As a seasoned researcher with over a decade of experience in the cryptocurrency market, I can say that Ethereum‘s price action in December has been intriguing, to say the least. While it’s disheartening to see ETH fall short of the $4,000 mark that many had anticipated, it’s important to remember that the crypto market is known for its volatility and unpredictability.

Ethereum (ETH) fell short of projected prices in December, leaving investors disheartened as they expected it to stay above $4,000. However, over the past week, ETH has demonstrated a slight recovery by rising approximately 6%. This growth indicates some level of strength and determination in the cryptocurrency market.

For the past week, the Relative Strength Index (RSI) has shown no clear direction, indicating a pause in strong price movements. Meanwhile, whale activity has remained close to its peak levels seen since September. As Ether’s price fluctuates between $3,523 and $3,220, its future action will depend on either breaking significant resistance or maintaining crucial support thresholds.

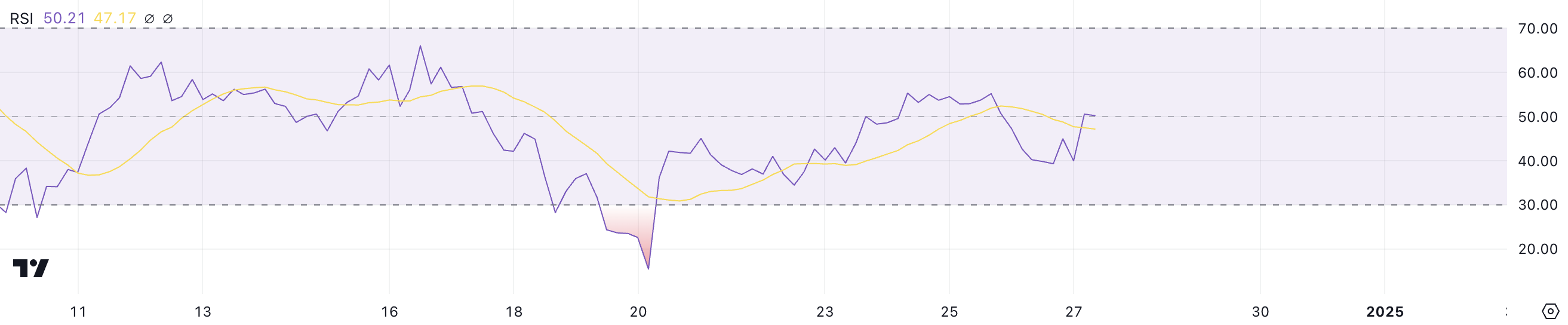

ETH RSI Has Been Neutral For a Week

The Ethereum Relative Strength Index (RSI) stands at approximately 50.21, keeping it within the neutral range which it’s been oscillating between 35 and 55 since December 20th.

Over the last week, the Ethereum price seems to have been moving slowly without much strong push in either upward or downward trend, suggesting a phase of stabilization or accumulation.

In simpler terms, the Relative Strength Index (RSI) is a tool that helps analyze the speed and direction of price changes in financial markets. It shows values between 0 and 100. When the RSI exceeds 70, it usually signals that the market may be overbought, which might mean a correction in prices is possible. Conversely, if the RSI falls below 30, it could indicate an oversold condition, possibly leading to price rebounds.

The Ethereum Relative Strength Index (RSI) standing at 50.21 indicates a neutral market situation, where neither the buyers nor the sellers are dominating significantly.

