As a seasoned analyst with years of experience navigating the complex and dynamic world of tech stocks, I find KULR Technology Group’s strategic move to incorporate Bitcoin into its treasury program intriguing. The company’s cautious yet ambitious approach, which prioritizes financial prudence while embracing innovation, is a refreshing change in today’s fast-paced market.

KULR Technology Group, Inc., trading on the NYSE under the symbol KULR, specializes in innovative energy management solutions, eyeing a market worth $24 billion for thermal management systems. This company is dedicated to enhancing safety and efficiency across sectors like renewable energy, aerospace, and defense. Their product lineup includes thermal interface materials, lightweight heat exchangers, and solutions specifically designed to handle the problem of lithium-ion battery thermal runaway—a significant safety concern in energy storage and electric vehicles. Given the fast pace of electrification and shift towards more eco-friendly energy systems, KULR’s products are well-suited for these evolving industries.

On December 4th, KULR revealed a fresh approach: adding Bitcoin as a main investment within their treasury plan. With more than $12 million in liquid assets, the company’s Board of Directors agreed to invest up to 90% of any additional cash into Bitcoin. This move underscores the company’s confidence in Bitcoin’s long-term worth and its potential as a protective measure against inflation, international political risks, and broader economic fluctuations.

CEO Michael Mo outlined that the increasing worldwide recognition of Bitcoin – from businesses and financial entities to governments – positions it as an exceptional resource for fortifying KULR’s financial standing. By implementing a Bitcoin reserve approach, KULR intends to improve its capacity to handle funds prudently while broadening its business ventures.

Instead of strictly adhering to a fixed strategy in Bitcoin investments like some firms do, KULR prioritizes flexibility. The company’s investment decisions will be influenced by market fluctuations and cash flow necessities, enabling adaptations according to changing strategic needs. This balanced approach – being both cautious and ambitious – demonstrates KULR’s dedication to striking a balance between innovative thinking and financial responsibility.

On the 26th of December, KULR made its initial move in this strategic plan: purchasing around 217 Bitcoin for about $21 million, with an average price of roughly $96,556.53 per Bitcoin. This is the start of a continued series of Bitcoin purchases as they utilize their excess funds. To ensure safekeeping and transactions, KULR teamed up with Coinbase Prime for custody, USDC, and self-custodial wallet services. This partnership underscores KULR’s commitment to utilizing robust platforms to back its financial strategy.

KULR’s approach to Bitcoin mirrors MicroStrategy’s, a software analytics firm led by Michael Saylor, who has positioned Bitcoin as the core of their financial strategy. Much like MicroStrategy, KULR has been active in converting cash reserves into Bitcoin, sometimes using borrowed funds for additional purchases. However, it’s important to note that while the strategies share similarities, there are distinct differences that set them apart.

Initially, KULR’s approach towards Bitcoin acquisition is less risky, linking these purchases directly with excess funds available. This way, the company prioritizes its operational and cash flow responsibilities. In comparison, MicroStrategy adopts a bolder strategy, using financial tools like bonds to accumulate Bitcoin in substantial amounts. This difference underscores KULR’s commitment to keeping financial options open while growing its Bitcoin reserves gradually.

In addition, KULR outlines its Bitcoin approach in light of its main operations and market tendencies. By coordinating its actions with the growing recognition of Bitcoin by governments and institutions—for instance, Senator Cynthia Lummis’s suggestion for a national strategic Bitcoin reserve and President-Elect Trump’s remarks about a national Bitcoin hoard—KULR demonstrates itself as an innovative and adaptable forward-thinking company. In contrast, MicroStrategy has primarily established itself as a company deeply involved with Bitcoin, where its corporate image is closely linked to the cryptocurrency.

From my perspective as a researcher, I’d like to emphasize that the strategic approach taken by KULR is characterized by its adaptability. Unlike MicroStrategy, which seems to maintain an unwavering focus on Bitcoin accumulation regardless of market conditions, KULR’s strategy demonstrates a balance between ambition and caution. This flexibility allows for a nuanced understanding of the dynamic opportunities and potential risks associated with Bitcoin, providing a more balanced approach in the ever-evolving Bitcoin market landscape.

On December 26th, KULR’s stock experienced a substantial rise, ending at $4.56, which represents a notable jump of 33.19% from the previous day’s closing price of $3.42. This surge seems to be fueled by the company’s announcement earlier in the day about its purchase of $21 million worth of Bitcoin, signifying the beginning of its strategic approach to managing its treasury.

KULR Technology Group, Inc. (symbol: $KULR) initiates its Bitcoin savings plan by acquiring 217.18 Bitcoins worth approximately $21 million, with each Bitcoin costing an average of around $96,556.

— KULR Technology (@KULRTech) December 26, 2024

There’s been a lot of buzz among investors about this news, as it seems the company’s future financial moves have sparked significant excitement, leading to increased trading activity.

