As a seasoned crypto investor who’s weathered countless market storms since my early days mining Bitcoin in my college dorm room, I find myself cautiously optimistic about the current state of the market. The recent 15% correction in Bitcoin is undoubtedly concerning, but it’s important to remember that these corrections are a natural part of any market cycle.

Last week in December, I witnessed a significant 15% decrease in Bitcoin’s value, which was its most substantial weekly price drop since August. This downturn is believed to be influenced by global macroeconomic factors. The experts are cautioning that if these economic pressures escalate, we might see more downward movement in Bitcoin’s price.

However, Bitcoin also has internal factors to counterbalance the negative impact of the macro.

Global Liquidity Plunges Over the Past Two Months

Based on The Kobeissi Letter’s findings, there seems to be a 10-week delay between Bitcoin’s price movements and the Global Money Supply (Global M2). Over the last two months, the Global M2 has decreased by approximately $4.1 trillion, which could suggest potential future drops in Bitcoin prices if this trend persists.

One way to rephrase the given text in natural and easy-to-read language is:

According to The Kobeissi Letter’s prediction, when global money supply reached a record-breaking $108.5 trillion in October and Bitcoin prices peaked at $108,000, a drop of $4.1 trillion in the money supply over the last two months (now standing at $104.4 trillion) might indicate that Bitcoin’s price could decrease by approximately $20,000 within the coming weeks if the current relationship persists.

Over a month ago, serving as a researcher examining the Bitcoin market, I took note of a prediction made by Joe Consorti, the Head of Growth at Bitcoin custody firm Theya. He cautioned about a possible 20%-25% correction in Bitcoin values, supported by similar indicators. It now seems that this forecast is coming to fruition.

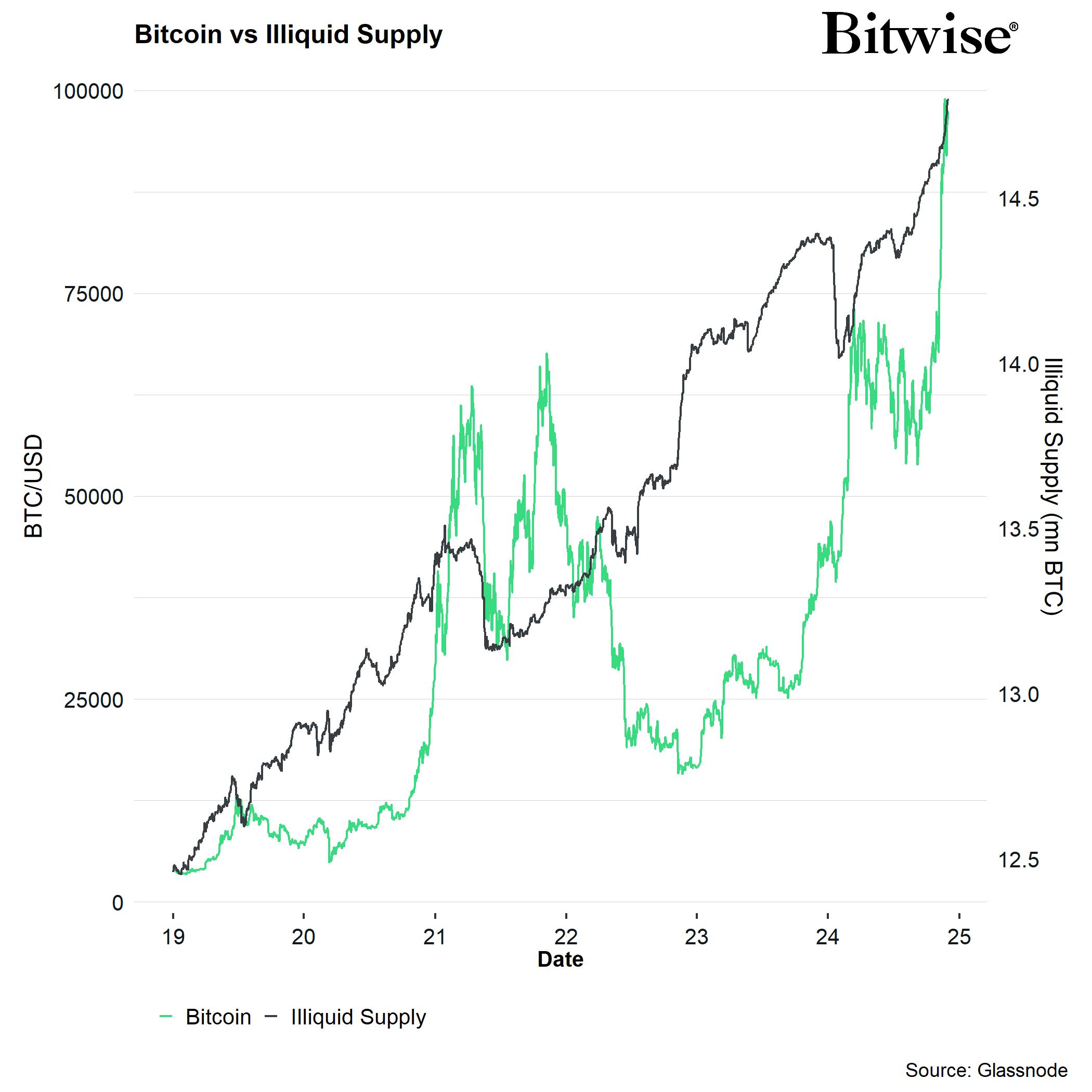

According to André Dragosch, the Chief Research Officer at Bitwise, he holds a comparable viewpoint. He predicts that Bitcoin will continue to experience pressure as a result of tightening liquidity conditions in the U.S. However, he underscores a significant internal aspect of Bitcoin that might offset this liquidity strain: the increasing illiquid supply of Bitcoin itself.

An increase in the illiquid supply of Bitcoin suggests that there’s less of it available on the market, which could lead to a perceived rarity or scarcity. This scarcity, within the context of demand and supply dynamics, might contribute to maintaining or even increasing its price.

As a researcher, I’m observing that Bitcoin is navigating between two contrasting forces:

Currently, Bitcoin is being exchanged for approximately $94,000 according to BeInCrypto’s latest figures. Over the weekend, it saw a nearly 6% decrease in value.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Oblivion Remastered: How to get and cure Vampirism

2024-12-23 08:52