As an experienced analyst with a background in traditional finance and a keen interest in digital assets, I find today’s $2.62 billion Bitcoin and Ethereum options expiry intriguing. With my eyes on the market for years, I’ve seen countless instances where these events have led to temporary volatility, but ultimately, the market has always found its equilibrium.

Today sees the expiration of approximately $2.62 billion worth of Bitcoin and Ethereum options contracts. This substantial event may influence short-term market behavior, particularly since both assets have experienced recent downturns.

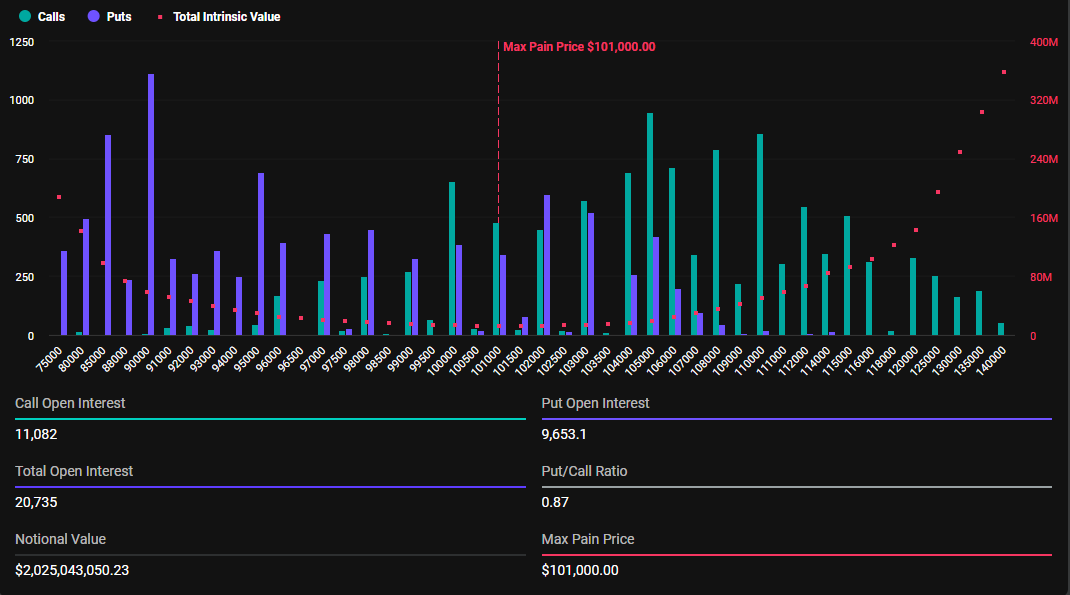

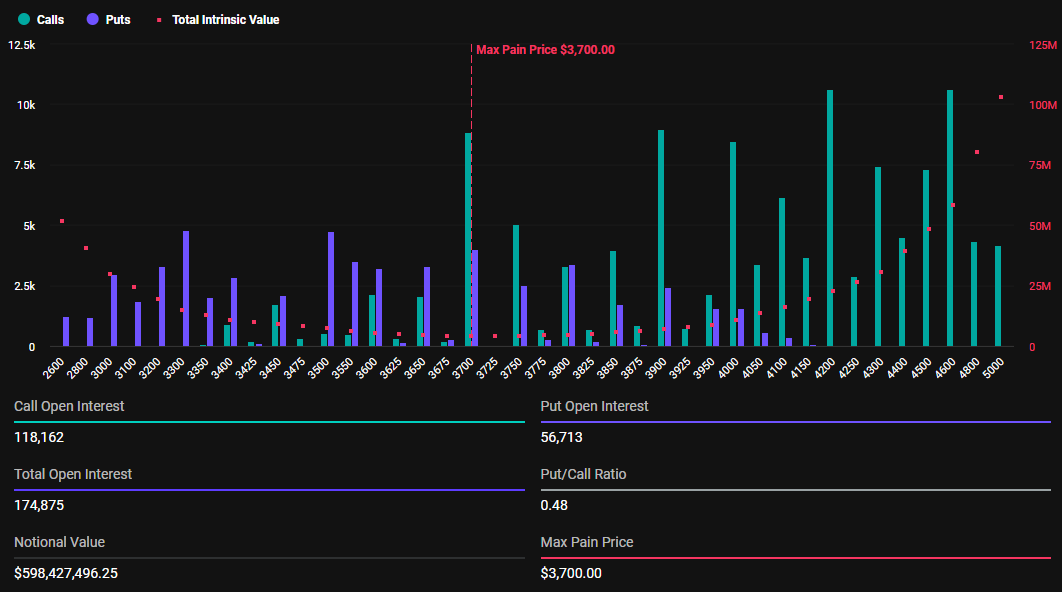

Traders are preparing for possible fluctuations as the value of Bitcoin options stands at approximately 2.02 billion dollars, while that of Ethereum is around 598.99 million dollars.

What Traders Should Watch Amid Over $2.6 Billion Options Expiry

Today’s expiring Bitcoin and Ethereum options show a minor decrease for Bitcoin and an increase for Ethereum compared to the figures from last week. As per Deribit data, the number of Bitcoin options contracts expiring today stands at 20,728, which is lower than the 20,815 contracts from last week. On the other hand, Ethereum’s expiring options have grown to 174,863 contracts this week, compared to 164,330 contracts in the previous week.

Regarding Bitcoin, the highest potential distress price for expiring options stands at around $110,000. Additionally, there are about 87 put options for every 100 call options, meaning there’s a slightly higher interest in bullish positions (calls) compared to bearish ones (puts). This suggests that investors generally remain optimistic about Bitcoin, even with its recent market correction.

To put it simply, the equivalent tokens on Ethereum networks are capped at a high of around $3,700 and have a put-to-call ratio of about 0.48. This indicates that the market view for these tokens is somewhat comparable to what we see here.

The maximum pain point is a crucial metric that often guides market behavior. It represents the price level at which most options expire worthless.