Over the past month, KULR’s stock has experienced a remarkable surge, increasing by an impressive 486.36% from $0.77 to $4.51. This significant upward trend really picked up speed in mid-December. The continuous climb suggests that investors are quite optimistic about KULR’s potential to carry out its strategic plans efficiently while keeping a close eye on its primary business sectors, which include energy management and thermal technologies.

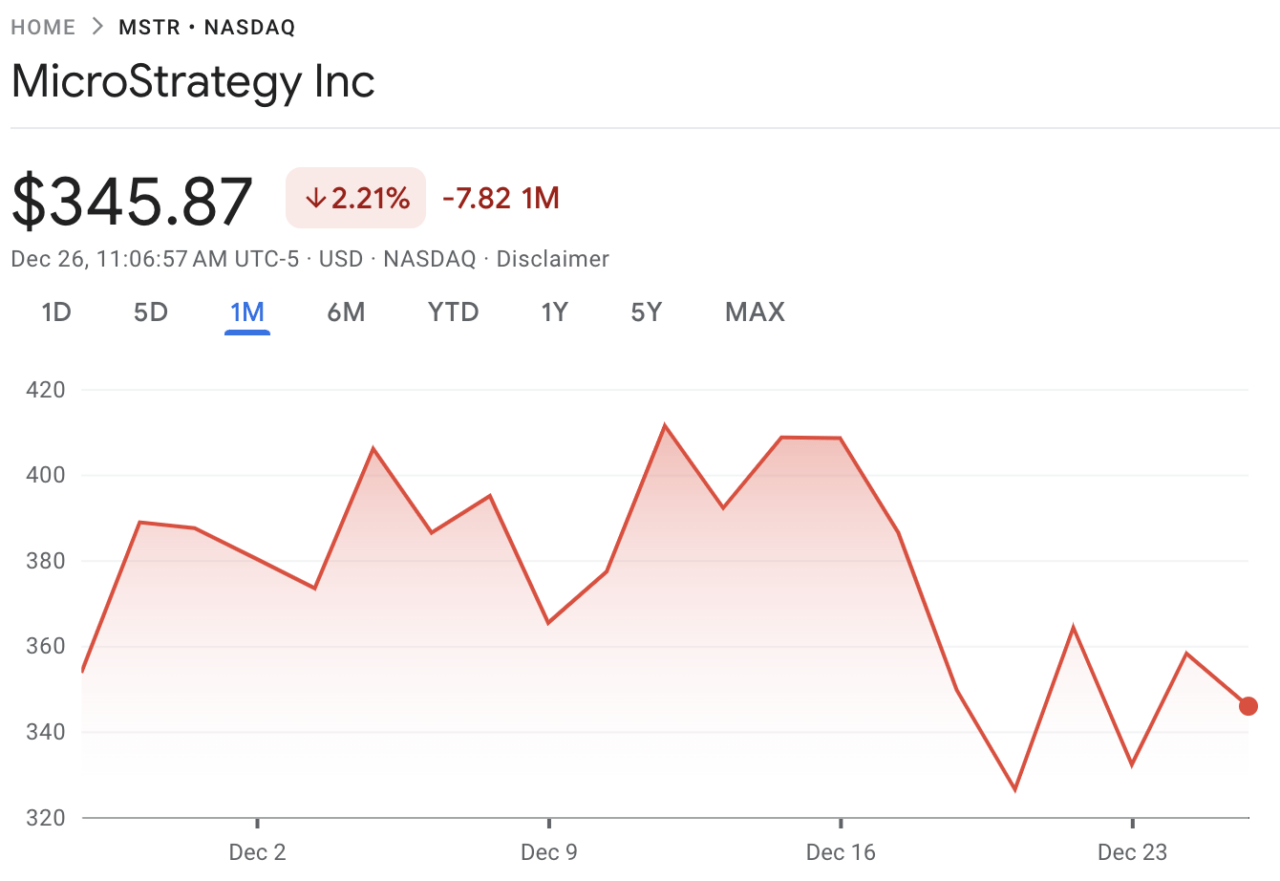

Contrary to MicroStrategy (MSTR), a firm renowned for its bold approach towards investing in Bitcoin, has followed a distinct path. As of now, MicroStrategy’s stock price has dipped by 3.38%, trading at $346.07 against its previous closing price of $358.18. Over the last month, MSTR has experienced a decrease of 2.21%, going from $353.69 to $345.87. This fluctuation suggests a tougher time for MicroStrategy, possibly linked to broader market fluctuations or Bitcoin’s recent performance.

The varying stock performances between KULR and MicroStrategy showcase significant discrepancies in market opinion and tactical implementation. KULR has been growing popular among investors, reflected in its impressive one-month surge of 486.36%, while MicroStrategy’s stock has faced challenges in sustaining growth momentum. This disparity could be due to KULR’s prudent and flexible strategy when incorporating Bitcoin into their financial plan, as opposed to MicroStrategy’s bolder and heavily-leveraged approach. Moreover, MicroStrategy might also be grappling with increased short selling, as some investors may be speculating against the company’s Bitcoin-centric strategy amid market unpredictability or broader economic uncertainties.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

2024-12-26 19:55