As a seasoned researcher with a keen eye for market trends and a soft spot for cryptocurrencies, I find myself intrigued by the latest developments surrounding World Liberty Financial (WLFI). With my years of experience tracking digital asset movements, I’ve seen my fair share of projects making waves in the crypto sphere. However, WLFI’s impact on altcoins is nothing short of remarkable.

Cow Protocol’s COW token experienced a surge of more than 30% following the news that World Liberty Financial (WLFI), a DeFi project associated with Donald Trump, carried out a $2.5 million USDC transaction to purchase approximately 759.36 ETH via the platform.

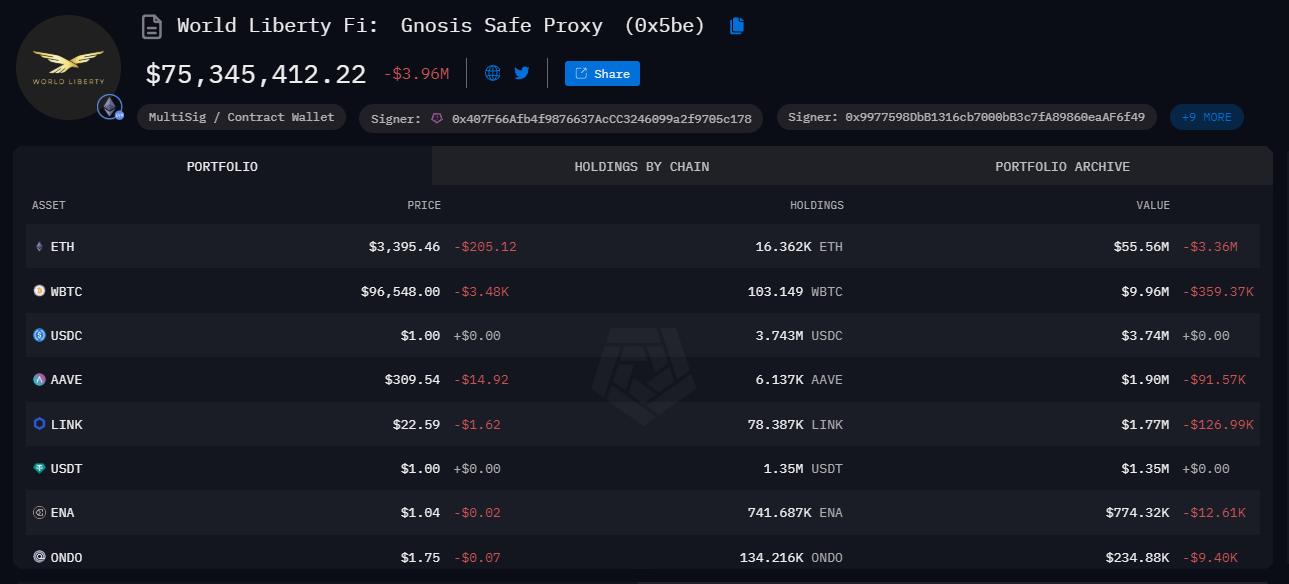

World Liberty Financial currently holds approximately 16,400 ETH, valued at $53.73 million.

Trump’s World Liberty Financial Continues to Impact Altcoins

Based on information from Arkham, the project has been actively acquiring different digital assets such as Ethereum (ETH), Wrapped Bitcoin (WBTC), AAVE, LINK, ENAN and ONDO. These cryptocurrencies have experienced losses lately, which align with increased market turbulence due to Federal Reserve interest rate reductions and inflation predictions.

Meanwhile, WLFI’s consistent use of the CoW Protocol has drawn attention, driving speculative interest in the platform. The COW token rose nearly 35% today, edging closer to $1.

During December, investments by WLFI have consistently sparked market surges. Just this month, the organization splurged more than $45 million, acquiring Ethereum, Ondo (ONDO), and Ethena (ENA). This has driven COW’s value to a peak of $1.02, its highest point in over a year.

This month’s transactions also featured the purchase of AAVE and the LINK token from Chainlink. The acquisition led to a surge in LINK’s value, reaching an impressive $28 – its highest point in over three years.

Furthermore, WLFI and Ethena Labs have incorporated sUSDe as security for their Aave v3 platform, thereby enhancing its capabilities.

Also, recently the project swapped $10.4 million of cbBTC for WBTC, following Coinbase’s delisting of cbBTC. Justin Sun, a key investor and advisor to WLFI, has publicly supported WBTC, citing its stronger governance and transparency compared to cbBTC.

Regardless of the advancements, Trump’s World Liberty Financial has encountered difficulties since its inception. Initially aiming for a presale target of $300 million, the project later reduced it dramatically to just $30 million – a significant decrease of 90%.

The WLFI tokens cannot be transferred and are only available to international and accredited American investors. This limitation is a factor in the challenges the project has faced during its initial sales phase.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-12-20 22:10