Furthermore, the fact that the put-to-call ratios are less than 1 for both Bitcoin and Ethereum indicates a positive outlook in the market, as more traders are wagering on price increases. However, given the large number of options expiring, traders and investors should prepare themselves for possible market fluctuations or volatility.

The end of an options period might cause heightened market volatility due to traders repositioning themselves. Keep a close eye on the movements in SPX and BTC, as they could respond to these shifting market conditions.

Could Options Expiry Catalyze Market Recovery?

I’ve observed an interesting pattern: The expiration of these options coincides with a drop in Bitcoin price to approximately $94,235. At present, I’m seeing Bitcoin trading at around $97,157, representing nearly a 4% decrease from the opening of the Friday session.

Bitcoin’s current high point of discomfort sits at around $101,000, which is significantly lower than its predicted level. Conversely, Ethereum is being traded at roughly $3,392, surpassing its maximum anticipated pressure point of $3,700. Applying the Max Pain principle, it seems that both Bitcoin and Ethereum may move closer to their respective estimated levels, suggesting potential market volatility ahead.

This occurs due to the maximum-pain hypothesis in options trading, which posits that those who write options (sell) are often large organizations or expert traders. Given their substantial resources and impact on the market, they can manipulate the closing price on the expiration day towards the point causing the most pain (significant losses) for option holders.

If Bitcoin recovers, it could regain the significant milestone of $100,000.

The user on X indicated that the overnight sessions aren’t promising, but there might still be a positive outcome if many expiring options prove to be worthless tomorrow.

In the meantime, it’s hard not to notice that although options expirations frequently trigger short-term price swings, markets tend to regain stability shortly afterward as traders adjust to the altered price conditions. Given the heavy trading volume today, it’s likely that a similar pattern will unfold, possibly shaping upcoming trends in the crypto market, particularly leading up to the weekend.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2024-12-20 09:36