As a seasoned analyst with over two decades of experience in the financial industry, I find this development by Nexo and 7RCC Global to be a game-changer. The ESG-centric Bitcoin ETF is not just a novel investment product but a testament to the evolving priorities of today’s investors. It’s refreshing to see that profitability and environmental and social responsibility are no longer mutually exclusive, but can coexist harmoniously in financial instruments.

Nexo and 7RRC Global are blazing a new trail in the investment industry as they unveil a Bitcoin exchange-traded fund (ETF) that emphasizes Environmental, Social, and Governance (ESG) principles.

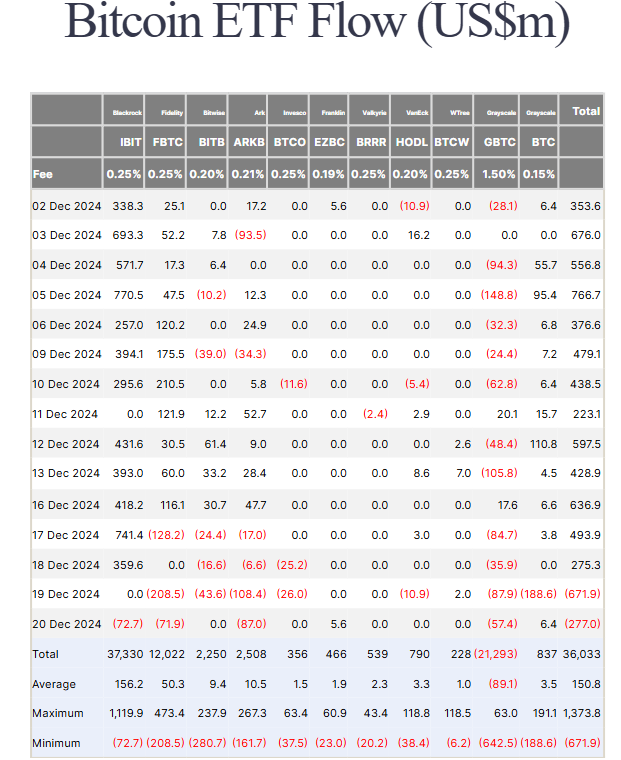

This business endeavor follows the notable upward trend seen in Bitcoin Spot ETFs since their launch in January.

Nexo and 7RCC Present an ESG Twist on Bitcoin Investment

On December 20th, Nate Geraci, president of the ETF Store, disclosed that Nexo and 7RCC Global had made an adjustment (amendment) to the United States Securities and Exchange Commission (SEC) for a fresh fund — the Nexo-7RCC Spot Bitcoin and Carbon Credit Futures ETF.

Geraci disclosed that this ETF intends to spread its investments by dedicating 80% towards Bitcoin and the remaining 20% to Carbon Credit Futures. He emphasized that the ETF’s primary focus will be on carbon emission permits from established cap-and-trade systems, such as those in the European Union, California, and the Regional Greenhouse Gas Initiative.

Carbon credit futures are financial products that change hands based on the anticipated worth of carbon credits. They serve as a tool to manage regulatory ambiguities while promoting eco-friendly investment strategies. As Geraci put it, this ETF can be likened to an “ESG equivalent of a direct Bitcoin ETF,” and he is hopeful about its potential for regulatory endorsement.

“Expect this to launch soon. Basically an ‘ESG’ version of spot BTC ETF,” Geraci said.

This undertaking doesn’t only mark a substantial leap towards integrating Environmental, Social, and Governance (ESG) values into crypto investment, but it also establishes a fresh standard for financial tools that aim to combine profitability with ecological and societal accountability.

Given its potential approval, this ETF would join an active market predominantly controlled by industry giants such as BlackRock and Fidelity at present. Notably, Bitcoin ETFs have seen approximately $36 billion in combined investments since the start of the year, highlighting the fast-paced and evolving investment environment.

Through its ETF and collaboration with 7RCC Global, Nexo is not only looking ahead to financial growth but also aiming for broader societal benefits. This partnership aligns with the World Economic Forum’s initiative, Safeguarding the Planet, demonstrating a shared dedication to progress that values and sustains the environment for future generations.

Through his role as Co-founder and Managing Partner at Nexo, Kalin Metodiev, a CFA, underscored their commitment to creating an enduring effect with this partnership.

20 years ago, the focus was primarily on earning money, but today’s generation values more than that – they aim to make a positive impact. This partnership underscores our dedication to eco-friendly approaches that will yield benefits for generations to come, as expressed by Metodiev.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

2024-12-22 00:35