As a seasoned researcher with years of experience analyzing cryptocurrency markets, I have to say that while the 4% surge in BTT is certainly intriguing, my technical analysis paints a slightly bearish picture for the near term. The Aroon Up Line at 0% and the MACD line significantly below the signal line suggest a lack of strong bullish momentum.

In the last 24 hours, BitTorrent Token (BTT), which operates the peer-to-peer (P2P) file-sharing platform without central authority, has been the highest climber among market assets. It has risen by a significant 4%.

However, while this uptick may reflect a renewed interest in the token and a potential shift in market sentiment, readings from BTT’s price charts hint at a correction in the near term.

BitTorrent Lacks the Bullish Momentum to Extend Rally

In the last 24 hours, the value of BTT has increased by 4%. Currently, it’s trading at approximately $0.00000111, and the trading activity is on an upward trend.

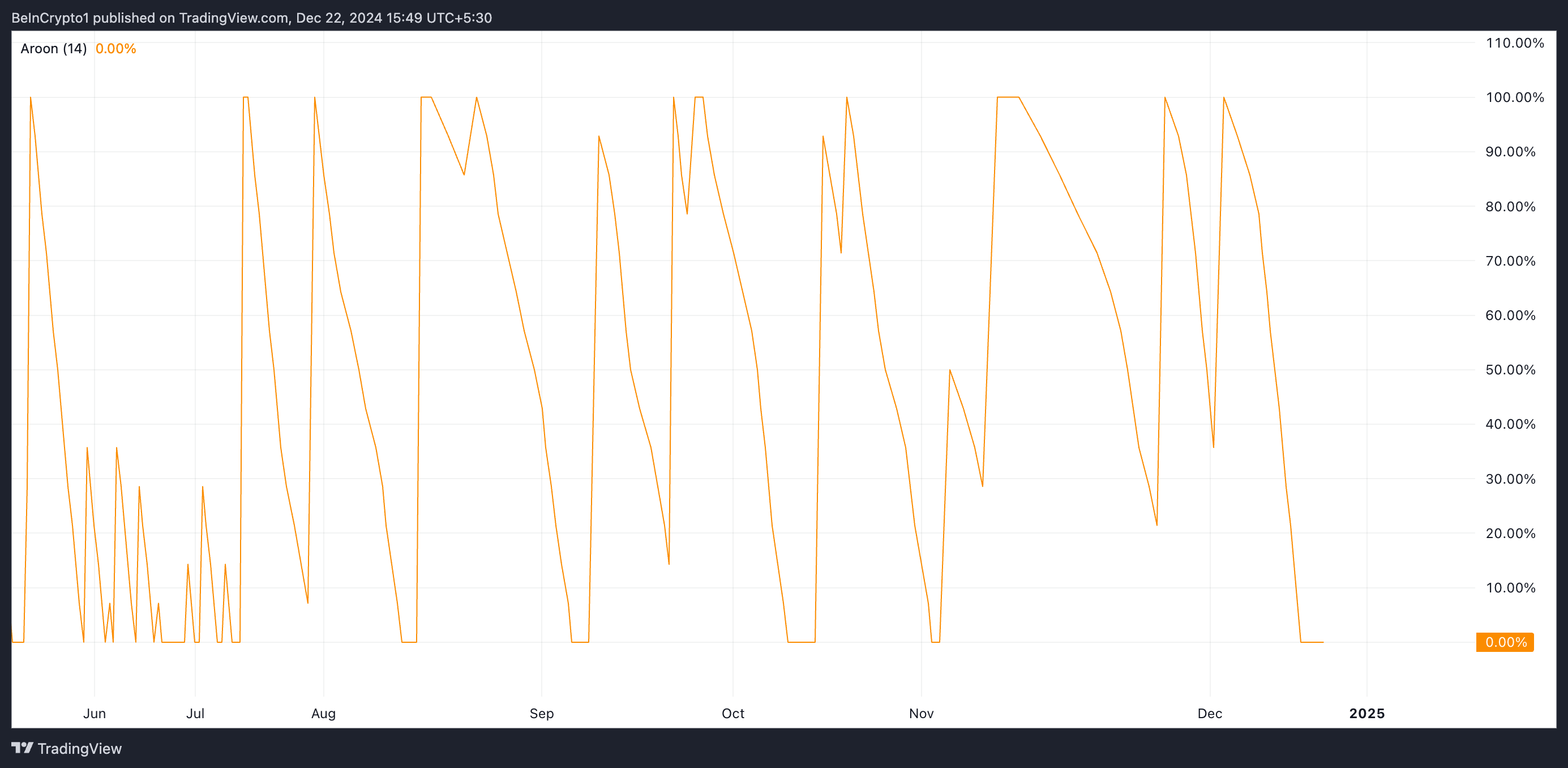

Although BTT’s price has increased, its Aroon Up Line stands at 0%, suggesting that the upward trend is currently lacking a significant momentum. This indicator, which assesses the strength and direction of a trend by considering the elapsed time since the most recent highest high and lowest low within a defined period, indicates this for BTT.

When an asset’s cost surges but its Aroon Up Line remains at zero, it suggests that although the price is increasing, the bullish energy hasn’t been particularly strong in the recent past. The Aroon Up Line tracks how long it’s been since an asset achieved a new high within a certain time frame. When it’s at zero, this means that the asset’s price hasn’t hit a new high during the specified period.

