As a seasoned researcher with years of experience in analyzing digital assets, I must say that the current state of Uniswap (UNI) has me slightly concerned but not entirely surprised. The crypto market is known for its volatility, and UNI’s recent 20% drop in just 24 hours is a testament to that.

Uniswap (UNI) has dropped by 20% over the past 24 hours, extending its negative trend following the loss of its $10 billion market cap that it held recently. Now, UNI stands at approximately $7.2 billion. This steep drop has placed UNI in a critical area, as technical indicators suggest significant downward pressure and the possibility of additional declines.

A “death cross” formation in the Exponential Moving Average (EMA) suggests a potential deeper drop may occur for UNI. Important floors are being monitored at $9.64 and $8.5, while a turnaround might lead to resistance levels at $13.5 and $16.2. If the bullish momentum strengthens, UNI could potentially climb toward $19.

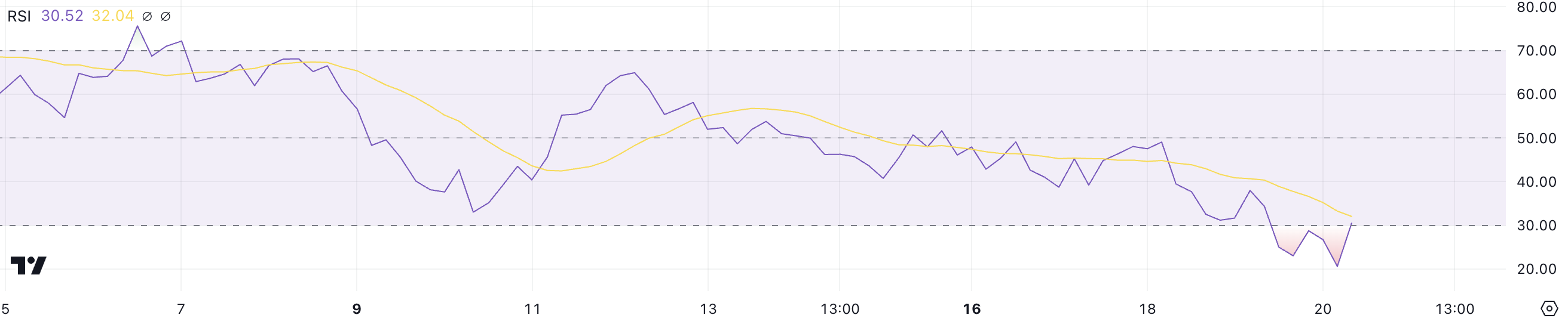

Uniswap RSI Is Recovering From Oversold Zone

At present, the Relative Strength Index (RSI) of Uniswap is at 30.5, representing a slight uptick from the 20 levels seen just a few hours back. An RSI below 30 suggests the market is oversold, meaning there’s been too much selling and it could potentially be undervalued in the short term, hinting at a possible recovery.

Lately, the University’s stock has moved towards being undervalued due to high selling pressure. However, a slight uptick to 30.5 indicates that the pace of selling may be slowing down. This could mean that investors are starting to buy again slowly.

The Relative Strength Index (RSI) gauges the momentum of price fluctuations, swinging from 0 to 100. This index offers insights into market trends: when the RSI falls below 30, it suggests the market is oversold and may be ready for a price increase; on the other hand, an RSI exceeding 70 signals overbought conditions and potential selling pressure.

If Uniswap’s Relative Strength Index (RSI) slightly exceeds the oversold level, there might be an attempt at price stabilization or a slight increase. But if the RSI doesn’t significantly surpass 30, it could suggest ongoing bearish influence and minimal short-term recovery potential.

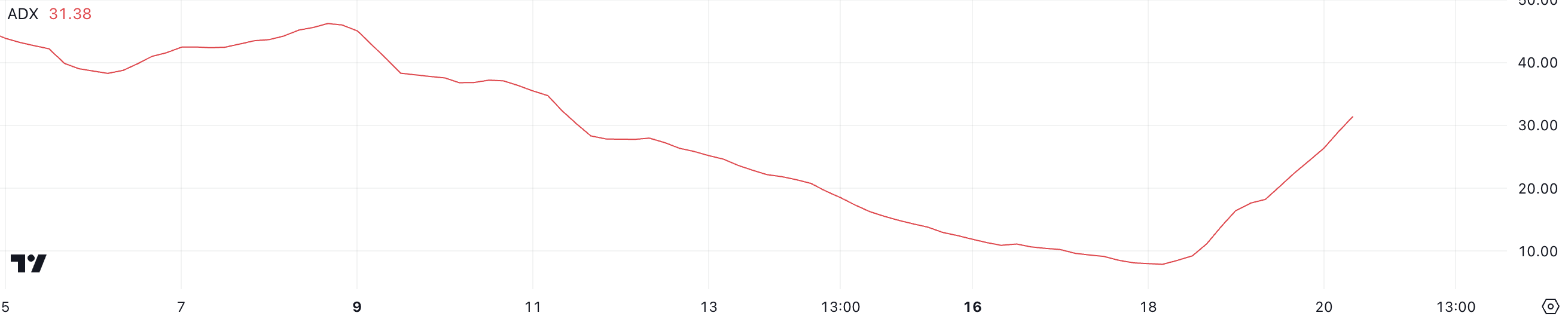

Uniswap Downtrend Is Very Strong Right Now

The ADX (Average Directional Index) for UNI is currently at 31.38, a significant increase from below 10 just two days ago. This sharp rise indicates that the strength of the current trend has intensified considerably over a short period.

Given that the current trend shows UNI’s price is decreasing, the high ADX indicates that negative momentum is strengthening, which might lead to additional price drops in the short term.

The ADX (Average Directional Movement Index) gauges the intensity of a market trend, whether it’s upward or downward, ranging from 0 to 100. Readings below 20 imply a weak or indecisive trend, while readings between 20 and 40 suggest a somewhat robust trend, and values exceeding 40 suggest a strong, decisive trend.

Currently, the ADX of UNI stands at 31.38, indicating a relatively robust downward trend that is gathering steam. Over the immediate future, this high ADX suggests ongoing stress on the price of UNI, with a potential for further decline unless buyers intervene to counterbalance the prevailing bearish market conditions.

UNI Price Prediction: The Altcoin Can Fall Below $10 Soon

At the University of Nicosia (UNI), the Exponential Moving Averages (EMA) are showing a bearish trend. The shortest-term EMA is approaching a possible downward crossover with the longest-term EMA, which is a pattern called the “death cross.” This pattern usually indicates a strengthening of bearish trends and might lead to a more significant price drop.

Should a “death cross” event transpire, the price of Uniswap might be tested at the potential support point of $9.64. If this support doesn’t manage to withstand the pressure, it could lead to a potential drop to the lower level of $8.5, signifying a more significant downward trend.

If UNI manages to turn around the downtrend and establish a robust upward momentum, it might initially encounter resistance at approximately $13.5.

If we manage to surpass the current level, it may open up a path for an increase up to around $16.2. If the positive market trend continues, there’s even a possibility that the price could climb higher, potentially reaching $19.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-12-20 22:36