As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I’ve learned to read between the lines of technical indicators and market trends. The current state of Mantra (OM) leaves me cautiously optimistic, as the RSI remains neutral since December 3, while the Ichimoku Cloud points towards increasing bearish momentum.

The spiritual token Mantra (OM) may encounter a crucial technical period due to signs suggesting possible downward pressure in the near future. Over the last week, this DeFi token has dropped by 13%, extending its correction from the record high it achieved on November 18. Presently, its value is 21% lower than that peak.

The technical analysis presents a blend of signals, as the Relative Strength Index (RSI) remains undecided in its stance, while the Ichimoku Cloud indicates an escalating bearish trend. Furthermore, there’s a possible formation of a death cross on the horizon, which could intensify the decline if verified.

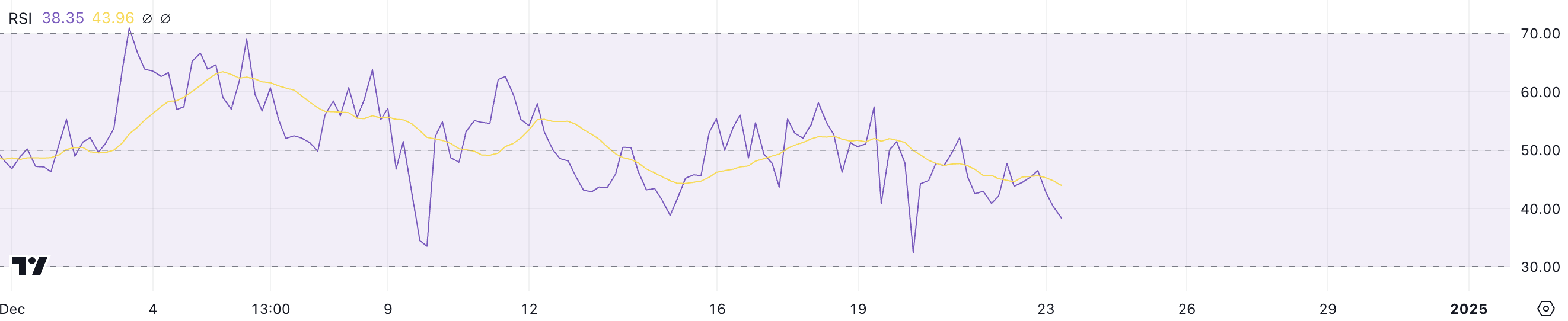

OM RSI Has Been Neutral Since December 3

For the OM, the Relative Strength Index (RSI) has held a fairly neutral level at 38.3 recently, demonstrating limited price fluctuations since December 3. The RSI is a popular technical indicator that fluctuates between 0 and 100, with values under 30 suggesting the asset might be oversold, while figures above 70 may indicate overbought conditions.

In this range, approximately 40 to 60, you often find a balanced market situation, neither the buyers nor the sellers having clear dominance over the other.

Currently, the Relative Strength Index (RSI) of the asset stands at 38.3, which is slightly lower than the neutral midpoint of 50. This slight dip suggests a hint of downward pressure, but it’s not enough to signal an oversold condition yet. The prolonged neutral RSI values might be indicating a consolidation phase, where the asset may be gathering strength before making a significant move. This movement could be either bullish if the indicator breaks above 50 or bearish if it drops below 30.

According to recent indications, traders could be holding off on substantial actions, preferring to wait for more definitive cues. However, the somewhat bearish tilt of 38.3 indicates a need to consider possible negative outcomes.

Ichimoku Cloud Shows a Bearish Setting For OM

The Ichimoku Cloud chart for OM shows a bearish trend developing over the past week.

In simpler terms, the green line (Chikou Span) has fallen under the regular price movements as of December 19, and the blue line (Conversion Line) is now lower than the red line (Base Line). This combination creates a bearish signal, suggesting a potential decrease in price.

The color change of the cloud structure from green to red signifies a move from optimistic (bullish) to pessimistic (bearish) market feelings. At present, the trading price is lower than not just the cloud but also all significant Ichimoku trend lines, suggesting robust downward pressure.

In simpler terms, since all prices seem to be approaching the same level, it might indicate an impending period of consolidation or even a shift in the trend.

OM Price Prediction: The $3.31 Support Is Fundamental

Right now, the temporary average of OM’s price sits higher than the extended one, but it’s losing speed, which could indicate an approaching crossover situation known as a “death cross.

Should the bearish indication occur, as indicated by the shorter moving average falling beneath the longer one, it’s possible that the Mantra price might encounter heightened selling activity, potentially causing it to approach the $3.31 support zone. If this level doesn’t hold, a further decline towards the $3.03 mark could follow.

If the price of OM recovers its upward trend prior to a “death cross” occurring, it might aim for the nearby resistance level at $3.76 instead.

If we manage to break through at this point, it could potentially open up opportunities for further advancements towards the $4.25 price point. However, such an outcome would depend on a significant change in the current market’s mood and possibly a renewed emphasis on the Real-World Assets (RWA) storyline.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2024-12-24 02:13