As a seasoned researcher with years of experience tracking the cryptocurrency market, I’ve seen my fair share of dramatic price swings – but the recent surge in Pudgy Penguins (PENGU) has left me genuinely impressed. The 30% increase in just 24 hours is nothing short of astounding and a testament to the token’s resilience amidst market turbulence.

Over the past day, the price of Pudgy Penguins (PENGU) has significantly increased by around 30%, bouncing back strongly following a drop to its lowest point on December 20th.

The significant rebound we’ve seen is propelled by robust optimism, with critical measures such as RSI and CMF reaching record peaks, demonstrating intense buying activity and restored faith among investors.

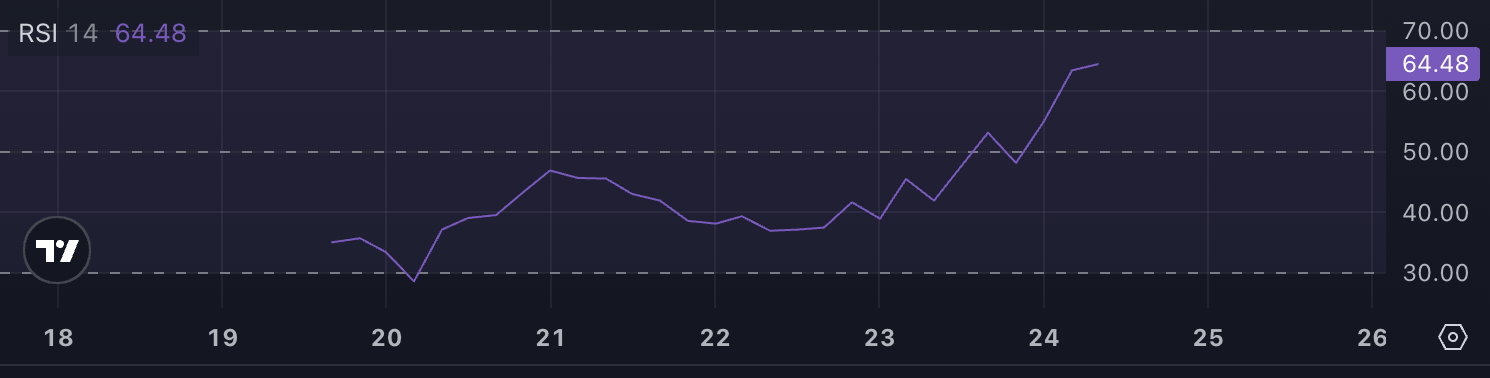

PENGU RSI Is At an All-Time High

As a researcher, I’m observing a noteworthy trend in the PENGU Relative Strength Index (RSI). At present, the RSI is sitting at an impressive 64.4, which is the highest it’s been since its introduction. This elevated RSI is a clear sign of robust buying momentum. In other words, the token has been subjected to substantial upward pressure, indicating a strong bullish trend.

Though it hasn’t reached the overbought state (usually signaled by a Relative Strength Index or RSI over 70), this level indicates growing market excitement and possibly bullish feelings among investors.

The well-known RSI (Relative Strength Index) gauge calculates the rate and intensity of price changes, ranging from 0 to 100. A reading over 70 typically signals an overbought situation, potentially leading to a downward correction in prices. Conversely, readings below 30 may indicate an oversold market, frequently followed by a price recovery.

With the PENGU Relative Strength Index (RSI) at 64.4, it’s approaching the overbought region, suggesting that its price might keep rising in the immediate future if the buying pressure stays strong. This could position PENGU among the top-performing cryptocurrencies over the past few days.

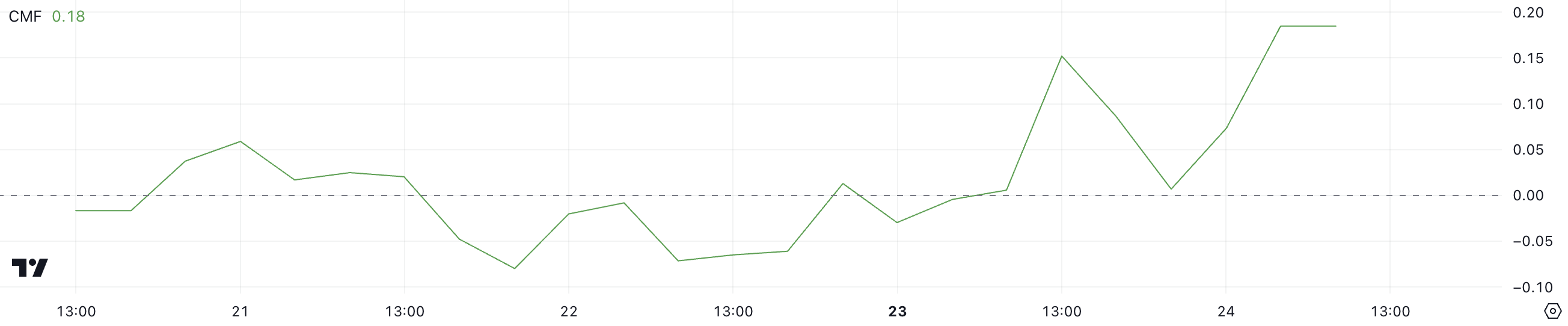

PENGU CMF Has Jumped In The Last Day

Pengu’s Chaikin Money Flow (CMF) has surged to 0.18 today, up from 0.01 yesterday and reaching its highest point since the token was launched. This sharp uptick suggests a large influx of funds, signaling strong buying interest and growing faith among investors in the altcoin, implying increased confidence.

At this stage, a Competitive Market Force indicates that the consumers have significant influence over the market, potentially leading to further price rises in the immediate future.

As an analyst, I’d like to highlight that the Capital Volume Weighted Moving Average (CMF) is a valuable tool for assessing the trend of an asset over a specified timeframe. The CMF varies between -1 and +1, with positive numbers indicating accumulation and buying pressure, and negative values signifying distribution and selling pressure. In simpler terms, when the CMF is positive, it implies that more people are buying than selling the asset, and vice versa for negative values.

Based on PENGU’s Current Market Value (CMV) being 0.18, the general market feeling is very positive, suggesting that the token may continue its upward trend if the investments keep coming in. Yet, such high levels could also trigger a phase of consolidation as traders take their profits, making it essential to observe whether the buying pattern remains strong or starts to slow down.

PENGU Price Prediction: Can PENGU Reach $0.045 In December?

If the uptrend persists, PENGU could approach a new all-time high of around $0.039.

Overcoming this obstacle might clear a path for more advancements, potentially reaching levels around $0.040 and $0.045, which equates to approximately a 20% increase.

If the Relative Strength Index (RSI) indicates the market is overbought due to high levels of buying pressure, there’s a possibility of a price adjustment. Under these circumstances, the PENGU price may encounter resistance at $0.030 as its initial significant resistance level.

If this support fails, PENGU price could decline further to $0.0229, marking a strong correction.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Oblivion Remastered: How to get and cure Vampirism

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- The Elder Scrolls: Oblivion Remastered Review – Rebirth of a Masterpiece

- Clair Obscur: Expedition 33 – If I were two years old, at what age would I Gommage?

2024-12-24 23:14