As an analyst with over two decades of experience in financial markets, I’ve seen my fair share of market fluctuations and trends. The current 7% decline in Bitcoin (BTC) over the past week is a cause for concern, especially when you delve deeper into the data.

Over the last seven days, Bitcoin (BTC) has dropped by 7%. This decrease, in part, can be attributed to the overall weakness in the cryptocurrency market. However, the main cause seems to be a drop in purchasing activity from significant investors, often called “whales.

Observers who closely follow significant Bitcoin holders may fear a potential drop if they remain inactive, given the following reasons.

Bitcoin Whales Refrain From Buying

Based on reports from IntoTheBlock, there’s been a significant decrease of 116% over the last week in the outflow of Bitcoin held by large investors – these are individuals or entities who possess more than 0.1% of the total Bitcoin supply currently in circulation.

In simpler terms, netflow refers to the gap between the quantity of cryptocurrency moving into and out of big-time investors’ accounts (incoming versus outgoing transactions). Similar to Bitcoin, when this indicator decreases, it suggests that these significant investors are offloading their cryptocurrency holdings by selling them for a profit because outflows surpass inflows.

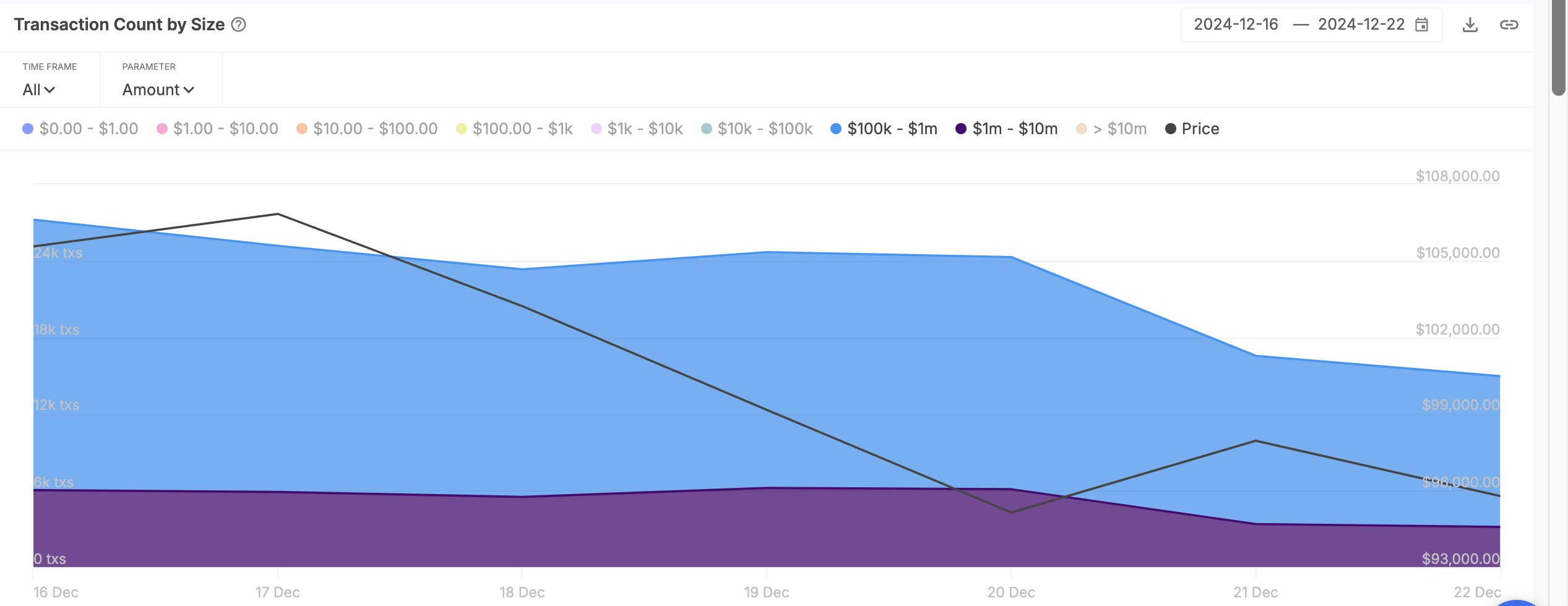

Furthermore, the decrease in the number of significant daily Bitcoin transactions as reported by IntoTheBlock, which shows a drop of 48% in transactions valued between $100,000 and $1 million over the last week, points to a reduction in whale activity.

During that particular span, I’ve noticed a significant decrease – approximately 50% – in the frequency of Bitcoin transactions valued between one million and ten million dollars.

It’s worth noting that the decrease in significant Bitcoin transactions by large investors is significant, as less purchasing from these big players could diminish the price floor and heighten the chances of additional price drops.

BTC Price Prediction: Break Below $95,690 Could Spell $85,000 Crash

On a daily basis, Bitcoin (BTC) slightly hovers over its support at approximately $95,690. As whale activity decreases, there’s a possibility that this crucial level won’t be sustained, leading to BTC’s price dropping below $90,000 and potentially reaching around $85,721 on the market.

Should the market sentiment reverse and significant Bitcoin holders (referred to as ‘whales’) recommence their coin amassing, this action could potentially ignite a surge towards the digital currency’s previous record high of $108,388.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2024-12-24 00:02