As a seasoned analyst with over two decades of experience navigating the ever-evolving financial markets, I must admit that the upcoming Bitcoin and Ethereum options expiry is one of the most intriguing events I’ve witnessed in recent years. The sheer volume of contracts involved – four times more than last week for Bitcoin and 4.5 times higher for Ethereum – is a testament to the growing interest and confidence in cryptocurrencies.

2024’s last few days witness an unprecedented event as we approach the biggest Bitcoin options expiration ever recorded, with a whopping $18 billion in Bitcoin and Ethereum options contracts reaching their maturity today.

Exciting and unexpected developments may be ahead for options traders and investors.

What Does the Record-High Crypto Options Value Indicate?

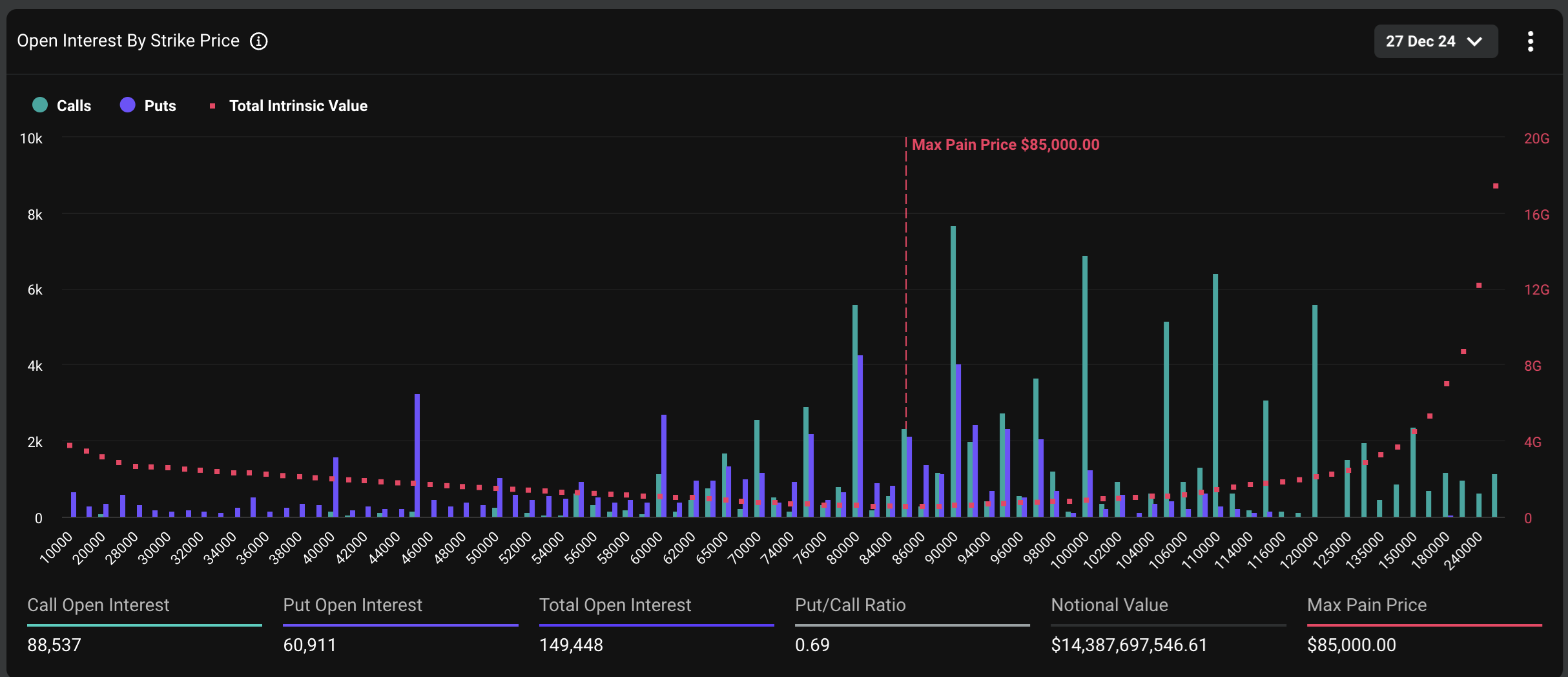

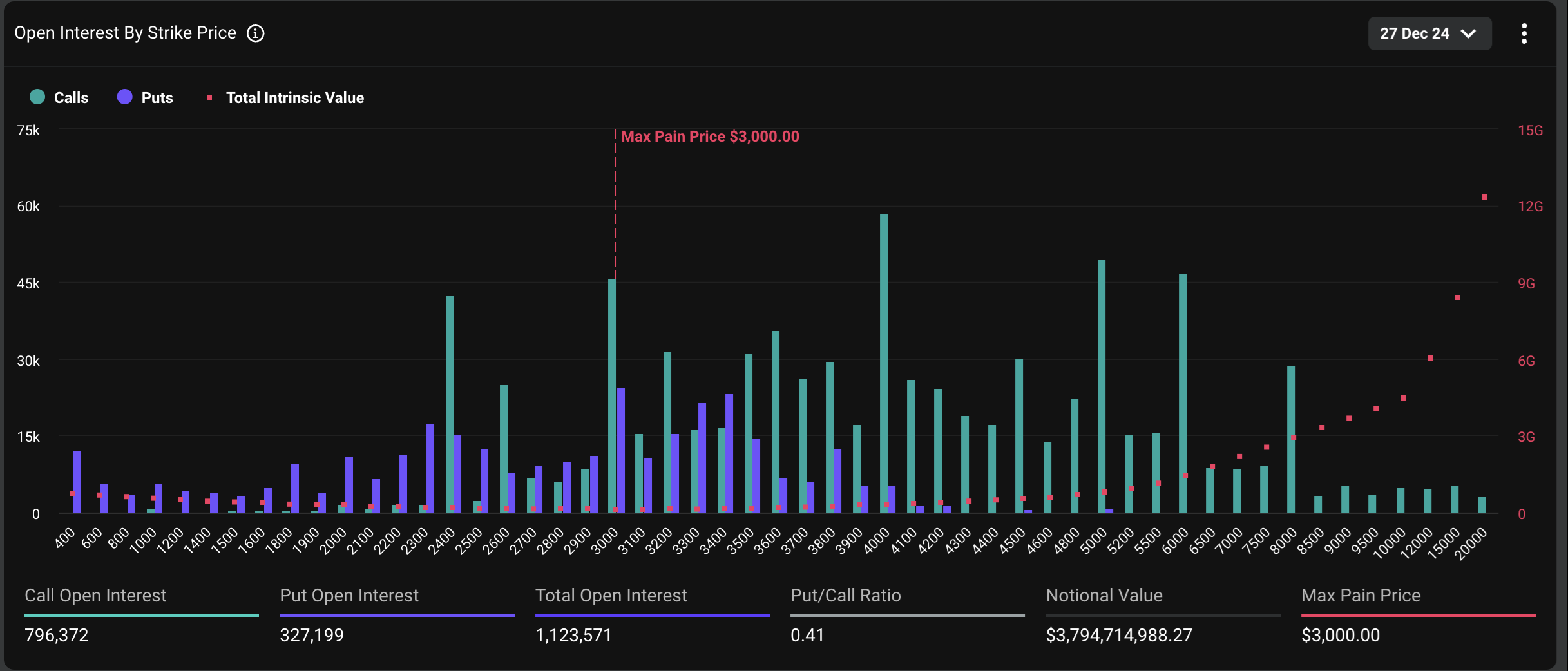

Based on figures from Deribit, this Bitcoin options expiration involves a staggering 88,537 contracts, four times as many as the previous week. On the other hand, Ethereum options contracts for today amount to an impressive 796,021, representing a 4.5-fold increase compared to the last week.

The combined worth of Bitcoin’s soon-to-expire options currently stands at an unprecedented $14.38 billion, whereas Ethereum’s options amount to approximately $3.7 billion. As the value of these expiring options grows larger, so too does the anticipation among traders for potential profits and the increasing need for risk mitigation strategies.

Regarding Bitcoin, the most expensive option contracts expire at $85,000. Historically, a low Put-to-Call (P/C) ratio (currently 0.69), which is below 1, suggests optimistic attitudes because more calls (wagers on price rises) are being bought, signaling bullish anticipation. Interestingly, Bitcoin’s P/C ratio has been climbing steadily in the last quarter of the year, possibly indicating an increase in risk-mitigation strategies or hedging behaviors among investors.