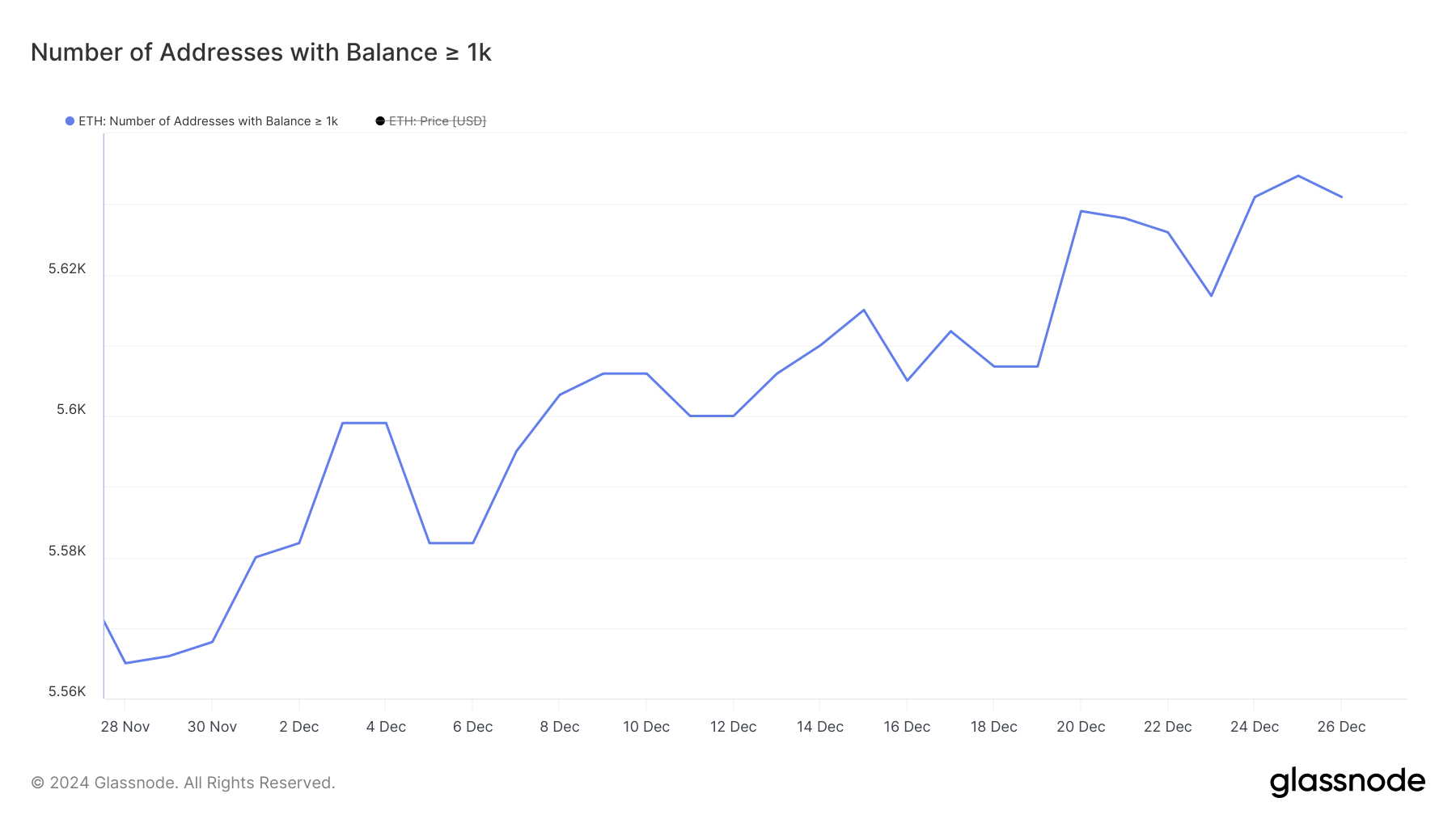

Ethereum Whales Dropped a Little, But Are Still at High Levels

5,634 Ethereum addresses containing 1,000 ETH or more hit an all-time high on December 25th, marking the peak since September. However, there was a minor dip the next day, with the number dropping to 5,631 on December 26th.

After hitting a monthly low of 5,565 on November 28th, I noticed a steady improvement in the activity of major stakeholders, suggesting a gradual recovery in their involvement.

Following the actions of major Ethereum (ETH) investors, commonly known as ‘whales’, is crucial since their large holdings and transactions can significantly impact the market given the vast liquidity they command.

At present, the sustained elevation might mean that significant investors are keeping faith in Ethereum, which could temporarily bolster its value. Yet, the minor dip signals some apprehension, implying that Ethereum’s price might stay within a certain range unless there’s a noticeable change in the behavior of large-scale investors.

ETH Price Prediction: Consolidation Before a New Breakout?

Right now, the price of Ethereum is moving between an upper limit around $3,523 and a lower limit at $3,220. The Exponential Moving Averages (EMA) suggest a decreasing trend, as the short-term averages are situated below the long-term ones.

Instead, the diminishing intensity of this pattern hints that Ethereum could be shifting towards a period of stabilization as opposed to experiencing further drops.

Should the cost of Ethereum surpass its current resistance level at around $3,523, there’s a possibility it might target even greater heights, reaching approximately $3,827, and possibly pushing further up to around $3,987.

If the $3,220 support doesn’t manage to withstand pressure, there’s a possibility that the price might fall even lower, potentially reaching $3,096. This level could be crucial as it might act as a potential anchor point for any future price recovery.

Read More

- Who Is Abby on THE LAST OF US Season 2? (And What Does She Want with Joel)

- ALEO/USD

- DEXE/USD

- Save or Doom Solace Keep? The Shocking Choice in Avowed!

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Who Is Dafne Keen? All About Logan Star As She Returns As X-23 In Deadpool & Wolverine

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Yellowstone 1994 Spin-off: Latest Updates & Everything We Know So Far

- Defeat Trokka Easily in The First Berserker: Khazan!

- 30 Best Couple/Wife Swap Movies You Need to See

2024-12-27 21:13