As a seasoned analyst with over two decades of experience in financial markets, I find Ki Young Ju’s insights intriguing and well-supported by data. His perspective on the current state of Bitcoin‘s market is a refreshing take, especially considering the ever-evolving dynamics of this digital asset.

Today on X (previously Twitter), CEO of CryptoQuant Ki Young Ju discussed recent developments in the Bitcoin market. His discussion focused on whale accumulation, referring to large-scale Bitcoin purchases by major investors. He noted that news about whale accumulation, which once significantly impacted the market a few years back, is now commonplace and no longer sparks surprise. This change, according to him, signifies a broader pattern: individual investors are gradually withdrawing from Bitcoin, allowing whales to hold significant sway in the market.

Ju posits that the major players have significant influence over the current market movements, a fact that’s generally acknowledged but seldom delved into thoroughly. Crucially, Ju emphasized that despite us being in a bull market, it does not equate to a bubble just yet. To clarify his point, he explains that a bubble occurs when the market price outstrips the money flowing into it, as demonstrated by blockchain data. At present, on-chain analysis shows approximately $7 billion in weekly capital entering the Bitcoin market, a figure that supports current price levels.

Even though there might be some adjustments, Ju suggested that these corrections would probably not exceed 30%, and if they do occur, they would likely be temporary. He also expressed optimism, stating that a significant rebound could follow, possibly causing Bitcoin prices to surge by more than 30% post-correction. Furthermore, he believes the peak of this Bitcoin cycle is yet to come and dismissed the notion of an immediate bear market, expressing skepticism towards those who disregard on-chain data.

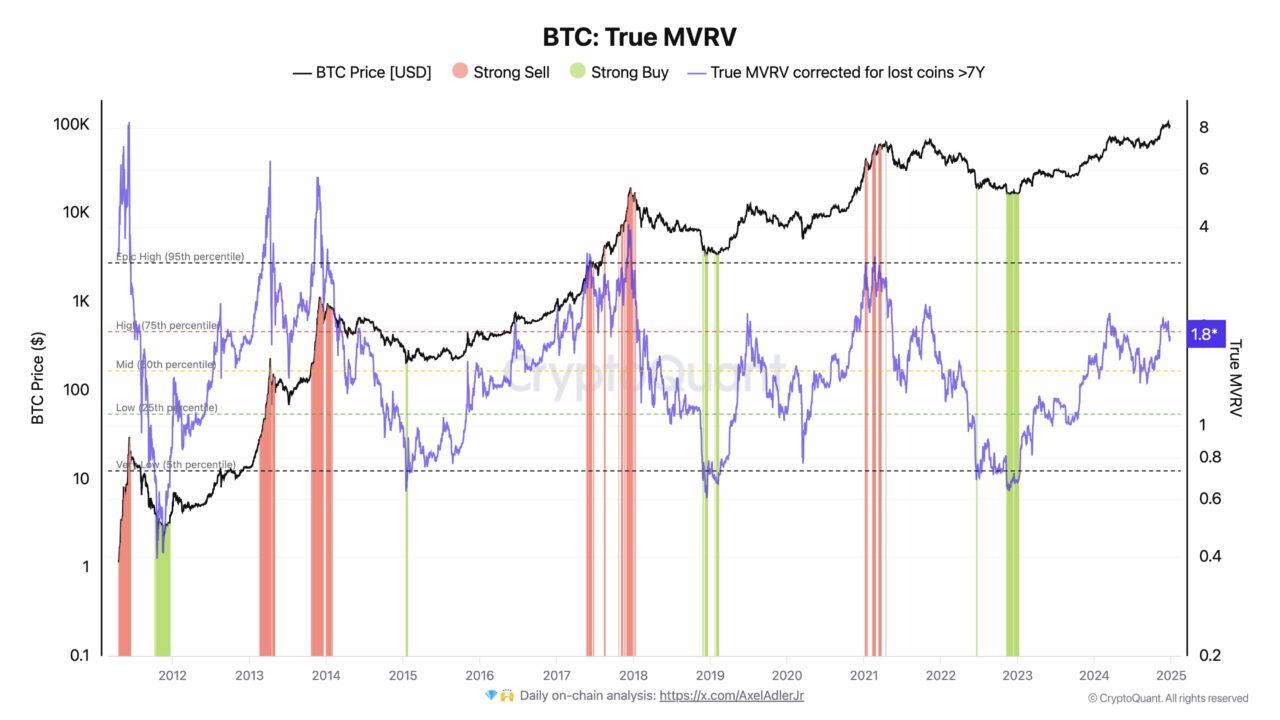

Ju’s post included a diagram labeled “Realized-to-Value Ratio for Bitcoin (MVRV),” which might look intricate initially, but offers valuable insights upon closer examination.

In simpler terms, MVRV represents Market Value to Realized Value. This is a tool used to determine if the current price of Bitcoin is high or low. The “Market Value” equals the total value of all Bitcoins in circulation, calculated by multiplying the current price by the number of coins currently in circulation. On the other hand, “Realized Value” estimates the worth of each Bitcoin based on the price at which it was last transacted or moved on the blockchain. By looking at these two figures together, MVRV gives us insights about investor sentiment and possible future price changes.

The chart plots Bitcoin’s price alongside the MVRV ratio, adjusted for coins that have been lost or untouched for over seven years (to ensure accuracy by excluding inactive coins). Here are the key zones and what they mean:

- Strong Sell Zones (Red): These are periods when the MVRV ratio is very high, often above 4. This indicates that Bitcoin’s market price is far higher than its realized value, suggesting the market is overheated. Historically, these zones have aligned with market tops, where significant price drops often follow.

- Strong Buy Zones (Green): These are periods when the MVRV ratio is very low, often below 1. These zones indicate that Bitcoin’s market price is undervalued relative to its realized value. Historically, these have been the best times to buy Bitcoin, aligning with market bottoms.

- Mid-Range Zones (Yellow): These are neutral areas where the market price aligns more closely with realized value. In these periods, the market is neither overvalued nor undervalued, reflecting balanced conditions.

At present, the graph displays the MVRV ratio around 1.8, which is higher than the average but hasn’t yet entered the “Strong Sell” zone. This implies that although Bitcoin’s price is increasing, it isn’t excessively overpriced at this point. Past trends suggest there may still be room for further growth before hitting a potential peak.

Delving into the comparison of present Bitcoin price fluctuations with historical patterns, I find myself aligning more with Ju’s perspective – these movements reflect a robust bull market rather than a speculative bubble.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Summer Game Fest 2025 schedule and streams: all event start times

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

2024-12-26 13:51