As a seasoned analyst with years of experience navigating the cryptocurrency market, I find myself intrigued by the recent surge in AAVE prices following the proposal to integrate Chainlink’s Smart Value Recapture (SVR). This is a promising development that could potentially address some long-standing issues within Aave’s lending protocol.

The cryptocurrency AAVE, which fuels the decentralized lending platform Aave, has experienced a 12% increase in value during the last day. This price surge is due to a recent suggestion for incorporating a new Chainlink data feed, also known as an oracle.

Currently, AAVE is being traded at $369.10 and appears ready to surpass its three-year peak of $399.85.

Aave Plans Chainlink’s Smart Value Recapture (SVR) Integration

On the 23rd of December, Chainlink unveiled Smart Value Recapture (SVR), a service that captures earnings stemming from Maximum Extraction Value (MEV) and redistributes these profits to Decentralized Finance (DeFi) platforms.

Following the launch, a community member suggested a proposal for a temperature check to Aave’s governing body regarding the integration of SVR into their lending system, with the intention of initiating a discussion.

In the suggested plan, it’s noted that during Aave’s liquidation process, liquidators and searchers tend to gain an unfairly large share of the profits. This leaves less value for users of the protocol. By incorporating Chainlink’s SVR system, the Miner Extractable Value (MEV) from Aave liquidations is reclaimed and equitably shared among all involved parties, such as searchers, builders, and the protocol itself.

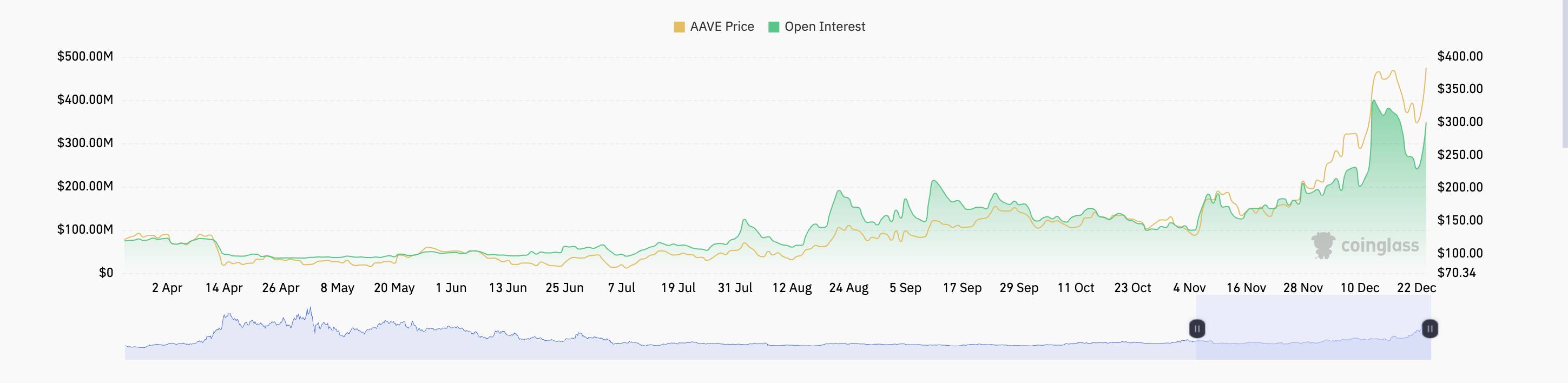

This proposal has ignited an uptick in AAVE’s trading activity. Over the past 24 hours, its value has climbed by double digits. Its rising open interest confirms the surge in the demand for the altcoin.

As of this writing, open interest stands at $376 million, climbing by 32%.

The term “open interest” signifies the sum of all unsettled contracts in markets dealing with derivatives like futures or options. For instance, if we consider AAVE, an increase in open interest during a price surge suggests that traders are creating new positions in line with the market trend. This shows robust market faith and potentially prolonged momentum.

To add to that, on a day-by-day basis, the Relative Strength Index (RSI) for AAVE is moving upward, indicating increased purchasing activity. At this moment, its reading stands at 62.88.

This metric gauges the extent to which a particular asset is being bought or sold excessively within the market, indicating oversold or overbought situations. Currently, with a reading of 62.88 and an uptrend ongoing, traders are preferring to acquire AAVE more than they’re offloading it at this moment.

AAVE Price Prediction: A Rally Above $400 Is Possible

Right now, AAVE is being traded below its three-year peak of $399.85’s resistance level. If purchasing activity persists, there’s a chance that AAVE might break this resistance and convert it into a solid support base. This potential breakout could drive the price above $400 for the first time since 2021.

If selling activity begins, it would contradict the current optimistic perspective, potentially causing AAVE’s price to drop down to approximately $323.46.

Read More

2024-12-24 20:11