As a seasoned analyst with extensive experience navigating the intricate world of financial regulations and cryptocurrencies, I find myself deeply concerned about the impending impact of MiCA on the European crypto market. My career has taken me through various global financial landscapes, and I’ve witnessed firsthand the transformative power of regulatory changes, for better or worse.

With the impending implementation of the European Union’s Markets in Crypto Assets (MiCA) regulations, numerous cryptocurrency exchanges within the EU are choosing to remove Tether (USDT) from their platforms. This mass delisting could potentially limit the EU market’s capacity to fully benefit from the ongoing crypto market rally.

The election of Donald Trump in the United States has been advantageous for Tether, along with the wider cryptocurrency sector, however, financial turmoil in the European Union might affect investments.

Tether Prepares for MiCA

For several months, it’s been evident that Tether’s USDT, the leading stablecoin, won’t conform to MiCA regulations. A recent report indicates that EU exchanges must delist this asset by December 30th. This development is causing increasing unease within the European crypto community, as the potential withdrawal of Tether could have significant repercussions for the industry. As a researcher studying this space, I’m closely monitoring the situation to understand its implications.

Usman Ahmad, CEO of Zodia Markets Holdings Ltd., explained that while he recognizes the reasoning behind it, using [USDT] can be quite exclusive and restrictive for EU clients because USDT is by far the most liquid stablecoin available.

In essence, Tether serves as an essential stablecoin for cryptocurrency transactions within the EU, providing significant liquidity. Despite the rapid growth and attention in this field, certain European financial services struggle to keep pace with the dominance of the U.S. crypto market.

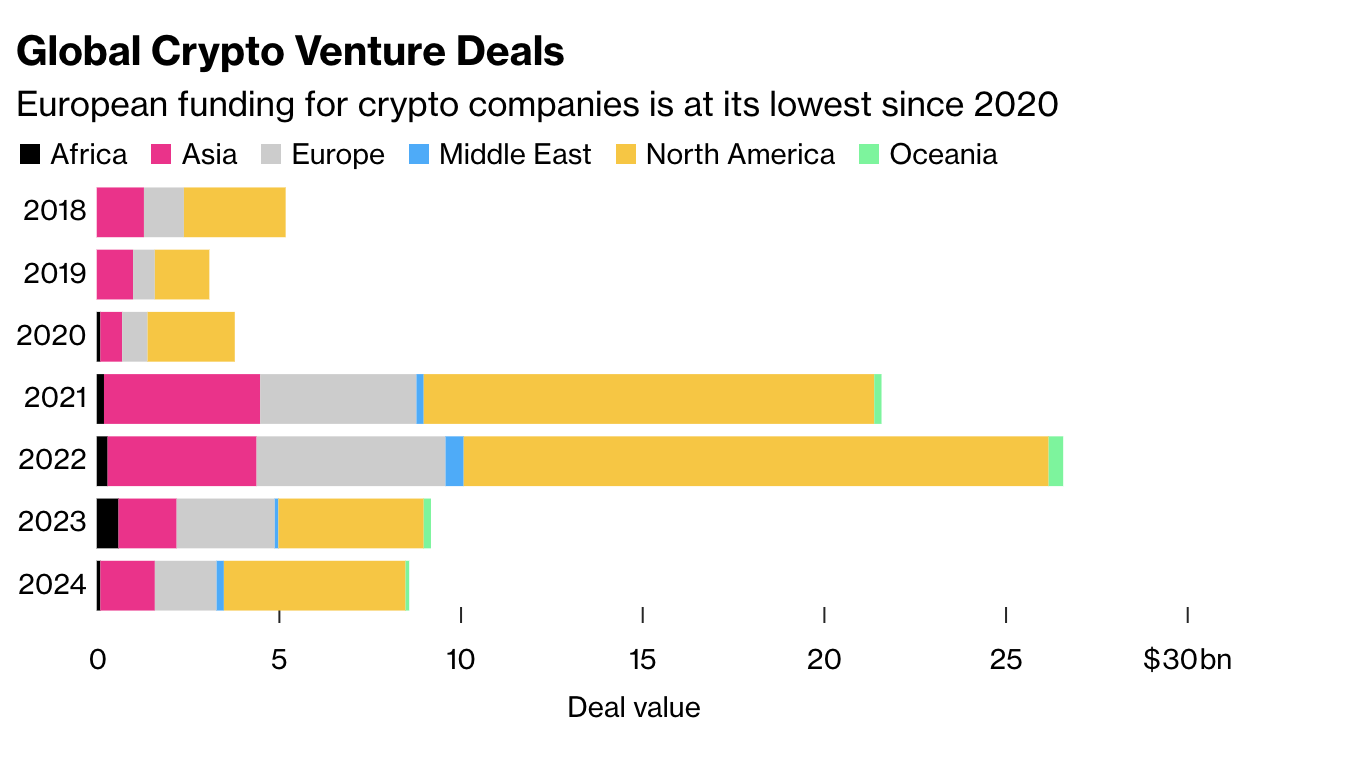

Generally speaking, crypto investment trends within the European Union have seen a decline in 2024 relative to other global regions. It’s also worth noting that if the proposed MiCA regulation comes into effect, there could be an additional decrease in these investments.

Over the past period, Tether has been getting ready for MiCA regulations by scaling back its European operations and pouring substantial resources into creating new compliant stablecoins. Meanwhile, some major rivals see this as a strategic moment to challenge Tether’s market supremacy.

Currently, there’s apprehension that regulatory confusion in the EU might arise at a time when other regional cryptocurrency markets are flourishing robustly. For instance, since Donald Trump assumed the U.S. Presidency, the country’s crypto sector has been experiencing significant growth. Tether, with its allies gaining new positions under Trump, appears to be particularly benefiting from this growing market.

As a financial analyst, I find myself hoping that the turbulence surrounding MiCA and the Tether exit won’t dampen European investment rates in the cryptocurrency sector. Despite the global surge in institutional and regional acceptance for crypto, there’s a risk that Europe may miss out on this growth momentum if we’re not careful.

Read More

- ALEO PREDICTION. ALEO cryptocurrency

- Solo Leveling Season 2: Check Out The Release Date, Streaming Details, Expected Plot And More

- Who is Owen Cooper? All About Netflix’s Adolescence Star Taking Hollywood by Storm

- Solo Leveling Season 2 Release Schedule: How Many Episodes Are Left? Find Here as Ep 10 Eyes More Battles

- Minecraft Movie Tracking $60M+ Opening: But No One’s Buying Tickets?

- The First Berserker Khazan: Best Greatsword Build

- Wall Street’s ‘Fear Index’ Jumps Over 25%, Hitting Its Highest Level Since March 2023

- The Roots Unveil Roots Picnic 2025 Lineup

- 30 Best Couple/Wife Swap Movies You Need to See

- ‘I was like No…’ – Joaquin Phoenix Included THIS Suggestion By Lady Gaga For Musicals In Joker: Folie à Deux

2024-12-20 22:09