Reflecting on the whirlwind that was 2024, I find myself both awestruck and humbled by the relentless innovation that swept through the crypto landscape. As someone who has been observing and participating in this space for years, it’s truly fascinating to see how far we’ve come.

2024 showcased a groundbreaking year in the crypto market, bursting with novelty and trends that significantly transformed the industry. Meme coins became cultural phenomena while quantum-resistant strategies laid the foundation for future security, highlighting the vast adaptability of blockchain technology.

This write-up delves into the leading cryptocurrency developments of 2024, which are shaping the progress of blockchain technology.

Meme Coins

2024 saw meme coins maintaining their prominence, transforming from mere internet humor into cultural sensations. Coins such as Neiro (NEIRO) and FLOKI Inu (FLOKI), inspired by Shiba Inus, showcased the financial possibilities stemming from community-led narratives. FLOKI took this a step further, introducing a debit card that seamlessly combines functional use with meme culture.

The most notable event of the year was the selection of Elon Musk as the head of the newly established Department of Government Efficiency (D.O.G.E), by President-elect Donald Trump. This choice humorously yet significantly showcased Dogecoin‘s (DOGE) impact, blending technology, society, and politics in a way never seen before. It turns out that meme coins aren’t just financial instruments—they are cultural and political declarations.

Additionally, platforms like Solana’s Pump.fun and Tron’s SunPump have fueled the excitement around meme coins even more. These launchpads offer a straightforward and less expensive method for creating meme tokens.

According to Shaun Lee, Research Analyst at CoinGecko, Solana’s comeback and the emergence of pump.fun have sparked a surge in meme coins. These days, it’s quite simple to generate meme coins – just a few clicks are needed. The trend that started in 2023 is still going strong.

Prediction Markets

Marketplaces for predictions grew significantly, offering services like Kalshi and Polymarket that allowed people to guess future events such as election results and cryptocurrency fluctuations. In the 2020 US presidential election alone, Kalshi saw more than $100 million worth of bets placed, demonstrating the public’s fascination with decentralized prediction systems. Likewise, Polymarket observed a rise in transaction volume and overall user engagement, signaling growing interest in these markets.

Yet, this growth encountered skepticism. Critics flagged concerns about its low liquidity and potential manipulation, casting doubts on its trustworthiness. Regulatory hurdles also towered, despite Kalshi’s legal triumph against the Commodity Futures Trading Commission (CFTC) paving the way for political event contracts.

Regardless of moral discussions surrounding election bets, prediction markets have underscored the need for open and accountable alternatives for actual situations, particularly those involving decentralization.

Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs)

2024 saw a surge in liquid staking as more than 33.8 million Ethereum (ETH) tokens were locked up. Pioneers like EigenLayer, Lido Finance, and Rocket Pool spearheaded this movement, introducing Liquid Restaking Tokens (LRTs). These tokens broadened the functionality of staked assets, empowering validators to secure multiple networks, thereby deepening the connection between staking and decentralized finance (DeFi).

As a researcher studying the evolution of blockchain technology, I’ve witnessed firsthand the remarkable impact of EigenLayer. By mid-2024, an impressive 4.1 million ETH had been reinvested through this innovation, a testament to its significance. This groundbreaking development has fortified Ethereum’s Proof-of-Stake (PoS) model and underscored the crucial role of staking within blockchain ecosystems, positioning it as a pillar for future advancements in this field.

Quantum Computing

Quantum computing presents a challenging situation for blockchain technology. On one hand, it offers the potential for significant advancements in computational capabilities. However, on the other, its power to potentially crack encryption codes raises serious concerns about the survival of cryptocurrencies. For instance, algorithms such as Shor’s algorithm might be able to break down the security measures of blockchain systems, leaving room for malicious users to expose weaknesses and take advantage of them.