The need for safeguards against potential losses has been increasing noticeably over the past few weeks. This surge might be due, in part, to investors wanting to secure their end-of-year performance evaluations for 2024. As David Lawant, Head of Research at FalconX, noted, the number of trades for protection (put options) compared to those for potential gains (call options) on December 27th has more than doubled from an October level of 0.35 to approximately 0.70 now.

Presently, the highest potential loss price for Ethereum options is set at around $3,000. Additionally, its Put/Call (P/C) ratio currently stands at 0.41. This ratio has dropped from 0.97 as of late October, suggesting a rising optimism among investors regarding ETH, implying more calls (buy) than puts (sell).

Currently, when this text is being penned, Bitcoin (BTC) and Ethereum (ETH) are being traded at approximately $96,300 and $3,300 respectively. These figures are notably higher than the previously mentioned prices that would cause maximum losses for all option contract holders (both call and put options). The term “maximum pain price” refers to the level where investors with these contracts experience the greatest financial hardship or “pain” at the time of expiration.

Some market experts employ the concept of maximum pain price to forecast possible price trends. This strategy is based on the idea that markets tend to move towards prices that maximize profits for option sellers, who are usually large financial organizations. In simpler terms, they look at this price as a potential turning point where the most losses (or “pain”) might occur for those who hold short positions (selling options).

Given that the market is currently very dependent on upward movement, even a substantial drop could lead to a quick chain reaction. Everyone is closely watching this expiration period to determine the storyline for the years leading up to 2025, according to Deribit’s assessment.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-12-27 09:31