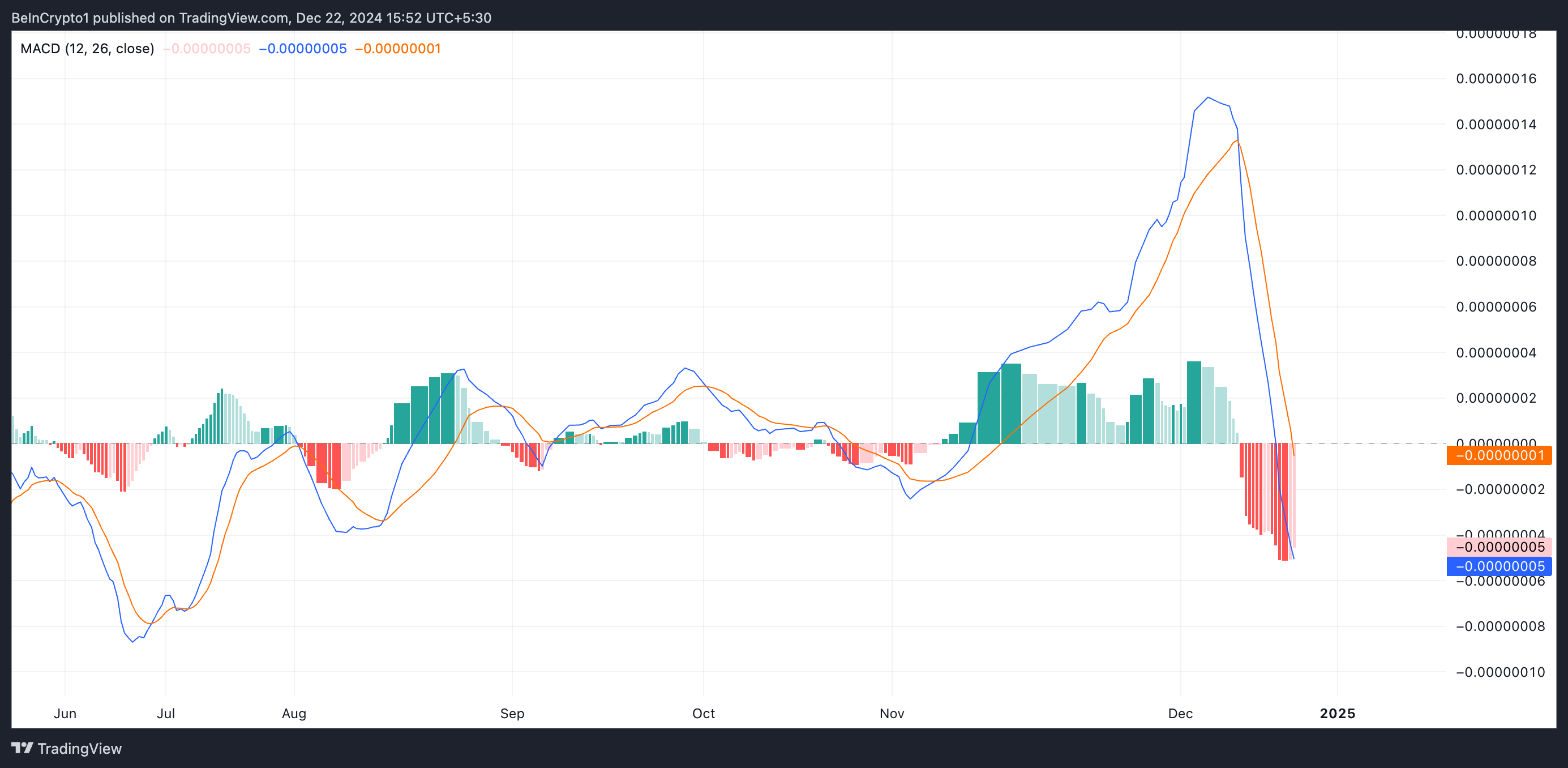

The Moving Average Convergence Divergence (MACD) of BTT is currently indicating a bearish trend. Specifically, as we speak, the MACD line (represented by blue) is positioned noticeably lower than its signal line (depicted in orange).

The MACD (Moving Average Convergence Divergence) indicator for an asset reveals trends and speed of its price fluctuations. This is useful to traders because it allows them to spot possible buy or sell opportunities when the MACD and signal lines intersect. For instance, if the MACD line sits below the signal line, as observed in BTT’s case, it suggests a bearish trend, meaning the asset’s value might decrease. Traders frequently interpret this intersection as a potential sign to sell.

BTT Price Prediction: Token Eyes Crucial Support, But Bulls Could Push for Further Gains

As a researcher examining the daily chart, I’ve noticed that BTT is currently trading above a crucial support level at 0.00000093. Should selling pressure increase significantly, this support could be tested. If the bears manage to outmaneuver the bulls, there’s potential for BTT to further slide and potentially drop as low as 0.00000067 – a level it hasn’t reached since August.

As a crypto investor, I’m keeping my eyes on BTT. If buying pressure intensifies, it might just keep climbing and surpass the resistance at $0.00000114. Should it manage to break this barrier, there’s a possibility for the token to regain its footing near $0.00000128.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-12-22 16:37