In response, there was a collective push towards secure, quantum-resistant technologies. Techniques such as lattice-based cryptography and Quantum Key Distribution (QKD) have seen increased adoption, bolstered by initiatives like the US National Institute of Standards and Technology’s (NIST) Post-Quantum Cryptography Standardization. The transition to quantum-safe systems is a complex endeavor, but ongoing proactive measures are paving the way for a robust and resilient future in cryptography.

DePINs

Decentralized Physical Infrastructure Networks (DePINs) connect blockchain technology with tangible assets and sectors such as transportation and logistics, demonstrating the capability of blockchain to boost transparency, safety, and productivity within physical infrastructure operations. Examples like Helium and decentralized ride-sharing platforms have showcased how blockchain can be utilized to optimize these industries.

Regardless of some difficulties related to scalability and compatibility, Decentralized Personal Identity Networks (DePINs) have paved the way for decentralized approaches to solving practical issues in various industries, demonstrating their ability to transform global markets.

AI Agents and Trading Bots

2024 saw automation take the limelight with the surge of trading bots and artificial intelligence agents. Developers were given the power to develop automated trading and asset management bots through platforms like Coinbase and Replit. Simultaneously, AI assistants such as Near’s AI Assistant simplified decision-making for traders by streamlining their processes.

Additionally, advancements in artificial intelligence frameworks like ChatGPT and algorithmic trading tools have significantly simplified tasks for both traders and software creators.

Since the launch of ChatGPT, there’s been a surge of curiosity within the cryptocurrency community regarding AI-integrated crypto projects. These projects gained momentum in 2024, with Virtuals and ai16z being among the notable ones, as mentioned by Shaun Lee.

Indeed, these innovations have sparked debate as well. Questions about fairness in trading and the ethical implications of AI within dynamic markets continue to arise. For example, the advent of Truth Terminal, an AI chatbot linked to meme coin fluctuations, has ignited discussions on AI ethics within financial systems. However transformative these advancements may be, striking a balance between automation and human supervision is crucial.

As an analyst, I find myself pondering over the construction of your crypto wallet, Truth Terminal. It appears to be designed and managed entirely by its human architect. Is this an accurate assessment? – A question posed by Brian Armstrong, the visionary CEO of Coinbase.

Rollups for Layer-2 Scaling

2024 saw Layer-2 (L2) rollups significantly improve Ethereum’s ability to handle more transactions without congestion and high fees. Rollups such as Optimism and zkSync shifted transaction processing away from the main Ethereum network, maintaining its security while boosting speed and decreasing costs.

By 2025, Vitalik Buterin aims to establish robust standards for rollups, focusing on making them resistant to fraud and implementing governance improvements. These developments have positioned rollups as a crucial component in Ethereum’s expansion, underpinning the growth of DeFi, NFTs, and dApps.

Tokenization of Real-World Assets (RWAs)

