens (NFTs). Recently, Solana announced improvements in scalability and formed strategic partnerships with significant corporations, strengthening its market position.

The legal case might tarnish Solana’s image, emphasizing the significance of moral guidance in preserving trust among investors. Experts point out that even though Solana’s technical strengths persist, continued unfavorable focus on its leadership may influence market opinion.

Bottom Line

With the increasing prominence of digital assets, traditional laws are finding it challenging to cope with matters such as determining ownership of staking rewards, preventing fraud, and managing asset distribution during divorce cases. Legal professionals predict that this situation could establish a substantial precedent, guiding courts on how to handle disagreements involving blockchain technology and digital possessions.

In similar instances, there have been demands for stricter regulations, specifically focusing on transparent reporting of assets during court cases and the classification of digital prizes as shared matrimonial property.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2024-12-30 13:10