As a seasoned analyst with over two decades of market observation under my belt, I find myself constantly reminded of the adage “the more things change, the more they stay the same.” Ethena (ENA) is no exception to this rule, as it continues its dance between bullish and bearish forces.

The price of Ethena (ENA) has seen substantial fluctuations recently, increasing by 63% over the past month but decreasing by 11% in the last week. Despite this recent downturn, ENA continues to hold a robust market position with a current market capitalization of approximately $3 billion.

The technical analysis shows that indicators like Relative Strength Index (RSI) and Daily Moving Average (DMI) indicate a phase of stability for the token, with no clear directional push. At present, traders are keeping a close eye on significant levels of support and resistance to predict ENA’s probable short-term action.

ENA RSI Is Currently Neutral

Currently, the ENA’s Relative Strength Index (RSI) stands at 47.3, indicating a neutral position similar to December 21. When the RSI is within this range, it implies that neither buyers nor sellers have a significant upper hand in the market. This suggests that the token’s trading momentum is well-balanced.

In simpler terms, this stance suggests that the latest price fluctuations are not showing a strong trend, making it difficult to determine if the market is overbought (too high) or oversold (too low).

The Relative Strength Index (RSI), a frequently employed momentum tool, gauges the rate at which prices are rising or falling between 0 and 100. When the RSI exceeds 70, it often signals that an asset might be overvalued, potentially leading to a price adjustment, also known as correction. On the contrary, when the RSI drops below 30, it may imply that the asset is undervalued, possibly preparing for a recovery or rebound.

Currently, with Ethena’s Relative Strength Index (RSI) at 47.3, it indicates a period of consolidation where neither a strong bullish surge nor immediate bearish action is suggested. For the near future, this level might suggest that Ethena’s price could maintain its current sideways trend. However, if there’s a break above or below significant RSI levels, it could potentially change the direction of the market momentum.

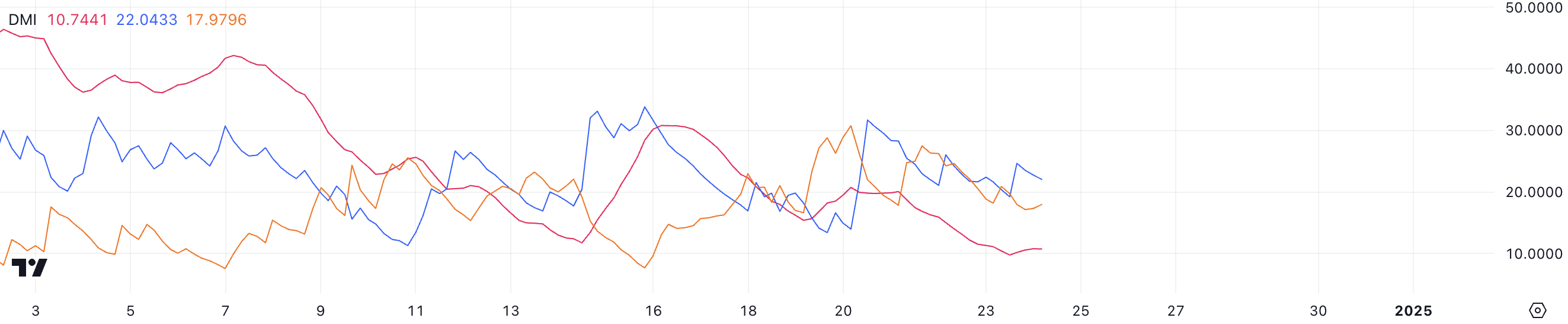

ENA DMI Shows an Undefined Trend

The ENA Directional Movement Index (DMI) chart shows that its Average Directional Index (ADX) has decreased from 20, which it was on December 21st, to 10.7 now. A decrease in ADX usually means a weakening trend, as values less than 20 often indicate a diminished directional power in the market.

Based on my years of trading experience and observing various market trends, I would say that this recent drop suggests to me a period of uncertainty for ENA. It appears that neither bullish nor bearish sentiments are prevailing strongly or consistently at the moment, which often indicates a phase of consolidation or indecision in the market. This is not uncommon and can be seen as an opportunity for careful investors like myself to make strategic moves while the market finds its direction. It’s essential to stay patient during such periods and carefully analyze the underlying fundamentals before making investment decisions.

the Positive Directional Indicator (D+) and the Negative Directional Indicator (D-). Currently, the D+ stands at 22, while the D- is slightly lower at 17.97.

For ENA, when D+ exceeds D-, it indicates a slight bullish bias, but the weak ADX value of 10.7 suggests the trend doesn’t have significant power. This scenario implies that ENA’s short-term price action may stay relatively stable without a clear directional push, which could lead to sideways trading or a period of indecisive movement. An increase in ADX might suggest a transition towards stronger trends, possibly moving upwards or downwards.

ENA Price Prediction: Can ENA Fall Below $0.80 Soon?

As a crypto investor, I’m currently observing that Ethena is confined within a specific trading range. At the moment, the immediate resistance for ENA is around $1.07, while its support lies at approximately $0.94. If Ethena manages to break above the resistance at $1.07, it might open doors for the price to challenge the next resistance level at $1.14. Should this upward momentum persist, the price could even climb up to $1.22.

In this situation, there’s a possibility that the value could increase by 18%, which indicates a positive risk-to-reward proportion for those who are optimistic about the market, should the trend continue to move forward.

If the support at $0.94 doesn’t manage to hold, there’s a possibility that the ENA price could experience a significant drop, possibly down to $0.75 – representing a potential decrease of 27%. This suggests the importance of the current price range, as breaking either level might significantly influence ENA’s short-term price direction.

Keeping an eye on the price levels around $1.07 and $0.94 is essential for traders, as a rise above $1.07 might indicate further bullish movement, while a fall below $0.94 could potentially trigger selling activity.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-12-24 15:39