As a seasoned analyst with over two decades of experience in both traditional and digital asset markets, I can confidently say that we are witnessing a classic case of macroeconomic forces impacting the crypto market. The recent downturn in XRP, along with other cryptocurrencies, is a clear reflection of tightening liquidity conditions and rising risk aversion – themes that I’ve seen play out multiple times in various markets throughout my career.

Over the past few days, the price of XRP has experienced a substantial drop, falling approximately 20% from its peak of $2.7255 on December 17 to $2.20 as of December 23, 2024. This decrease coincides with broader challenges in the cryptocurrency market, where unfavorable economic conditions have triggered a significant sell-off. Although XRP doesn’t seem to have any specific internal problems, a tightening global financial environment and a more aggressive stance from the Federal Reserve have put stress on the crypto market as a whole.

State of the Crypto Market on December 23, 2024

As a researcher observing the cryptocurrency landscape, it’s evident that we’re witnessing a notable downturn. As of December 23, the cumulative market capitalization of cryptocurrencies is $3.459 trillion, representing a decrease of approximately 2.4% over the last 24 hours. Despite this dip, trading volumes continue to be brisk, with an impressive $193.75 billion worth of activity recorded during the same period. However, it’s important to note that selling pressure is currently prevailing across the major cryptocurrencies.

- Bitcoin (BTC), the largest cryptocurrency, is priced at $95,998.96, down 8.4% over the past week and 0.9% in the past 24 hours. Its market cap stands at $1.9 trillion.

- Ethereum (ETH) is trading at $3,337.48, with steeper losses of 15.5% over the week. It has shed 1.2% in the past 24 hours, leaving its market cap at $401.98 billion.

- XRP, ranked 4th by market cap, is priced at $2.20, down 8.0% over the week and 3.2% in the past day. Its 24-hour trading volume of $11.09 billion highlights active participation but insufficient demand to counter selling pressure.

- Other top altcoins, including BNB ($673.30) and Solana (SOL) ($184.55), have also struggled, with Solana losing 15.9% over the week. The market’s synchronized downturn underscores the influence of external macroeconomic factors.

Impact of the Federal Reserve on XRP and the Crypto Market

The significant drop in XRP, along with other cryptocurrencies, started directly following the Federal Reserve’s policy meeting on December 18. Although the Fed lowered its key rate by 0.25%, the statement and remarks from Chair Jerome Powell during the press conference took a more hawkish stance than expected.

The Federal Reserve’s new predictions suggest that they anticipate only two more small interest rate adjustments by 2025, which is less than the four cuts previously predicted in September. Chairman Powell stressed that although inflation has slowed, it still surpasses the Fed’s 2% target, and future reductions will hinge on ongoing progress. This conservative approach suggests that monetary conditions will stay tight until 2025, surprising many investors.

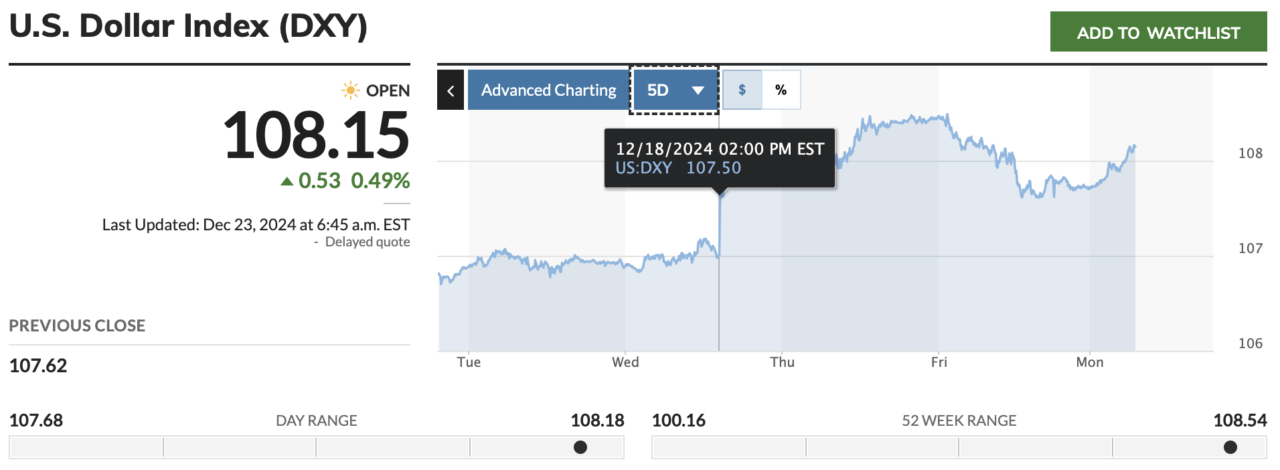

The market’s reaction was swift. At 2:00 p.m. ET on December 18, the U.S. Dollar Index (DXY) spiked from 107.50 to above 108, reflecting a stronger dollar. By December 23, the DXY reached 108.15, its highest level in months. A stronger dollar tightens global financial conditions, making speculative assets like cryptocurrencies less attractive.

XRP’s Price Action

Over the past month, Ripple‘s price chart clearly demonstrates a significant turnaround from its peak on December 17, where it hit an intraday high of $2.7255. However, after the Federal Reserve made their announcements, XRP started to plummet sharply. This downward trend mirrors the overall crypto market’s reaction to increasing liquidity constraints and heightened risk caution.

The substantial 24-hour trading volume of XRP at approximately $11.09 billion indicates high market engagement. However, ongoing selling pressure caused by broader economic issues continues to pull its price in a descending trend.

Tightening Liquidity and Global Market Dynamics

Last week, Jamie Coutts, who is the Chief Crypto Strategist at Real Vision, stated on X that tightening liquidity plays a significant role in the difficulties the crypto market is experiencing. Over the last two months, global liquidity has decreased as central bank balance sheets have shrunk and bond market volatility has increased. Furthermore, Federal Reserve Chair Jerome Powell’s hawkish comments during his December 18 press conference further exacerbated these worries.

Coutts pointed out that cryptocurrencies tend to be strongly affected by changes in liquidity situations. Previously, tightened financial situations have often been followed by significant drops in speculative investments. The recent increase in the DXY and growing Treasury yields, currently at 4.54% for the 10-year note, suggest a restrictive economic environment. As risk tolerance decreases, it’s the crypto assets that are taking most of the impact from this decline.

For two months, there has been a noticeable restriction in liquidity. If this trend continues, it might cause concern among central planners. Keep an eye out, as buying opportunities could be on the horizon.

— Jamie Coutts CMT (@Jamie1Coutts) December 20, 2024

Conclusion: What’s Next for XRP?

It seems that the fall in XRP’s value is primarily influenced by broader economic factors, not events specific to the asset itself. The Federal Reserve’s decision to reduce rate cuts, a strong U.S. dollar, and increasing yields have made conditions difficult for speculative assets. As of December 23, XRP is trading at around $2.20, and the general market sentiment will likely determine its immediate direction.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Jurassic World Rebirth: Scarlett Johansson in a Dino-Filled Thriller – Watch the Trailer Now!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

2024-12-23 15:17