As a seasoned crypto investor with a knack for deciphering market trends and patterns, I find myself intrigued by Solana’s current standing. With my fingers crossed and eyes glued to the charts, I can’t help but feel a sense of cautious optimism regarding SOL‘s near-term price trajectory.

As a researcher, I’ve noticed an intriguing trend with Solana (SOL). On November 22, it reached a record high, but since then, we’ve been witnessing a corrective phase. Regrettably, the price is now trading approximately 27% lower than that peak. The technical indicators are presenting mixed signals at the moment. While bearish momentum is still prevailing in the market, there are hints that it might be easing slightly.

Despite a slight uptick from its recent slump, the BBTrend continues to dip below zero, indicating ongoing negativity. On the other hand, the DMI hints that the present downward trend might be weakening. As for SOL, it’s teetering close to a significant resistance level at $195. The direction of its price movement will hinge on whether bullish indicators pick up momentum or bearish pressure escalates further.

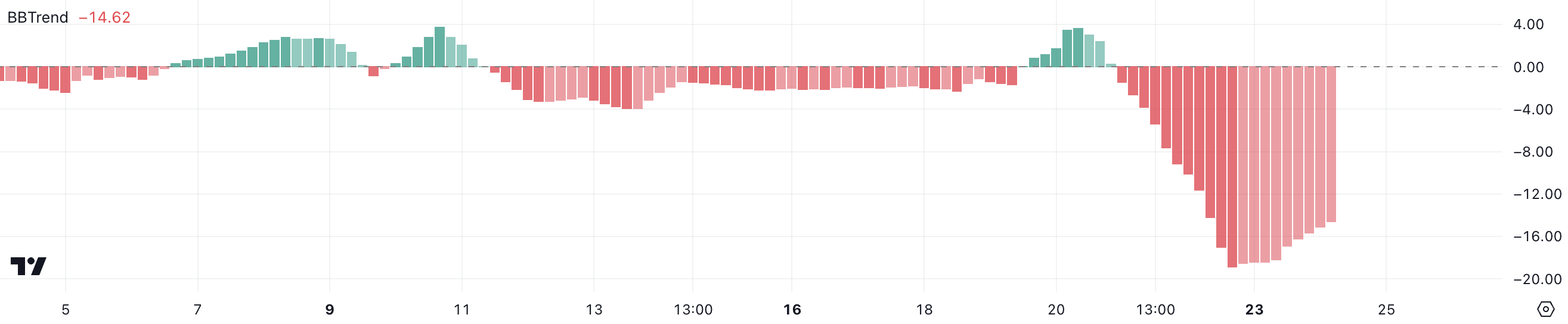

SOL BBTrend Is Still Very Negative

On December 22nd, the BBTrend indicator for Solana dipped to its lowest point since August, registering a value of -18.89. Since December 21st, it has stayed below zero.

At present, the BBTrend stands at -14.64, suggesting it’s on an upward trajectory and potentially signaling a change in market attitude. This tentative rise, even though it remains negative, indicates that selling activity could be decreasing as investors may start to re-engage in the market with caution.

The term “BBTrend” refers to a momentum indicator that is calculated based on Bollinger Bands. This indicator assesses the gap between an asset’s price and the midpoint of its Bollinger Bands, offering insights about the intensity and direction of market trends. A negative BBTrend value signals a bearish trend, whereas a positive value indicates a bullish momentum.

As SOL BBTrend increases from -18.89 to -14.64, this suggests that the downward pressure is decreasing, which could lead to a short-term price increase. Nevertheless, it’s important to note that until BBTrend moves into positive figures, the market may stay wary, with the price trend possibly staying flat or confined within a range.

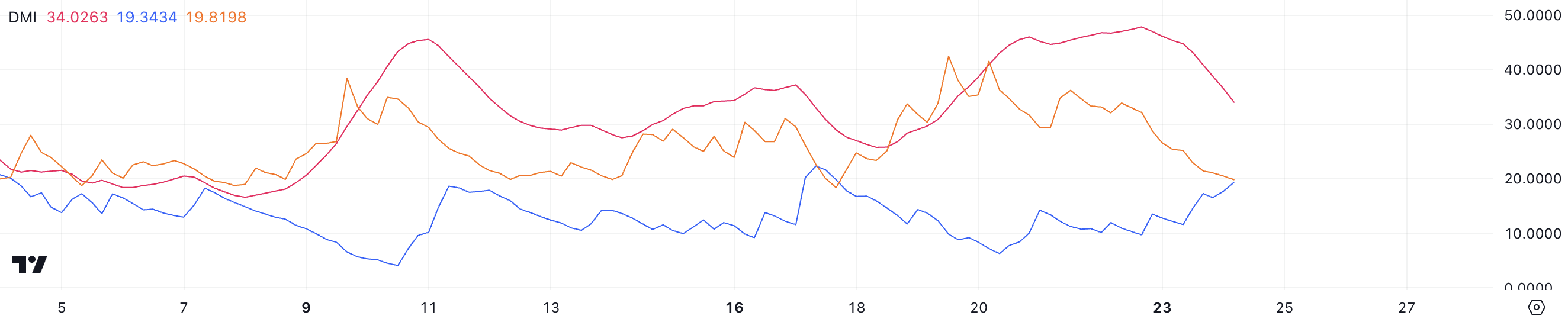

Solana DMI Shows an Uptrend Could Appear Soon

Looking at the Solana Directional Movement Index (DMI) chart, we see that its Average Directional Index (ADX) has dropped significantly from around 49 yesterday to 34 now. Even though an ADX over 25 indicates a robust trend, this recent decrease implies that the intensity of SOL’s downward trend may be lessening.

The drop in trend intensity occurs as Solana (SOL) shows signs of a bear market, yet the declining Average Directional Movement Index might suggest that the selling pressure may be losing steam.

In simpler terms, ADX (which is part of DMI) gauges the intensity of a market trend, ranging from 0 to 100, regardless of whether it’s bullish or bearish. A value over 25 indicates a strong trend, while less than 20 hints at weak or non-existent trends. Furthermore, the D+ (positive directional indicator) is currently at 19.34, and the D- (negative directional indicator) stands at 19.81. This means that there’s a nearly equal force from buyers and sellers, with a slight lean towards selling, suggesting a slightly bearish market.

The decrease in ADX along with almost equal D+ and D-, indicates that although SOL continues its downward trend, the intense bearish push might be weakening. In the immediate future, this could result in a period of stabilization or even a possible reversal if buying pressure increases significantly.

SOL Price Prediction: Back to $200 In December?

The key resistance for Solana’s price appears to be around $195, making it a significant point to watch in its future price fluctuations. At present, the Exponential Moving Averages (EMAs) indicate a bearish trend, as the short-term EMAs are positioned below the long-term ones.

On the other hand, the latest rise in short-term Exponential Moving Averages suggests there might be an impending golden cross, a positive indicator that may point towards a potential change in trend direction.

Should the price of Solana manage to surpass the $195 barrier, it might aim for $204 next, and potentially even reach $215, indicating a substantial upward trend in its recovery process.

If the BBTrend continues to be strongly negative and the current downward trend intensifies, there’s a possibility that the SOL price might revisit the $183 support point. Should this support fail, we could see a continued drop, possibly reaching the $175 mark.

Read More

2024-12-24 18:15