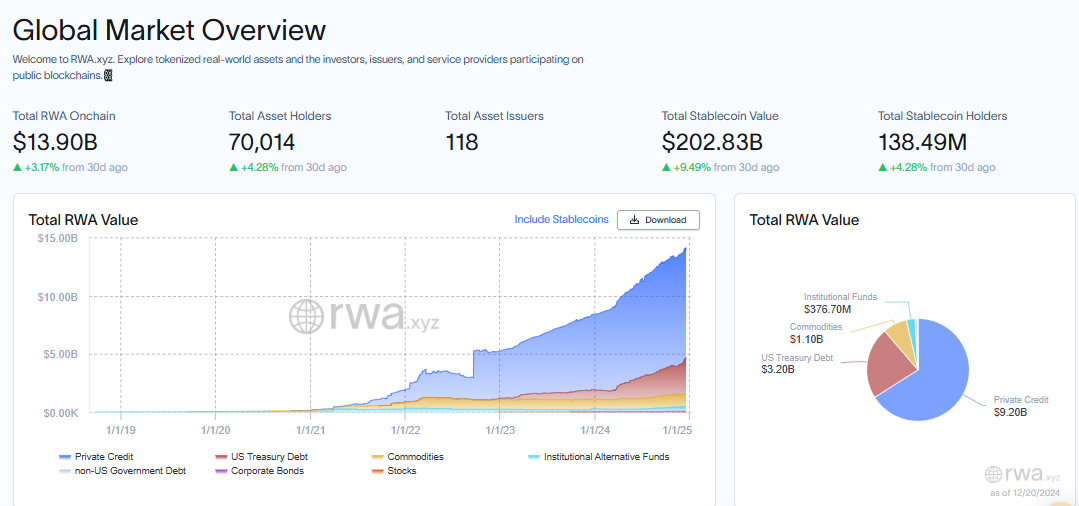

2024 saw a significant leap in the adoption of tokenization, becoming a transformative force with the global real assets market’s worth reaching an astounding $867 trillion. Pioneering platforms such as Ethena and AgriDex were at the forefront, facilitating the tokenizing of sectors like private credit and agricultural trade. This innovation streamlined financial systems, making them more efficient and democratized access to these resources.

In a similar fashion, financial giants such as UBS Group are introducing tokenized investment funds, indicating a movement towards blockchain-driven asset management. Given predictions that tokenized assets may constitute around 10% of global Gross Domestic Product by 2027, Regulatory and Wealth Management Authorities (RWAs) have paved the way for substantial economic change.

Key participants in the world of tokenized assets are companies like BlackRock and Franklin Templeton, along with others. The fact that these institutions are involved indicates a positive outlook for this trend as it becomes more widely accepted by the general public.

Shaun stated that Real-World Asset (RWA) initiatives are now a permanent fixture. In earlier phases, the RWA concept had difficulty gaining traction, but it has finally found stability in this instance. Notably, leading financial corporations have amplified their engagement within the RWA sector. BlackRock, for example, established its BUIDL fund, providing eligible investors with the prospect to generate US dollar returns.

As reported by RWA.xyz, the value of tokenized treasuries has surpassed $13 billion, marking a significant increase from its initial value of around $700 million at the beginning of the year.

Modular Blockchains

2024 saw the emergence of modular chain technology, where consensus, processing, and data access were divided into distinct modules. Pioneering projects such as Celestia and Fuel introduced this design, improving both scalability and adaptability in blockchain systems.

Through tackling issues such as data accessibility and performance optimization, modular blockchains provide a versatile solution compared to conventional monolithic designs, thereby opening up new possibilities in blockchain system architecture.

Telegram Games

2024 saw Telegram emerge as a vibrant platform for crypto gaming, featuring interactive titles such as Hamster Kombat and Catizen. These games cleverly combined fun with the potential to earn cryptocurrencies, thus drawing in countless gamers worldwide.

Nevertheless, the unpredictable nature of in-game currencies and concerns over gameplay monotony presented difficulties. Overcoming these obstacles, Telegram games demonstrated the promise of integrating gaming and blockchain technology, boosting user involvement and acceptance.

2024 marked a pivotal year for the cryptocurrency sector, filled with advancements such as meme coins and modular blockchains, along with obstacles to overcome. These trends showcase the industry’s ability to bounce back and evolve, setting the stage for further creativity in 2025 and beyond.

Read More

- Who Is Clive Davis? Breaking Down Music Mogul’s Influence and Allegations Involving Sean ‘Diddy’ Combs and Justin Bieber

- ZRO PREDICTION. ZRO cryptocurrency

- Who Is Matt LeBlanc’s Daughter? All We Know About Marina Pearl LeBlanc

- How I Attended An All-Guy’s Mixer Episode 12: Release Date, Where To Stream, Expected Plot And More

- GBP CAD PREDICTION

- SHIB PREDICTION. SHIB cryptocurrency

- FIL PREDICTION. FIL cryptocurrency

- FLOW PREDICTION. FLOW cryptocurrency

- BLUR PREDICTION. BLUR cryptocurrency

- GLMR PREDICTION. GLMR cryptocurrency

2024-12-25 00:19