As a researcher with extensive experience in studying the global cryptocurrency market, I find the current surge in South Korea’s Kimchi Premium particularly intriguing. Having closely followed the Asian market for years, I can attest that this phenomenon is deeply rooted in the unique economic and political landscape of South Korea.

The premium on Bitcoin, known as the ‘Kimchi Premium’, has soared in South Korea, hitting a peak not seen since March 2009. This surge comes during South Korea’s escalating political turmoil and economic instability.

This week, the price gap between Bitcoin on South Korean platforms like Upbit compared to international exchanges such as Coinbase, known as the premium, has increased to a range of 3-5%. Data from blockchain analysis firm CryptoQuant shows this trend. Interestingly, a similar pattern has emerged in the premium for the stablecoin Tether, suggesting an increase in demand for digital assets.

As a researcher delving into the intricacies of cryptocurrency trading, I’ve come across a fascinating concept known as the Kimchi Premium. This term signifies the disparity in pricing between digital currencies traded on South Korean exchanges versus those traded globally. This price gap arises when demand for Bitcoin and other cryptos within South Korea outstrips the supply available on local exchanges, which is often the case due to factors such as market isolation, stringent capital controls, and high retail interest.

In simple terms, capital restrictions in South Korea create difficulties for investors looking to exploit price differences between local and global markets when it comes to Bitcoin trading. Consequently, this sustained Bitcoin’s premium due to the fact that traders find it hard to purchase Bitcoin at lower costs from other regions and sell it at a profit in South Korea.

Presently, South Korea is facing a period of intense political turmoil, causing ripples in financial markets and exacerbating economic difficulties. On the 3rd of December, President Yoon Suk Yeol announced martial law, a contentious decision that was withdrawn on the 4th after encountering widespread criticism. In response, the National Assembly impeached Yoon on the 14th of December, temporarily handing over presidential powers to Prime Minister Han Duck-soo.

The political crisis deepened in South Korea on December 27, when Han was additionally impeached by parliament – a historic first for a serving president in the country. This impeachment came as a result of opposition to Han’s refusal to nominate three new judges to the Constitutional Court, resulting in an understaffed court with only six members tasked with deciding on Yoon’s impeachment. Finance Minister Choi Sang-mok now temporarily holds the presidency.

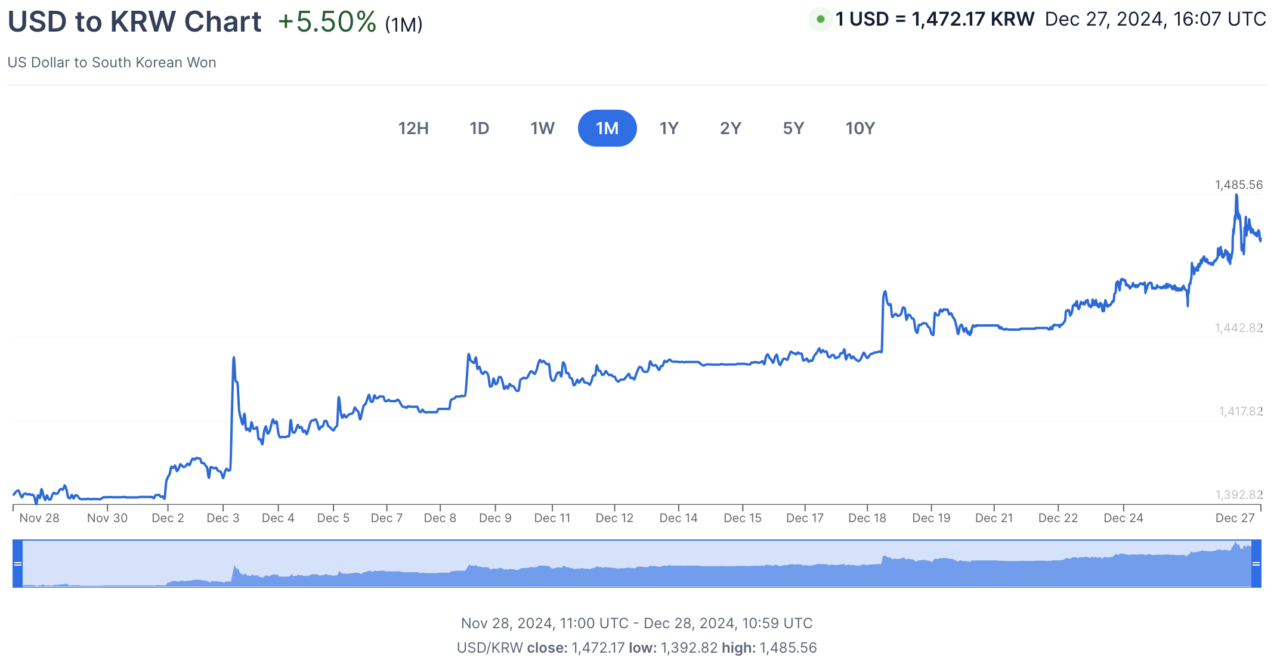

Over the past week, these recent occurrences have heightened doubts in South Korea as the South Korean currency, the won, dropped by 0.35% compared to the U.S. dollar. Since the declaration of martial law on December 3, the won has reportedly depreciated by approximately 5% against the U.S. dollar. The country’s economic difficulties, such as a shrinking birth rate and sluggish growth, have only made things worse, causing investors to seek out different investment options instead.

The rising Kimchi Premium indicates a growing interest among South Korean investors in Bitcoin and other cryptocurrencies, driven by political instability, inflation concerns, and economic uncertainty. As wealth leaves South Korea, Ki Young Ju, CEO of CryptoQuant, explains that investors are moving their assets to safe havens like U.S. stocks, Bitcoin, gold, dollars, and more. This shift has been observed in favor of cryptocurrency exchanges over traditional banking systems, resulting in higher premiums for Bitcoin and Tether.

As a researcher in the field, I can attest that South Korea stands out as one of the bustling retail hubs for cryptocurrencies. Frequently, the trading volumes on local cryptocurrency exchanges surpass those seen in traditional stock exchanges. Furthermore, regulatory restrictions within the country prevent corporate accounts from being established on domestic crypto platforms, thereby making the activity predominantly driven by individual or retail investors.

The Kimchi Premium isn’t a recent occurrence; it has surfaced in past market fluctuations. It tends to emerge when local aspects like economic instability, geopolitical conflicts, or regulatory adjustments stimulate cryptocurrency interest. For example, during Bitcoin’s price surge towards the end of 2017, the Kimchi Premium reached up to 50%, demonstrating the distinctive characteristics of South Korea’s crypto market.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- ALEO/USD

- DEXE/USD

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Dafne Keen? All About Logan Star As She Returns As X-23 In Deadpool & Wolverine

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- The Last Of Us 2 Teaser: Pedro Pascal And Bella Ramsay Promise An Emotional-Tense Ride In The First Glimpse Of The Post-Apocalyptic Drama

- Discover the Exciting World of ‘To Be Hero X’ – Episode 1 Release Date and Watching Guide!

2024-12-28 14:38