As a seasoned researcher who has closely followed the crypto market since its inception, I must say that the surge in venture capital investment activity this year is nothing short of impressive. Having witnessed the ups and downs of the industry over the years, I can confidently assert that we are currently experiencing one of the most bullish periods yet.

Based on RootData’s data, there were around 1,530 rounds of cryptocurrency venture capital investments made publicly available in the year 2024, marking a substantial 25.1% rise compared to the number from the preceding year.

Total fundraising this year reached $10.04 billion, a 7.59% increase from 2023.

A Healthy Surge in Crypto Investment

Venture capital investment activity is an important metric regarding the crypto industry’s health, and current levels paint an optimistic picture. Initially, the strongest fundraising activity took place in the first half of the year, with a steady decline in the following months. However, since Trump’s re-election to the US Presidency, this trend is reversing thanks to new inflows.

2024 saw a decrease in investment rounds exceeding $20 million compared to the previous year, however, all crypto fundraising sizes between $1 million and $20 million witnessed an increase. Moreover, seed funding constituted a smaller share of total fundraising rounds, whereas strategic funding experienced a growth spurt in 2024.

Despite an upward trend in investment capital within the cryptocurrency market, the distribution of these funds experienced significant shifts. Notably, investments in blockchain infrastructure dominated as the preferred venture capital recipient throughout both years.

However, DeFi funding nearly doubled, sweeping into a comfortable second place. CeFi, on the other hand, cratered to fifth.

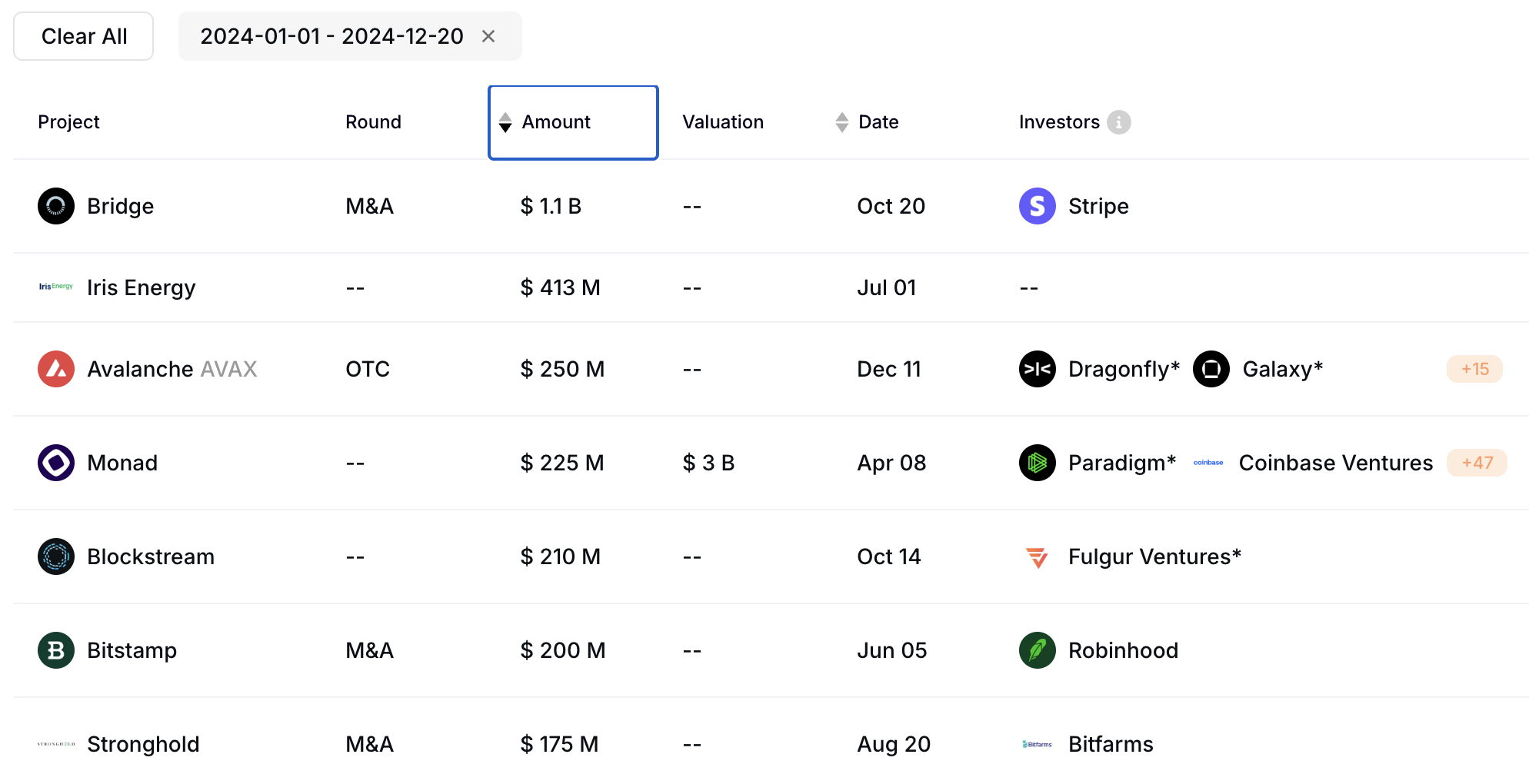

Stripe’s Bridge Deal Leads the Way

In October, the most significant investment was made, led by Stripe, a renowned payments giant. In a groundbreaking transaction intended to boost its operations in the cryptocurrency sector, Stripe acquired Bridge for an impressive $1.1 billion. This substantial amount not only held the top spot in fundraising but also outstripped the nearest competitor by more than twice as much.

The purchase of Bridge for $1 billion by Stripe indicates to venture capitalists that startups focusing on stablecoins, which were earlier overlooked due to initial token illiquidity, now have a more defined route towards significant acquisitions. This development could lead to increased funding and an influx of entrepreneurs eager to build around stablecoins, as suggested by Qiao Wang, founder of Alliance DAO.

In July, Australian miner Iris Energy secured a $413 million investment from Venture Capitalists. This substantial funding will enable the company to expand its operational capabilities significantly. By 2024, Iris aims to increase its computational power by 30 Exahash per second (EH/s) and operate 510 megawatts (MW) of data centers. Additionally, Iris is involved in a 1400 MW mining project based in West Texas.

Last year, Avalanche, a well-known blockchain initiative, managed to secure significant venture capital investments. This trend of increased funding towards blockchain infrastructure surpassed any other sector within the crypto/Web3 realm. On December 11th, they held a private token sale where institutions such as Galaxy Digital made the largest contributions.

2024 saw a surge in cryptocurrency investment, with the approval of the Bitcoin ETF setting the stage. This approval led to an increased involvement of institutions across the entire crypto market. Furthermore, surveys within the crypto community indicate a high level of individual enthusiasm, mirrored in the heavy investments being made.

Read More

2024-12-24 19:21